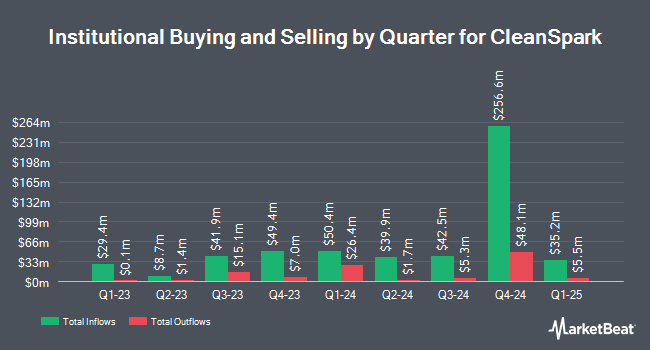

Millennium Management LLC boosted its holdings in CleanSpark, Inc. (NASDAQ:CLSK - Free Report) by 74.6% during the 2nd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,251,278 shares of the company's stock after acquiring an additional 534,825 shares during the quarter. Millennium Management LLC owned about 0.55% of CleanSpark worth $19,958,000 as of its most recent SEC filing.

Other large investors also recently made changes to their positions in the company. Russell Investments Group Ltd. boosted its position in shares of CleanSpark by 36.8% in the 1st quarter. Russell Investments Group Ltd. now owns 2,926 shares of the company's stock valued at $62,000 after purchasing an additional 787 shares during the period. SteelPeak Wealth LLC raised its holdings in shares of CleanSpark by 3.0% during the second quarter. SteelPeak Wealth LLC now owns 36,907 shares of the company's stock valued at $589,000 after acquiring an additional 1,066 shares during the period. Amalgamated Bank lifted its position in shares of CleanSpark by 18.4% in the 2nd quarter. Amalgamated Bank now owns 7,667 shares of the company's stock valued at $122,000 after acquiring an additional 1,194 shares in the last quarter. Tobam boosted its stake in CleanSpark by 6.4% in the 1st quarter. Tobam now owns 23,142 shares of the company's stock worth $491,000 after purchasing an additional 1,394 shares during the period. Finally, Scotia Capital Inc. grew its position in CleanSpark by 14.5% during the 4th quarter. Scotia Capital Inc. now owns 11,810 shares of the company's stock worth $130,000 after purchasing an additional 1,500 shares in the last quarter. Institutional investors own 43.12% of the company's stock.

Analyst Ratings Changes

Several analysts have recently commented on CLSK shares. Macquarie assumed coverage on CleanSpark in a research report on Wednesday, September 25th. They issued an "outperform" rating and a $20.00 target price for the company. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $23.00 price objective on shares of CleanSpark in a research report on Thursday. JPMorgan Chase & Co. decreased their target price on shares of CleanSpark from $12.50 to $10.50 and set a "neutral" rating for the company in a research note on Friday, August 23rd. Finally, HC Wainwright reiterated a "buy" rating and set a $27.00 price objective on shares of CleanSpark in a report on Wednesday, September 25th. One equities research analyst has rated the stock with a hold rating and six have assigned a buy rating to the stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $19.11.

Read Our Latest Report on CLSK

CleanSpark Price Performance

Shares of NASDAQ:CLSK traded up $0.92 on Friday, reaching $9.58. The company had a trading volume of 22,479,433 shares, compared to its average volume of 30,051,752. The stock has a 50-day moving average price of $10.76 and a 200 day moving average price of $15.00. CleanSpark, Inc. has a twelve month low of $3.38 and a twelve month high of $24.72.

CleanSpark (NASDAQ:CLSK - Get Free Report) last announced its earnings results on Friday, August 9th. The company reported $0.01 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.04 by ($0.03). CleanSpark had a negative return on equity of 3.64% and a negative net margin of 46.31%. The company had revenue of $104.11 million for the quarter, compared to the consensus estimate of $114.04 million. On average, equities research analysts predict that CleanSpark, Inc. will post -0.06 EPS for the current fiscal year.

Insider Buying and Selling

In other CleanSpark news, Director Thomas Leigh Wood sold 22,222 shares of CleanSpark stock in a transaction that occurred on Thursday, September 12th. The stock was sold at an average price of $9.24, for a total value of $205,331.28. Following the transaction, the director now directly owns 137,050 shares of the company's stock, valued at $1,266,342. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Insiders have sold 26,272 shares of company stock worth $256,874 in the last quarter. 3.46% of the stock is currently owned by company insiders.

CleanSpark Profile

(

Free Report)

CleanSpark, Inc operates as a bitcoin miner in the Americas. It owns and operates data centers that primarily run on low-carbon power. Its infrastructure supports Bitcoin, a digital commodity and a tool for financial independence and inclusion. The company was formerly known as Stratean Inc and changed its name to CleanSpark, Inc in November 2016.

Further Reading

Before you consider CleanSpark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CleanSpark wasn't on the list.

While CleanSpark currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.