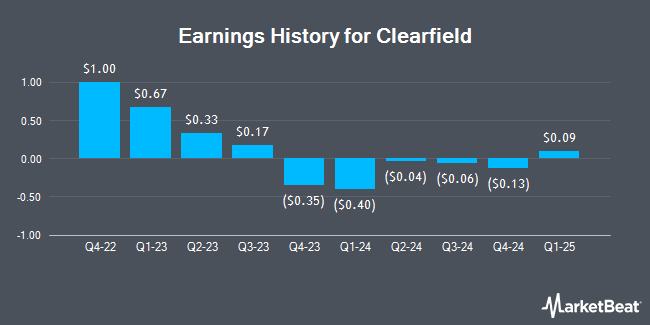

Clearfield (NASDAQ:CLFD - Get Free Report) is set to post its quarterly earnings results after the market closes on Thursday, November 7th. Analysts expect Clearfield to post earnings of ($0.19) per share for the quarter. Persons that are interested in participating in the company's earnings conference call can do so using this link.

Clearfield (NASDAQ:CLFD - Get Free Report) last posted its quarterly earnings data on Thursday, August 1st. The communications equipment provider reported ($0.04) EPS for the quarter, topping analysts' consensus estimates of ($0.34) by $0.30. Clearfield had a negative return on equity of 3.06% and a negative net margin of 5.26%. The company had revenue of $48.79 million for the quarter, compared to the consensus estimate of $42.13 million. During the same quarter in the previous year, the business earned $0.33 EPS. The company's quarterly revenue was down 20.4% compared to the same quarter last year. On average, analysts expect Clearfield to post $-1 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Clearfield Price Performance

CLFD stock traded down $0.19 during trading hours on Thursday, hitting $35.93. 101,274 shares of the stock traded hands, compared to its average volume of 155,297. The company has a current ratio of 8.38, a quick ratio of 5.73 and a debt-to-equity ratio of 0.01. The stock has a 50-day simple moving average of $37.65 and a 200 day simple moving average of $37.36. Clearfield has a one year low of $22.91 and a one year high of $44.83. The company has a market cap of $511.39 million, a P/E ratio of -146.40 and a beta of 1.34.

Insider Buying and Selling at Clearfield

In other news, Director Walter Louis Jones, Jr. acquired 1,324 shares of the firm's stock in a transaction dated Wednesday, August 7th. The shares were bought at an average price of $37.77 per share, with a total value of $50,007.48. Following the acquisition, the director now owns 6,061 shares of the company's stock, valued at $228,923.97. This trade represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 16.00% of the company's stock.

Wall Street Analyst Weigh In

CLFD has been the topic of a number of research reports. Northland Securities boosted their target price on shares of Clearfield from $40.00 to $45.00 and gave the stock an "outperform" rating in a report on Friday, August 2nd. StockNews.com cut Clearfield from a "hold" rating to a "sell" rating in a research note on Wednesday, October 23rd. Roth Mkm cut their price objective on Clearfield from $47.00 to $45.00 and set a "buy" rating for the company in a report on Friday, August 2nd. Lake Street Capital upgraded shares of Clearfield from a "hold" rating to a "buy" rating and lifted their target price for the company from $31.00 to $47.00 in a research note on Friday, August 2nd. Finally, Needham & Company LLC restated a "buy" rating and set a $50.00 price target on shares of Clearfield in a research note on Tuesday, September 24th. One investment analyst has rated the stock with a sell rating and four have given a buy rating to the company's stock. According to data from MarketBeat, Clearfield has a consensus rating of "Moderate Buy" and a consensus price target of $46.75.

Check Out Our Latest Analysis on Clearfield

Clearfield Company Profile

(

Get Free Report)

Clearfield, Inc manufactures and sells various fiber connectivity products in the United States and internationally. The company offers FieldSmart, a series of panels, cabinets, wall boxes, and other enclosures; WaveSmart, an optical components integrated for signal coupling, splitting, termination, multiplexing, demultiplexing, and attenuation for integration within its fiber management platform; and active cabinet products.

Featured Stories

Before you consider Clearfield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearfield wasn't on the list.

While Clearfield currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.