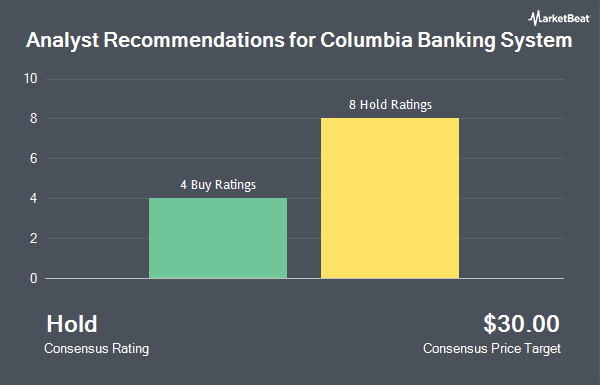

Columbia Banking System, Inc. (NASDAQ:COLB - Get Free Report) has received a consensus rating of "Hold" from the thirteen brokerages that are currently covering the stock, MarketBeat.com reports. Ten analysts have rated the stock with a hold recommendation and three have assigned a buy recommendation to the company. The average 1 year price objective among brokers that have issued ratings on the stock in the last year is $25.81.

Several analysts recently issued reports on the stock. Truist Financial dropped their price objective on shares of Columbia Banking System from $29.00 to $28.00 and set a "hold" rating for the company in a research note on Friday, September 20th. Stephens upped their price objective on shares of Columbia Banking System from $22.00 to $26.00 and gave the company an "equal weight" rating in a research note on Friday, July 26th. JPMorgan Chase & Co. dropped their price objective on shares of Columbia Banking System from $29.00 to $28.00 and set a "neutral" rating for the company in a research note on Wednesday, October 9th. Wedbush raised shares of Columbia Banking System from a "neutral" rating to an "outperform" rating and upped their price objective for the company from $28.00 to $31.00 in a research note on Tuesday, September 24th. Finally, StockNews.com raised shares of Columbia Banking System from a "sell" rating to a "hold" rating in a research note on Saturday, October 5th.

View Our Latest Research Report on COLB

Institutional Inflows and Outflows

A number of hedge funds have recently modified their holdings of the stock. Signaturefd LLC grew its position in shares of Columbia Banking System by 14.0% in the 3rd quarter. Signaturefd LLC now owns 5,767 shares of the financial services provider's stock valued at $151,000 after buying an additional 709 shares during the last quarter. Bleakley Financial Group LLC grew its position in Columbia Banking System by 2.9% during the 3rd quarter. Bleakley Financial Group LLC now owns 25,111 shares of the financial services provider's stock worth $656,000 after purchasing an additional 718 shares during the last quarter. ZWJ Investment Counsel Inc. grew its position in Columbia Banking System by 5.0% during the 3rd quarter. ZWJ Investment Counsel Inc. now owns 128,073 shares of the financial services provider's stock worth $3,344,000 after purchasing an additional 6,142 shares during the last quarter. Capital Advisors Wealth Management LLC grew its position in Columbia Banking System by 5.5% during the 3rd quarter. Capital Advisors Wealth Management LLC now owns 118,412 shares of the financial services provider's stock worth $3,092,000 after purchasing an additional 6,208 shares during the last quarter. Finally, Creative Planning grew its position in Columbia Banking System by 19.9% during the 3rd quarter. Creative Planning now owns 50,429 shares of the financial services provider's stock worth $1,317,000 after purchasing an additional 8,366 shares during the last quarter. 92.53% of the stock is owned by hedge funds and other institutional investors.

Columbia Banking System Trading Up 1.6 %

Shares of Columbia Banking System stock traded up $0.42 during trading hours on Tuesday, reaching $27.05. The stock had a trading volume of 1,123,365 shares, compared to its average volume of 2,303,015. The stock's 50 day moving average is $25.17 and its 200 day moving average is $22.01. The firm has a market capitalization of $5.66 billion, a PE ratio of 11.61 and a beta of 0.64. Columbia Banking System has a twelve month low of $17.08 and a twelve month high of $28.15.

Columbia Banking System (NASDAQ:COLB - Get Free Report) last released its quarterly earnings results on Thursday, July 25th. The financial services provider reported $0.67 earnings per share for the quarter, topping the consensus estimate of $0.57 by $0.10. Columbia Banking System had a net margin of 15.94% and a return on equity of 10.89%. The firm had revenue of $472.15 million during the quarter, compared to the consensus estimate of $476.01 million. During the same quarter in the prior year, the firm earned $0.81 EPS. The company's revenue for the quarter was down 9.8% on a year-over-year basis. As a group, sell-side analysts predict that Columbia Banking System will post 2.55 earnings per share for the current year.

Columbia Banking System Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Monday, September 9th. Stockholders of record on Friday, August 23rd were issued a $0.36 dividend. The ex-dividend date was Friday, August 23rd. This represents a $1.44 dividend on an annualized basis and a dividend yield of 5.32%. Columbia Banking System's payout ratio is 61.80%.

About Columbia Banking System

(

Get Free ReportColumbia Banking System, Inc operates as the holding company of Umpqua Bank that provides banking, private banking, mortgage, and other financial services in the United States. The company offers deposit products, including business, non-interest bearing checking, interest-bearing checking and savings, money market, and certificate of deposit accounts; and insured cash sweep and other investment sweep solutions.

Further Reading

Before you consider Columbia Banking System, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Columbia Banking System wasn't on the list.

While Columbia Banking System currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.