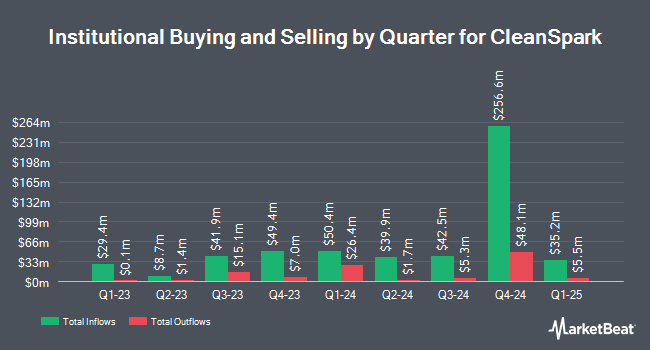

SRN Advisors LLC boosted its holdings in shares of CleanSpark, Inc. (NASDAQ:CLSK - Free Report) by 65.3% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 261,427 shares of the company's stock after purchasing an additional 103,283 shares during the quarter. CleanSpark comprises 2.2% of SRN Advisors LLC's portfolio, making the stock its 3rd biggest holding. SRN Advisors LLC owned 0.11% of CleanSpark worth $2,442,000 as of its most recent SEC filing.

Other large investors also recently added to or reduced their stakes in the company. Vanguard Group Inc. increased its holdings in CleanSpark by 6.8% in the 4th quarter. Vanguard Group Inc. now owns 8,048,511 shares of the company's stock valued at $88,775,000 after acquiring an additional 515,314 shares during the last quarter. CAP Partners LLC bought a new stake in shares of CleanSpark in the first quarter worth about $767,000. Sloy Dahl & Holst LLC bought a new stake in shares of CleanSpark in the first quarter worth about $302,000. United Capital Management of KS Inc. purchased a new stake in shares of CleanSpark in the first quarter worth about $327,000. Finally, Principal Financial Group Inc. boosted its stake in CleanSpark by 20.4% during the first quarter. Principal Financial Group Inc. now owns 22,511 shares of the company's stock valued at $477,000 after buying an additional 3,810 shares during the last quarter. 43.12% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of analysts have issued reports on CLSK shares. Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $23.00 price objective on shares of CleanSpark in a research note on Thursday, October 3rd. HC Wainwright restated a "buy" rating and issued a $27.00 price target on shares of CleanSpark in a research report on Wednesday, September 25th. Macquarie began coverage on shares of CleanSpark in a research note on Wednesday, September 25th. They set an "outperform" rating and a $20.00 price target on the stock. Finally, JPMorgan Chase & Co. dropped their price objective on shares of CleanSpark from $12.50 to $10.50 and set a "neutral" rating for the company in a research note on Friday, August 23rd. One research analyst has rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, CleanSpark presently has a consensus rating of "Moderate Buy" and a consensus target price of $19.11.

Read Our Latest Stock Report on CleanSpark

Insiders Place Their Bets

In other CleanSpark news, Director Thomas Leigh Wood sold 22,222 shares of the business's stock in a transaction that occurred on Thursday, September 12th. The stock was sold at an average price of $9.24, for a total transaction of $205,331.28. Following the completion of the transaction, the director now owns 137,050 shares in the company, valued at $1,266,342. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Insiders sold a total of 26,272 shares of company stock valued at $250,003 over the last 90 days. Insiders own 3.46% of the company's stock.

CleanSpark Stock Down 4.8 %

CLSK traded down $0.57 during trading on Friday, reaching $11.39. The company had a trading volume of 32,996,601 shares, compared to its average volume of 30,002,354. The business has a 50 day simple moving average of $10.19 and a 200-day simple moving average of $14.13. CleanSpark, Inc. has a 52 week low of $3.46 and a 52 week high of $24.72.

CleanSpark (NASDAQ:CLSK - Get Free Report) last released its earnings results on Friday, August 9th. The company reported $0.01 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.04 by ($0.03). CleanSpark had a negative return on equity of 3.64% and a negative net margin of 46.31%. The firm had revenue of $104.11 million during the quarter, compared to the consensus estimate of $114.04 million. On average, sell-side analysts expect that CleanSpark, Inc. will post -0.06 EPS for the current year.

About CleanSpark

(

Free Report)

CleanSpark, Inc operates as a bitcoin miner in the Americas. It owns and operates data centers that primarily run on low-carbon power. Its infrastructure supports Bitcoin, a digital commodity and a tool for financial independence and inclusion. The company was formerly known as Stratean Inc and changed its name to CleanSpark, Inc in November 2016.

Read More

Before you consider CleanSpark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CleanSpark wasn't on the list.

While CleanSpark currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.