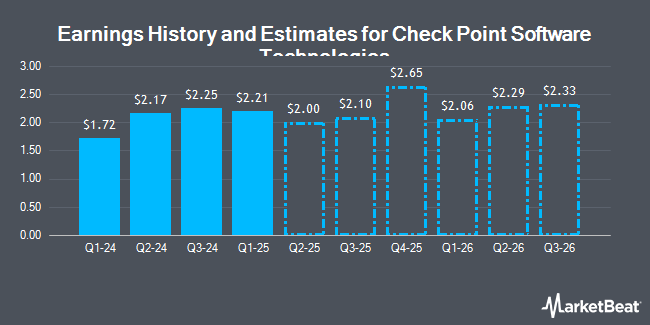

Check Point Software Technologies (NASDAQ:CHKP - Get Free Report) issued an update on its fourth quarter 2024 earnings guidance on Friday morning. The company provided earnings per share (EPS) guidance of 2.600-2.700 for the period, compared to the consensus estimate of 2.650. The company issued revenue guidance of $675.0 million-$715.0 million, compared to the consensus revenue estimate of $698.6 million. Check Point Software Technologies also updated its FY 2024 guidance to 9.050-9.150 EPS.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on CHKP shares. BMO Capital Markets boosted their price objective on Check Point Software Technologies from $200.00 to $238.00 and gave the company a "market perform" rating in a research note on Friday, October 25th. Jefferies Financial Group upped their price target on Check Point Software Technologies from $210.00 to $225.00 and gave the company a "buy" rating in a research report on Tuesday, September 24th. Robert W. Baird cut their price objective on shares of Check Point Software Technologies from $210.00 to $205.00 and set a "neutral" rating for the company in a research report on Wednesday. Evercore ISI upped their target price on shares of Check Point Software Technologies from $180.00 to $185.00 and gave the stock an "in-line" rating in a report on Wednesday. Finally, Bank of America cut shares of Check Point Software Technologies from a "buy" rating to a "neutral" rating and lowered their target price for the stock from $205.00 to $195.00 in a research note on Wednesday. Fifteen equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $197.74.

Get Our Latest Report on Check Point Software Technologies

Check Point Software Technologies Price Performance

NASDAQ CHKP traded down $2.71 on Friday, reaching $170.50. 860,178 shares of the company's stock traded hands, compared to its average volume of 694,497. The stock has a market cap of $18.75 billion, a PE ratio of 23.29, a P/E/G ratio of 2.71 and a beta of 0.63. Check Point Software Technologies has a 12 month low of $134.72 and a 12 month high of $210.70. The stock has a 50-day simple moving average of $194.47 and a 200 day simple moving average of $174.87.

Check Point Software Technologies (NASDAQ:CHKP - Get Free Report) last released its earnings results on Tuesday, October 29th. The technology company reported $2.25 EPS for the quarter, meeting the consensus estimate of $2.25. Check Point Software Technologies had a net margin of 33.17% and a return on equity of 31.84%. The company had revenue of $635.10 million for the quarter, compared to analyst estimates of $634.96 million. During the same quarter last year, the firm earned $1.80 EPS. The firm's quarterly revenue was up 6.5% compared to the same quarter last year. As a group, analysts anticipate that Check Point Software Technologies will post 7.84 EPS for the current year.

Check Point Software Technologies Company Profile

(

Get Free Report)

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a multilevel security architecture, cloud, network, mobile devices, endpoints information, and IOT solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against fifth generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile.

Recommended Stories

Before you consider Check Point Software Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Check Point Software Technologies wasn't on the list.

While Check Point Software Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.