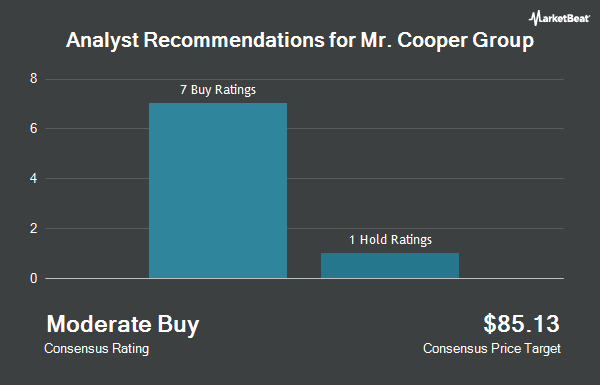

Shares of Mr. Cooper Group Inc. (NASDAQ:COOP - Get Free Report) have been given an average rating of "Moderate Buy" by the eight analysts that are presently covering the firm, MarketBeat.com reports. Two investment analysts have rated the stock with a hold recommendation and six have issued a buy recommendation on the company. The average 12-month price objective among brokerages that have updated their coverage on the stock in the last year is $98.00.

Several brokerages have recently commented on COOP. Keefe, Bruyette & Woods downgraded Mr. Cooper Group from an "outperform" rating to a "market perform" rating and set a $95.00 target price for the company. in a research note on Monday, July 22nd. Barclays lifted their price objective on shares of Mr. Cooper Group from $103.00 to $108.00 and gave the stock an "overweight" rating in a research report on Tuesday, October 8th. Compass Point increased their price objective on shares of Mr. Cooper Group from $97.00 to $110.00 and gave the company a "buy" rating in a research report on Thursday, October 24th. Wedbush restated an "outperform" rating and set a $115.00 target price on shares of Mr. Cooper Group in a research note on Thursday, October 24th. Finally, Piper Sandler upped their price target on shares of Mr. Cooper Group from $91.00 to $106.00 and gave the company an "overweight" rating in a research note on Friday, July 26th.

Check Out Our Latest Stock Analysis on Mr. Cooper Group

Institutional Trading of Mr. Cooper Group

A number of large investors have recently added to or reduced their stakes in COOP. Blue Trust Inc. lifted its stake in Mr. Cooper Group by 77.1% in the 2nd quarter. Blue Trust Inc. now owns 333 shares of the company's stock worth $26,000 after purchasing an additional 145 shares in the last quarter. CWM LLC grew its holdings in Mr. Cooper Group by 34.5% in the 2nd quarter. CWM LLC now owns 601 shares of the company's stock worth $49,000 after acquiring an additional 154 shares during the last quarter. Aristeia Capital L.L.C. raised its position in Mr. Cooper Group by 4.2% during the 2nd quarter. Aristeia Capital L.L.C. now owns 4,197 shares of the company's stock valued at $341,000 after purchasing an additional 169 shares during the last quarter. Truist Financial Corp boosted its holdings in Mr. Cooper Group by 1.6% in the second quarter. Truist Financial Corp now owns 11,840 shares of the company's stock valued at $962,000 after acquiring an additional 187 shares in the last quarter. Finally, B. Riley Wealth Advisors Inc. raised its holdings in Mr. Cooper Group by 2.0% in the first quarter. B. Riley Wealth Advisors Inc. now owns 10,521 shares of the company's stock worth $820,000 after purchasing an additional 203 shares in the last quarter. Hedge funds and other institutional investors own 89.82% of the company's stock.

Mr. Cooper Group Stock Performance

COOP traded up $1.61 during trading on Tuesday, reaching $92.21. 351,084 shares of the company's stock were exchanged, compared to its average volume of 446,042. The company's fifty day moving average price is $91.83 and its 200-day moving average price is $86.69. The firm has a market capitalization of $5.90 billion, a PE ratio of 11.91 and a beta of 1.40. Mr. Cooper Group has a fifty-two week low of $54.07 and a fifty-two week high of $97.35.

Mr. Cooper Group (NASDAQ:COOP - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The company reported $2.84 EPS for the quarter, topping the consensus estimate of $2.54 by $0.30. The firm had revenue of $616.00 million for the quarter, compared to the consensus estimate of $548.09 million. Mr. Cooper Group had a net margin of 25.87% and a return on equity of 13.77%. The business's quarterly revenue was up 32.8% on a year-over-year basis. During the same period last year, the company posted $2.79 EPS. Research analysts forecast that Mr. Cooper Group will post 10.17 earnings per share for the current fiscal year.

About Mr. Cooper Group

(

Get Free ReportMr. Cooper Group Inc, together with its subsidiaries, operates as a non-bank servicer of residential mortgage loans in the United States. The company operates through Servicing and Originations segments. The Servicing segment performs activities on behalf of investors or owners of the underlying mortgages and mortgage servicing rights, including collecting and disbursing borrower payments, investor reporting, customer service, modifying loans, performing collections, foreclosures, and the sale of real estate owned.

Recommended Stories

Before you consider Mr. Cooper Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mr. Cooper Group wasn't on the list.

While Mr. Cooper Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.