IAG Wealth Partners LLC acquired a new position in shares of Crocs, Inc. (NASDAQ:CROX - Free Report) in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 5,500 shares of the textile maker's stock, valued at approximately $796,000.

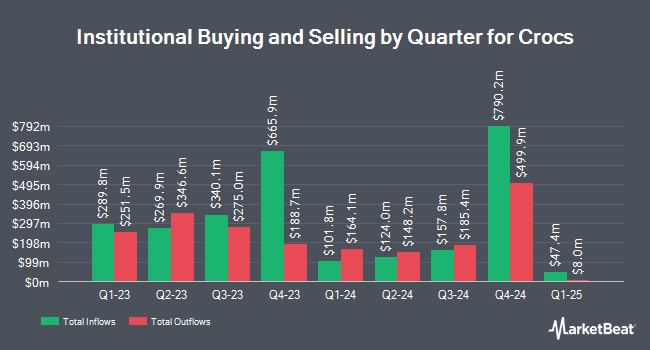

A number of other hedge funds and other institutional investors also recently made changes to their positions in the stock. Vanguard Group Inc. raised its stake in shares of Crocs by 1.4% in the first quarter. Vanguard Group Inc. now owns 5,572,643 shares of the textile maker's stock worth $801,346,000 after acquiring an additional 76,460 shares during the last quarter. Pacer Advisors Inc. lifted its position in Crocs by 15.1% during the 2nd quarter. Pacer Advisors Inc. now owns 1,091,097 shares of the textile maker's stock valued at $159,235,000 after purchasing an additional 142,944 shares during the period. Thrivent Financial for Lutherans boosted its stake in shares of Crocs by 1.3% in the 2nd quarter. Thrivent Financial for Lutherans now owns 901,973 shares of the textile maker's stock valued at $131,634,000 after purchasing an additional 11,986 shares during the last quarter. Dimensional Fund Advisors LP grew its position in shares of Crocs by 12.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 790,225 shares of the textile maker's stock worth $115,322,000 after buying an additional 89,610 shares during the period. Finally, Van Lanschot Kempen Investment Management N.V. raised its stake in shares of Crocs by 6.7% during the second quarter. Van Lanschot Kempen Investment Management N.V. now owns 521,726 shares of the textile maker's stock worth $76,141,000 after buying an additional 32,984 shares during the last quarter. 93.44% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

A number of equities analysts have issued reports on CROX shares. Williams Trading raised shares of Crocs from a "hold" rating to a "buy" rating and raised their price objective for the company from $135.00 to $163.00 in a research note on Thursday, August 22nd. Loop Capital decreased their price objective on Crocs from $155.00 to $150.00 and set a "buy" rating for the company in a research note on Wednesday. Raymond James lowered Crocs from an "outperform" rating to a "market perform" rating in a research note on Wednesday. Guggenheim reduced their target price on Crocs from $182.00 to $155.00 and set a "buy" rating on the stock in a report on Wednesday. Finally, Monness Crespi & Hardt lowered their price target on Crocs from $170.00 to $140.00 and set a "buy" rating for the company in a research note on Wednesday. Four equities research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $154.00.

View Our Latest Stock Analysis on Crocs

Insiders Place Their Bets

In other Crocs news, Director John B. Replogle acquired 2,240 shares of the company's stock in a transaction on Wednesday, October 30th. The stock was acquired at an average price of $112.60 per share, for a total transaction of $252,224.00. Following the purchase, the director now directly owns 9,304 shares of the company's stock, valued at $1,047,630.40. This trade represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. In related news, Director John B. Replogle bought 2,240 shares of the business's stock in a transaction dated Wednesday, October 30th. The stock was purchased at an average cost of $112.60 per share, for a total transaction of $252,224.00. Following the transaction, the director now owns 9,304 shares in the company, valued at $1,047,630.40. The trade was a 0.00 % increase in their position. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Douglas J. Treff sold 10,594 shares of the firm's stock in a transaction on Thursday, August 8th. The stock was sold at an average price of $132.38, for a total value of $1,402,433.72. Following the completion of the transaction, the director now owns 81,254 shares in the company, valued at $10,756,404.52. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 2.72% of the company's stock.

Crocs Stock Performance

Crocs stock traded down $1.61 during mid-day trading on Friday, hitting $106.21. 1,880,424 shares of the company's stock traded hands, compared to its average volume of 1,612,433. Crocs, Inc. has a fifty-two week low of $74.00 and a fifty-two week high of $165.32. The stock has a market cap of $6.19 billion, a price-to-earnings ratio of 7.70, a P/E/G ratio of 1.09 and a beta of 2.01. The firm has a 50 day simple moving average of $135.60 and a two-hundred day simple moving average of $138.24. The company has a debt-to-equity ratio of 0.82, a current ratio of 1.43 and a quick ratio of 0.95.

Crocs (NASDAQ:CROX - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The textile maker reported $3.60 EPS for the quarter, beating analysts' consensus estimates of $3.10 by $0.50. Crocs had a net margin of 20.50% and a return on equity of 49.70%. The business had revenue of $1.06 billion for the quarter, compared to analyst estimates of $1.05 billion. During the same quarter in the prior year, the business earned $3.25 EPS. Crocs's quarterly revenue was up 1.6% on a year-over-year basis. On average, research analysts expect that Crocs, Inc. will post 12.93 EPS for the current fiscal year.

Crocs Profile

(

Free Report)

Crocs, Inc, together with its subsidiaries, designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under Crocs and HEYDUDE Brand in the United States and internationally. The company offers various footwear products, including clogs, sandals, slides, flips, wedges, platforms, socks, boots, charms, flip flops, sneakers, and slippers.

Featured Articles

Before you consider Crocs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crocs wasn't on the list.

While Crocs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report