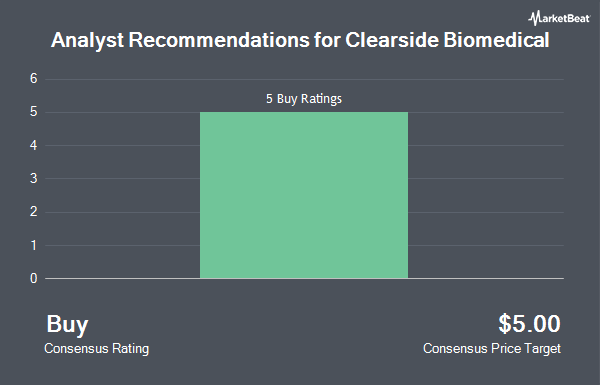

Clearside Biomedical, Inc. (NASDAQ:CLSD - Get Free Report) has received an average recommendation of "Buy" from the six brokerages that are presently covering the stock, MarketBeat reports. Six research analysts have rated the stock with a buy rating. The average 12 month price target among brokerages that have updated their coverage on the stock in the last year is $5.17.

CLSD has been the subject of several research analyst reports. Chardan Capital restated a "buy" rating and issued a $6.00 price objective on shares of Clearside Biomedical in a research report on Monday, October 14th. Needham & Company LLC upped their target price on shares of Clearside Biomedical from $4.00 to $6.00 and gave the company a "buy" rating in a research report on Thursday, October 10th. StockNews.com upgraded Clearside Biomedical from a "sell" rating to a "hold" rating in a research report on Friday, October 18th. Finally, HC Wainwright reissued a "buy" rating and issued a $5.00 target price on shares of Clearside Biomedical in a research note on Tuesday, August 27th.

Get Our Latest Stock Report on Clearside Biomedical

Institutional Investors Weigh In On Clearside Biomedical

Institutional investors and hedge funds have recently modified their holdings of the company. SG Americas Securities LLC acquired a new position in shares of Clearside Biomedical in the first quarter valued at approximately $49,000. XTX Topco Ltd boosted its stake in Clearside Biomedical by 172.2% in the second quarter. XTX Topco Ltd now owns 54,313 shares of the company's stock valued at $71,000 after buying an additional 34,359 shares in the last quarter. Assenagon Asset Management S.A. bought a new position in Clearside Biomedical in the second quarter valued at about $368,000. Renaissance Technologies LLC raised its stake in Clearside Biomedical by 6.6% during the second quarter. Renaissance Technologies LLC now owns 582,689 shares of the company's stock worth $757,000 after acquiring an additional 35,900 shares in the last quarter. Finally, Vanguard Group Inc. lifted its holdings in shares of Clearside Biomedical by 14.5% in the first quarter. Vanguard Group Inc. now owns 2,490,796 shares of the company's stock worth $3,811,000 after acquiring an additional 314,480 shares during the last quarter. 18.75% of the stock is owned by institutional investors.

Clearside Biomedical Price Performance

CLSD remained flat at $1.10 during trading on Monday. The company's stock had a trading volume of 272,889 shares, compared to its average volume of 407,795. The company has a market capitalization of $82.20 million, a PE ratio of -2.01 and a beta of 2.35. The company's 50 day moving average price is $1.17 and its 200 day moving average price is $1.21. Clearside Biomedical has a 52-week low of $0.69 and a 52-week high of $2.12.

Clearside Biomedical (NASDAQ:CLSD - Get Free Report) last issued its quarterly earnings results on Monday, August 12th. The company reported ($0.10) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.14) by $0.04. The company had revenue of $0.09 million for the quarter, compared to analyst estimates of $0.25 million. During the same quarter last year, the company earned ($0.15) EPS. As a group, analysts predict that Clearside Biomedical will post -0.56 earnings per share for the current year.

About Clearside Biomedical

(

Get Free ReportClearside Biomedical, Inc, a biopharmaceutical company, focuses on the revolutionizing the delivery of therapies to the back of the eye through the suprachoroidal space. It offers XIPERE, a triamcinolone acetonide suprachoroidal injectable suspension for the treatment of uveitis macular edema. It also develops CLS-AX, an axitinib injectable suspension for suprachoroidal injection, which is in Phase IIb clinical trial to treat wet AMD.

Read More

Before you consider Clearside Biomedical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearside Biomedical wasn't on the list.

While Clearside Biomedical currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.