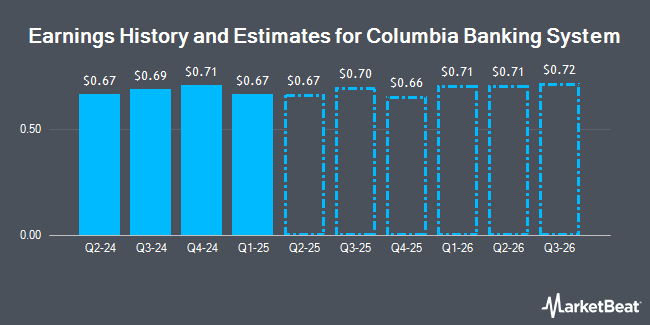

Columbia Banking System, Inc. (NASDAQ:COLB - Free Report) - Analysts at Wedbush raised their Q4 2024 earnings estimates for shares of Columbia Banking System in a report issued on Thursday, October 24th. Wedbush analyst D. Chiaverini now expects that the financial services provider will post earnings per share of $0.65 for the quarter, up from their previous estimate of $0.63. Wedbush currently has a "Outperform" rating and a $35.00 target price on the stock. The consensus estimate for Columbia Banking System's current full-year earnings is $2.55 per share. Wedbush also issued estimates for Columbia Banking System's Q1 2025 earnings at $0.67 EPS, Q2 2025 earnings at $0.69 EPS, Q3 2025 earnings at $0.70 EPS, Q1 2026 earnings at $0.71 EPS, Q2 2026 earnings at $0.71 EPS, Q3 2026 earnings at $0.72 EPS and FY2026 earnings at $2.85 EPS.

Other equities analysts have also issued research reports about the company. Royal Bank of Canada increased their price target on Columbia Banking System from $29.00 to $31.00 and gave the company a "sector perform" rating in a research report on Friday. Barclays lifted their target price on shares of Columbia Banking System from $25.00 to $29.00 and gave the stock an "equal weight" rating in a research report on Friday. StockNews.com upgraded shares of Columbia Banking System from a "sell" rating to a "hold" rating in a research report on Saturday, October 5th. Stephens lifted their price objective on shares of Columbia Banking System from $22.00 to $26.00 and gave the stock an "equal weight" rating in a research report on Friday, July 26th. Finally, Keefe, Bruyette & Woods boosted their target price on shares of Columbia Banking System from $23.00 to $27.00 and gave the company a "market perform" rating in a research note on Friday, July 26th. Eleven analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average target price of $27.12.

View Our Latest Research Report on COLB

Columbia Banking System Trading Up 3.1 %

Shares of NASDAQ COLB traded up $0.87 during mid-day trading on Monday, reaching $28.77. The company had a trading volume of 1,868,078 shares, compared to its average volume of 2,305,061. The company has a 50-day moving average price of $25.49 and a two-hundred day moving average price of $22.26. The stock has a market cap of $6.02 billion, a PE ratio of 12.01 and a beta of 0.64. Columbia Banking System has a 1-year low of $17.08 and a 1-year high of $28.88.

Columbia Banking System (NASDAQ:COLB - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The financial services provider reported $0.69 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.62 by $0.07. Columbia Banking System had a return on equity of 10.89% and a net margin of 15.94%. The company had revenue of $765.06 million for the quarter, compared to analysts' expectations of $478.80 million. During the same quarter in the prior year, the company earned $0.79 earnings per share.

Columbia Banking System Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Monday, September 9th. Investors of record on Friday, August 23rd were paid a $0.36 dividend. The ex-dividend date was Friday, August 23rd. This represents a $1.44 annualized dividend and a dividend yield of 5.01%. Columbia Banking System's payout ratio is 61.80%.

Institutional Trading of Columbia Banking System

Large investors have recently added to or reduced their stakes in the business. Picton Mahoney Asset Management acquired a new stake in shares of Columbia Banking System in the 2nd quarter valued at $33,000. Abich Financial Wealth Management LLC boosted its stake in shares of Columbia Banking System by 85.1% during the 1st quarter. Abich Financial Wealth Management LLC now owns 2,219 shares of the financial services provider's stock worth $43,000 after acquiring an additional 1,020 shares in the last quarter. GAMMA Investing LLC increased its holdings in shares of Columbia Banking System by 144.0% during the 2nd quarter. GAMMA Investing LLC now owns 2,350 shares of the financial services provider's stock valued at $47,000 after acquiring an additional 1,387 shares during the last quarter. Allspring Global Investments Holdings LLC increased its holdings in shares of Columbia Banking System by 111.5% during the 2nd quarter. Allspring Global Investments Holdings LLC now owns 2,618 shares of the financial services provider's stock valued at $52,000 after acquiring an additional 1,380 shares during the last quarter. Finally, Hexagon Capital Partners LLC raised its stake in shares of Columbia Banking System by 137,166.7% in the 2nd quarter. Hexagon Capital Partners LLC now owns 4,118 shares of the financial services provider's stock valued at $82,000 after acquiring an additional 4,115 shares in the last quarter. 92.53% of the stock is owned by institutional investors.

About Columbia Banking System

(

Get Free Report)

Columbia Banking System, Inc operates as the holding company of Umpqua Bank that provides banking, private banking, mortgage, and other financial services in the United States. The company offers deposit products, including business, non-interest bearing checking, interest-bearing checking and savings, money market, and certificate of deposit accounts; and insured cash sweep and other investment sweep solutions.

Featured Stories

Before you consider Columbia Banking System, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Columbia Banking System wasn't on the list.

While Columbia Banking System currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.