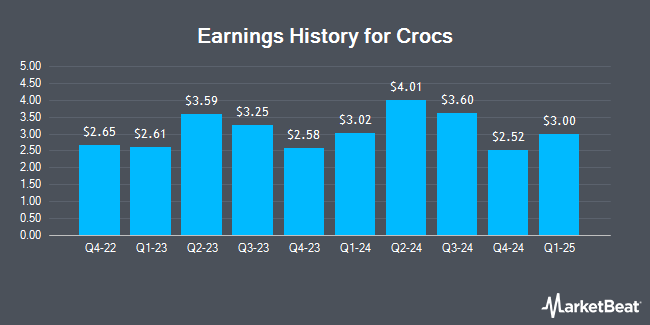

Crocs (NASDAQ:CROX - Get Free Report) issued its quarterly earnings results on Tuesday. The textile maker reported $3.60 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.10 by $0.50, Briefing.com reports. Crocs had a net margin of 20.50% and a return on equity of 49.70%. The company had revenue of $1.06 billion during the quarter, compared to analyst estimates of $1.05 billion. During the same quarter last year, the business posted $3.25 EPS. Crocs's quarterly revenue was up 1.6% compared to the same quarter last year.

Crocs Price Performance

Crocs stock opened at $107.82 on Friday. The company has a quick ratio of 0.95, a current ratio of 1.43 and a debt-to-equity ratio of 0.82. The business has a 50-day simple moving average of $137.05 and a 200 day simple moving average of $138.45. Crocs has a 52 week low of $74.00 and a 52 week high of $165.32. The stock has a market cap of $6.28 billion, a price-to-earnings ratio of 7.82, a PEG ratio of 1.10 and a beta of 1.99.

Analysts Set New Price Targets

Several equities research analysts have recently issued reports on the stock. Loop Capital decreased their price target on shares of Crocs from $155.00 to $150.00 and set a "buy" rating for the company in a research note on Wednesday. Robert W. Baird cut their price objective on shares of Crocs from $190.00 to $180.00 and set an "outperform" rating for the company in a report on Wednesday. KeyCorp cut their price objective on shares of Crocs from $155.00 to $150.00 and set an "overweight" rating for the company in a report on Wednesday. Barclays cut their price objective on shares of Crocs from $164.00 to $125.00 and set an "overweight" rating for the company in a report on Tuesday. Finally, StockNews.com downgraded shares of Crocs from a "buy" rating to a "hold" rating in a report on Wednesday. Four equities research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $154.00.

Check Out Our Latest Research Report on Crocs

Insiders Place Their Bets

In other Crocs news, Director Douglas J. Treff sold 10,594 shares of Crocs stock in a transaction dated Thursday, August 8th. The stock was sold at an average price of $132.38, for a total transaction of $1,402,433.72. Following the completion of the sale, the director now owns 81,254 shares of the company's stock, valued at $10,756,404.52. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. In related news, Director John B. Replogle bought 2,240 shares of the stock in a transaction dated Wednesday, October 30th. The stock was bought at an average price of $112.60 per share, with a total value of $252,224.00. Following the purchase, the director now owns 9,304 shares in the company, valued at approximately $1,047,630.40. The trade was a 0.00 % increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Douglas J. Treff sold 10,594 shares of the business's stock in a transaction dated Thursday, August 8th. The shares were sold at an average price of $132.38, for a total value of $1,402,433.72. Following the completion of the sale, the director now directly owns 81,254 shares of the company's stock, valued at approximately $10,756,404.52. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 2.72% of the company's stock.

Crocs Company Profile

(

Get Free Report)

Crocs, Inc, together with its subsidiaries, designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under Crocs and HEYDUDE Brand in the United States and internationally. The company offers various footwear products, including clogs, sandals, slides, flips, wedges, platforms, socks, boots, charms, flip flops, sneakers, and slippers.

Further Reading

Before you consider Crocs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crocs wasn't on the list.

While Crocs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.