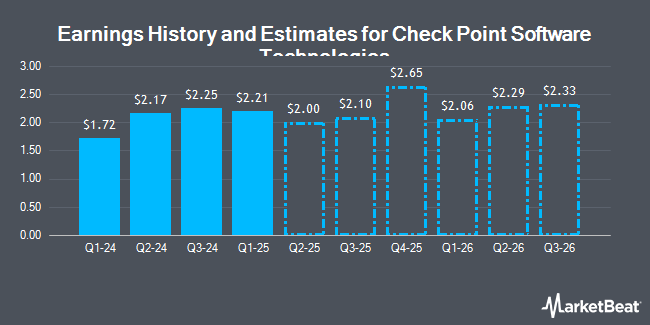

Check Point Software Technologies (NASDAQ:CHKP - Get Free Report) updated its fourth quarter earnings guidance on Tuesday. The company provided EPS guidance of $2.60-2.70 for the period, compared to the consensus EPS estimate of $2.65. The company issued revenue guidance of $675-715 million, compared to the consensus revenue estimate of $701.63 million.

Wall Street Analyst Weigh In

Several research firms have recently issued reports on CHKP. Truist Financial increased their price target on Check Point Software Technologies from $200.00 to $220.00 and gave the stock a "buy" rating in a research note on Wednesday, October 23rd. Jefferies Financial Group increased their price target on Check Point Software Technologies from $210.00 to $225.00 and gave the stock a "buy" rating in a research note on Tuesday, September 24th. Susquehanna upped their price objective on Check Point Software Technologies from $200.00 to $215.00 and gave the company a "positive" rating in a report on Thursday, July 25th. Wedbush upped their price objective on Check Point Software Technologies from $200.00 to $230.00 and gave the company an "outperform" rating in a report on Wednesday, October 9th. Finally, Royal Bank of Canada upped their price objective on Check Point Software Technologies from $165.00 to $187.00 and gave the company a "sector perform" rating in a report on Thursday, July 25th. Fifteen research analysts have rated the stock with a hold rating and nine have issued a buy rating to the stock. Based on data from MarketBeat, Check Point Software Technologies presently has a consensus rating of "Hold" and an average target price of $196.78.

View Our Latest Stock Analysis on Check Point Software Technologies

Check Point Software Technologies Price Performance

Check Point Software Technologies stock traded down $30.09 during mid-day trading on Tuesday, hitting $177.87. The company's stock had a trading volume of 3,401,402 shares, compared to its average volume of 689,777. The firm's 50 day moving average is $195.73 and its 200 day moving average is $174.56. The company has a market cap of $20.08 billion, a PE ratio of 24.70, a price-to-earnings-growth ratio of 3.17 and a beta of 0.62. Check Point Software Technologies has a 52-week low of $126.57 and a 52-week high of $210.70.

About Check Point Software Technologies

(

Get Free Report)

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a multilevel security architecture, cloud, network, mobile devices, endpoints information, and IOT solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against fifth generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile.

See Also

Before you consider Check Point Software Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Check Point Software Technologies wasn't on the list.

While Check Point Software Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.