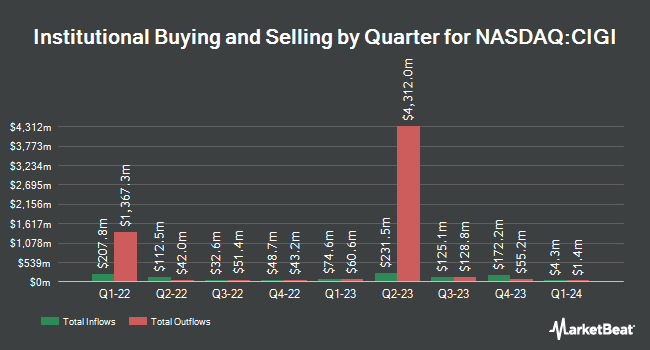

Ceredex Value Advisors LLC cut its holdings in Colliers International Group Inc. (NASDAQ:CIGI - Free Report) TSE: CIGI by 5.0% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 82,594 shares of the financial services provider's stock after selling 4,350 shares during the quarter. Ceredex Value Advisors LLC owned about 0.17% of Colliers International Group worth $12,539,000 as of its most recent SEC filing.

A number of other institutional investors have also recently bought and sold shares of the business. The Manufacturers Life Insurance Company increased its stake in shares of Colliers International Group by 47.6% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 1,011,898 shares of the financial services provider's stock valued at $112,834,000 after acquiring an additional 326,453 shares during the last quarter. Clearbridge Investments LLC raised its holdings in Colliers International Group by 91.3% in the second quarter. Clearbridge Investments LLC now owns 310,602 shares of the financial services provider's stock worth $34,677,000 after purchasing an additional 148,265 shares during the period. Intact Investment Management Inc. bought a new position in shares of Colliers International Group during the second quarter worth $6,970,000. Healthcare of Ontario Pension Plan Trust Fund bought a new position in shares of Colliers International Group during the first quarter worth $7,092,000. Finally, Victory Capital Management Inc. grew its holdings in shares of Colliers International Group by 5.9% in the 2nd quarter. Victory Capital Management Inc. now owns 743,150 shares of the financial services provider's stock valued at $82,973,000 after buying an additional 41,225 shares during the period. Institutional investors and hedge funds own 80.09% of the company's stock.

Colliers International Group Stock Down 0.5 %

Colliers International Group stock traded down $0.70 during mid-day trading on Friday, reaching $151.94. The company's stock had a trading volume of 81,465 shares, compared to its average volume of 84,656. The company has a debt-to-equity ratio of 1.13, a quick ratio of 1.03 and a current ratio of 1.03. Colliers International Group Inc. has a 12 month low of $83.38 and a 12 month high of $156.29. The business's 50 day simple moving average is $147.86 and its 200 day simple moving average is $128.93. The company has a market capitalization of $7.46 billion, a price-to-earnings ratio of 51.68 and a beta of 1.50.

Colliers International Group (NASDAQ:CIGI - Get Free Report) TSE: CIGI last released its earnings results on Thursday, August 1st. The financial services provider reported $1.36 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.37 by ($0.01). The company had revenue of $1.14 billion during the quarter, compared to analyst estimates of $1.11 billion. Colliers International Group had a net margin of 3.20% and a return on equity of 23.60%. Colliers International Group's revenue was up 5.7% compared to the same quarter last year. During the same period in the prior year, the firm posted $1.21 EPS. As a group, research analysts anticipate that Colliers International Group Inc. will post 5.65 earnings per share for the current year.

Analyst Ratings Changes

Several research firms have weighed in on CIGI. Royal Bank of Canada lifted their target price on Colliers International Group from $160.00 to $174.00 and gave the stock an "outperform" rating in a report on Monday, October 21st. BMO Capital Markets lifted their price objective on Colliers International Group from $163.00 to $164.00 and gave the company an "outperform" rating in a report on Friday, September 13th. Scotiabank increased their target price on Colliers International Group from $150.00 to $155.00 and gave the stock a "sector outperform" rating in a research note on Friday, August 2nd. National Bankshares lifted their price target on shares of Colliers International Group from $125.00 to $137.00 and gave the company a "sector perform" rating in a research note on Friday, August 2nd. Finally, StockNews.com downgraded shares of Colliers International Group from a "buy" rating to a "hold" rating in a research report on Tuesday, October 8th. Two research analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $158.33.

Get Our Latest Stock Analysis on Colliers International Group

Colliers International Group Profile

(

Free Report)

Colliers International Group Inc provides commercial real estate professional and investment management services to corporate and institutional clients in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers outsourcing and advisory services, such as engineering and project management, property management, valuation, and other services, as well as loan servicing for commercial real estate clients.

Recommended Stories

Before you consider Colliers International Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Colliers International Group wasn't on the list.

While Colliers International Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.