Grace & White Inc. NY lowered its position in Chord Energy Co. (NASDAQ:CHRD - Free Report) by 65.5% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 4,948 shares of the company's stock after selling 9,399 shares during the period. Grace & White Inc. NY's holdings in Chord Energy were worth $644,000 as of its most recent filing with the Securities & Exchange Commission.

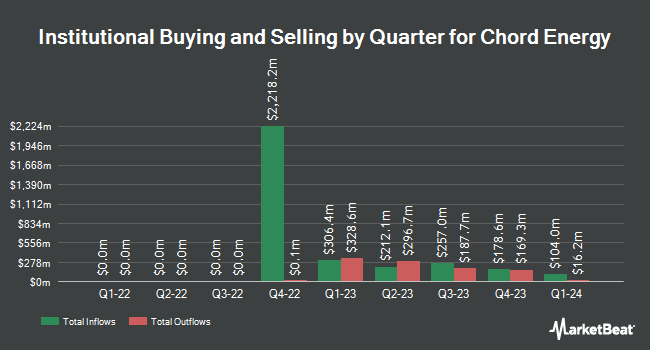

A number of other institutional investors also recently added to or reduced their stakes in the business. Allspring Global Investments Holdings LLC grew its stake in shares of Chord Energy by 2.5% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 572,113 shares of the company's stock worth $74,506,000 after purchasing an additional 13,784 shares during the period. Blue Trust Inc. boosted its holdings in Chord Energy by 101.8% during the third quarter. Blue Trust Inc. now owns 3,206 shares of the company's stock worth $418,000 after buying an additional 1,617 shares in the last quarter. Sumitomo Mitsui DS Asset Management Company Ltd grew its position in Chord Energy by 2.7% during the third quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 5,464 shares of the company's stock worth $712,000 after buying an additional 145 shares during the period. Redmont Wealth Advisors LLC purchased a new position in Chord Energy in the third quarter valued at about $467,000. Finally, Arkfeld Wealth Strategies L.L.C. acquired a new stake in shares of Chord Energy during the 3rd quarter valued at approximately $12,152,000. Hedge funds and other institutional investors own 97.76% of the company's stock.

Insider Buying and Selling at Chord Energy

In other Chord Energy news, Director Samantha Holroyd purchased 500 shares of the firm's stock in a transaction dated Friday, August 23rd. The stock was bought at an average cost of $149.51 per share, with a total value of $74,755.00. Following the purchase, the director now directly owns 14,417 shares of the company's stock, valued at $2,155,485.67. The trade was a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which can be accessed through this link. Insiders own 0.70% of the company's stock.

Analyst Upgrades and Downgrades

CHRD has been the subject of several research analyst reports. Wells Fargo & Company dropped their price objective on Chord Energy from $185.00 to $180.00 and set an "overweight" rating for the company in a research note on Wednesday, October 16th. Royal Bank of Canada restated an "outperform" rating and issued a $200.00 price target on shares of Chord Energy in a research report on Friday, September 20th. BMO Capital Markets decreased their price objective on shares of Chord Energy from $205.00 to $175.00 and set an "outperform" rating on the stock in a research report on Friday, October 4th. Bank of America raised their target price on shares of Chord Energy from $201.00 to $208.00 and gave the company a "buy" rating in a report on Wednesday, August 21st. Finally, Truist Financial reduced their price target on shares of Chord Energy from $223.00 to $185.00 and set a "buy" rating on the stock in a report on Monday, September 30th. Two research analysts have rated the stock with a hold rating, ten have issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $190.18.

View Our Latest Stock Analysis on Chord Energy

Chord Energy Stock Performance

CHRD stock traded up $0.05 during mid-day trading on Tuesday, reaching $129.99. 667,035 shares of the stock traded hands, compared to its average volume of 882,978. The company has a quick ratio of 0.91, a current ratio of 0.96 and a debt-to-equity ratio of 0.11. The business has a 50-day moving average of $138.55 and a two-hundred day moving average of $161.47. The firm has a market capitalization of $5.42 billion, a PE ratio of 6.10, a P/E/G ratio of 5.06 and a beta of 0.97. Chord Energy Co. has a 52 week low of $126.38 and a 52 week high of $190.23.

Chord Energy (NASDAQ:CHRD - Get Free Report) last announced its quarterly earnings results on Wednesday, August 7th. The company reported $4.69 EPS for the quarter, missing the consensus estimate of $5.00 by ($0.31). Chord Energy had a net margin of 20.83% and a return on equity of 15.06%. The company had revenue of $902.70 million during the quarter, compared to analyst estimates of $982.43 million. During the same period in the prior year, the firm earned $3.65 EPS. Chord Energy's quarterly revenue was up 29.8% compared to the same quarter last year. As a group, equities analysts predict that Chord Energy Co. will post 17.32 EPS for the current fiscal year.

Chord Energy Cuts Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, September 5th. Stockholders of record on Wednesday, August 21st were given a dividend of $1.25 per share. The ex-dividend date was Wednesday, August 21st. This represents a $5.00 dividend on an annualized basis and a dividend yield of 3.85%. Chord Energy's dividend payout ratio is 23.46%.

About Chord Energy

(

Free Report)

Chord Energy Corporation operates as an independent exploration and production company in the United States. It acquires, explores, develops, and produces crude oil, natural gas, and natural gas liquids in the Williston Basin. The company sells its products to refiners, marketers, and other purchasers that have access to nearby pipeline and rail facilities.

Further Reading

Before you consider Chord Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chord Energy wasn't on the list.

While Chord Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.