Boston Trust Walden Corp cut its holdings in shares of Columbia Sportswear (NASDAQ:COLM - Free Report) by 1.8% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 1,280,926 shares of the textile maker's stock after selling 23,835 shares during the quarter. Boston Trust Walden Corp owned 2.17% of Columbia Sportswear worth $106,560,000 at the end of the most recent quarter.

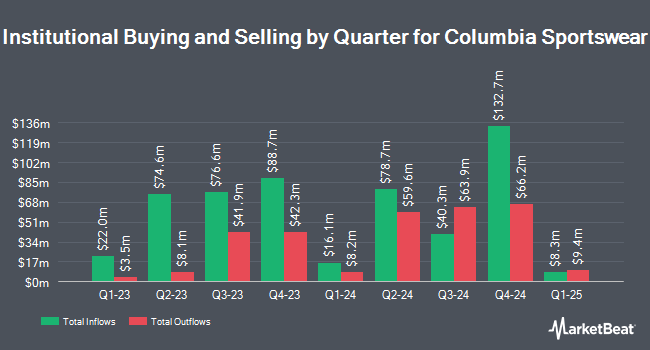

Several other institutional investors and hedge funds also recently bought and sold shares of COLM. Vanguard Group Inc. grew its stake in Columbia Sportswear by 0.7% in the first quarter. Vanguard Group Inc. now owns 3,170,400 shares of the textile maker's stock valued at $257,373,000 after purchasing an additional 21,104 shares in the last quarter. Pacer Advisors Inc. grew its stake in shares of Columbia Sportswear by 44.3% in the 2nd quarter. Pacer Advisors Inc. now owns 1,480,868 shares of the textile maker's stock valued at $117,107,000 after buying an additional 454,738 shares in the last quarter. Dimensional Fund Advisors LP increased its holdings in Columbia Sportswear by 4.9% in the second quarter. Dimensional Fund Advisors LP now owns 1,195,386 shares of the textile maker's stock worth $94,530,000 after buying an additional 56,348 shares during the last quarter. American Century Companies Inc. raised its position in Columbia Sportswear by 153.3% during the second quarter. American Century Companies Inc. now owns 616,110 shares of the textile maker's stock valued at $48,722,000 after acquiring an additional 372,886 shares in the last quarter. Finally, Bank of New York Mellon Corp grew its position in Columbia Sportswear by 3.7% in the second quarter. Bank of New York Mellon Corp now owns 425,483 shares of the textile maker's stock worth $33,647,000 after acquiring an additional 15,375 shares in the last quarter. Hedge funds and other institutional investors own 47.76% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts recently issued reports on COLM shares. Stifel Nicolaus raised shares of Columbia Sportswear from a "hold" rating to a "buy" rating and lifted their price objective for the company from $84.00 to $92.00 in a research note on Monday, July 8th. Wedbush reiterated a "neutral" rating and set a $80.00 price target on shares of Columbia Sportswear in a research note on Thursday, July 18th. Finally, StockNews.com lowered Columbia Sportswear from a "buy" rating to a "hold" rating in a report on Saturday, October 5th. One investment analyst has rated the stock with a sell rating, two have issued a hold rating and one has issued a buy rating to the company's stock. According to data from MarketBeat.com, Columbia Sportswear presently has an average rating of "Hold" and an average price target of $77.00.

Get Our Latest Stock Report on Columbia Sportswear

Columbia Sportswear Stock Down 2.1 %

NASDAQ COLM traded down $1.60 during trading on Friday, hitting $75.18. The company's stock had a trading volume of 367,356 shares, compared to its average volume of 453,269. Columbia Sportswear has a 52 week low of $66.01 and a 52 week high of $87.23. The firm has a market cap of $4.44 billion, a P/E ratio of 18.34, a price-to-earnings-growth ratio of 3.00 and a beta of 0.92. The firm has a 50 day moving average price of $81.32 and a 200 day moving average price of $80.75.

Columbia Sportswear (NASDAQ:COLM - Get Free Report) last released its earnings results on Thursday, July 25th. The textile maker reported ($0.20) EPS for the quarter, beating the consensus estimate of ($0.34) by $0.14. Columbia Sportswear had a net margin of 6.72% and a return on equity of 13.01%. The firm had revenue of $570.20 million during the quarter, compared to analysts' expectations of $569.37 million. During the same period in the prior year, the company earned $0.14 EPS. The business's quarterly revenue was down 8.2% compared to the same quarter last year. On average, equities analysts expect that Columbia Sportswear will post 3.84 earnings per share for the current year.

Columbia Sportswear Company Profile

(

Free Report)

Columbia Sportswear Company, together with its subsidiaries, designs, develops, markets, and distributes outdoor, active, and everyday lifestyle apparel, footwear, accessories, and equipment in the United States, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and Canada. The company provides apparel, accessories, and equipment for hiking, trail running, snow, fishing, hunting, mountaineering, climbing, skiing and snowboarding, trail, and outdoor activities.

Further Reading

Before you consider Columbia Sportswear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Columbia Sportswear wasn't on the list.

While Columbia Sportswear currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.