Moody Aldrich Partners LLC increased its position in shares of Credo Technology Group Holding Ltd (NASDAQ:CRDO - Free Report) by 38.8% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 208,908 shares of the company's stock after buying an additional 58,351 shares during the period. Credo Technology Group comprises about 1.2% of Moody Aldrich Partners LLC's portfolio, making the stock its 27th biggest position. Moody Aldrich Partners LLC owned 0.13% of Credo Technology Group worth $6,434,000 at the end of the most recent reporting period.

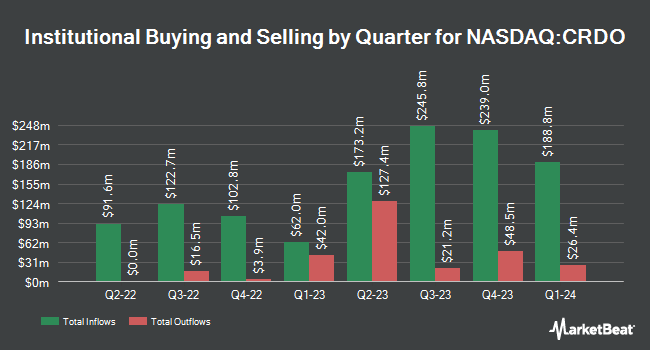

Several other hedge funds have also recently added to or reduced their stakes in the company. Arcadia Investment Management Corp MI acquired a new stake in shares of Credo Technology Group in the 2nd quarter valued at $29,000. Fifth Third Bancorp lifted its holdings in Credo Technology Group by 59.3% during the 2nd quarter. Fifth Third Bancorp now owns 1,074 shares of the company's stock worth $34,000 after buying an additional 400 shares during the last quarter. Covestor Ltd increased its holdings in shares of Credo Technology Group by 19,240.0% in the 1st quarter. Covestor Ltd now owns 1,934 shares of the company's stock valued at $41,000 after acquiring an additional 1,924 shares during the last quarter. CWM LLC raised its position in shares of Credo Technology Group by 78.1% during the 2nd quarter. CWM LLC now owns 1,355 shares of the company's stock worth $43,000 after acquiring an additional 594 shares in the last quarter. Finally, Cranbrook Wealth Management LLC purchased a new stake in Credo Technology Group during the second quarter worth approximately $51,000. Institutional investors and hedge funds own 80.46% of the company's stock.

Insider Activity

In related news, CTO Chi Fung Cheng sold 55,000 shares of the business's stock in a transaction dated Thursday, August 1st. The shares were sold at an average price of $26.85, for a total transaction of $1,476,750.00. Following the sale, the chief technology officer now owns 9,278,602 shares of the company's stock, valued at approximately $249,130,463.70. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. In other news, CTO Chi Fung Cheng sold 55,000 shares of the stock in a transaction that occurred on Thursday, August 1st. The shares were sold at an average price of $26.85, for a total value of $1,476,750.00. Following the sale, the chief technology officer now directly owns 9,278,602 shares in the company, valued at $249,130,463.70. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, COO Yat Tung Lam sold 10,000 shares of the stock in a transaction on Monday, August 12th. The shares were sold at an average price of $27.67, for a total value of $276,700.00. Following the sale, the chief operating officer now directly owns 2,807,777 shares in the company, valued at approximately $77,691,189.59. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 1,444,817 shares of company stock worth $45,913,586 in the last 90 days. 23.89% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

Several brokerages have recently weighed in on CRDO. Barclays boosted their price objective on shares of Credo Technology Group from $30.00 to $32.00 and gave the stock an "overweight" rating in a research report on Thursday, September 5th. Bank of America lifted their target price on Credo Technology Group from $25.00 to $27.00 and gave the stock an "underperform" rating in a research report on Thursday, September 5th. Roth Mkm upped their target price on Credo Technology Group from $35.00 to $45.00 and gave the company a "buy" rating in a research report on Tuesday. Craig Hallum boosted their price objective on Credo Technology Group from $30.00 to $38.00 and gave the company a "buy" rating in a research note on Thursday, September 5th. Finally, Needham & Company LLC upped their price target on shares of Credo Technology Group from $29.00 to $33.00 and gave the company a "buy" rating in a research report on Thursday, September 5th. One research analyst has rated the stock with a sell rating, seven have given a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, Credo Technology Group has a consensus rating of "Moderate Buy" and a consensus target price of $36.56.

Check Out Our Latest Report on Credo Technology Group

Credo Technology Group Price Performance

NASDAQ CRDO traded up $0.34 on Thursday, hitting $39.01. 1,232,855 shares of the company's stock were exchanged, compared to its average volume of 2,229,677. The firm has a market cap of $6.44 billion, a price-to-earnings ratio of -216.72 and a beta of 2.24. The firm's 50-day moving average price is $32.51 and its two-hundred day moving average price is $27.45. Credo Technology Group Holding Ltd has a fifty-two week low of $13.38 and a fifty-two week high of $40.37.

Credo Technology Group (NASDAQ:CRDO - Get Free Report) last announced its quarterly earnings data on Wednesday, September 4th. The company reported ($0.06) earnings per share for the quarter, missing analysts' consensus estimates of ($0.03) by ($0.03). Credo Technology Group had a negative return on equity of 3.74% and a negative net margin of 12.05%. The business had revenue of $59.71 million for the quarter, compared to analyst estimates of $59.50 million. On average, research analysts predict that Credo Technology Group Holding Ltd will post -0.02 earnings per share for the current fiscal year.

Credo Technology Group Profile

(

Free Report)

Credo Technology Group Holding Ltd provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally. Its products include HiWire active electrical cables, optical digital signal processors, low-power line card PHY, serializer/deserializer (SerDes) chiplets, and SerDes IP, as well as integrated circuits, active electrical cables.

Featured Articles

Before you consider Credo Technology Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Credo Technology Group wasn't on the list.

While Credo Technology Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.