Lederer & Associates Investment Counsel CA bought a new position in shares of CrowdStrike Holdings, Inc. (NASDAQ:CRWD - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor bought 3,036 shares of the company's stock, valued at approximately $852,000.

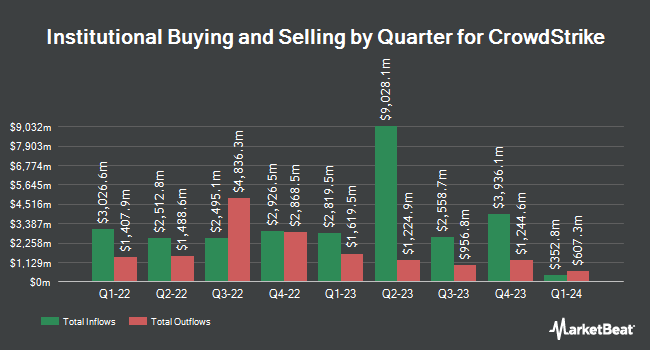

Other large investors have also modified their holdings of the company. International Assets Investment Management LLC grew its holdings in CrowdStrike by 17,926.3% during the 3rd quarter. International Assets Investment Management LLC now owns 925,831 shares of the company's stock valued at $259,668,000 after buying an additional 920,695 shares during the last quarter. Bank of New York Mellon Corp grew its holdings in CrowdStrike by 47.5% during the 2nd quarter. Bank of New York Mellon Corp now owns 1,753,252 shares of the company's stock valued at $671,828,000 after buying an additional 564,662 shares during the last quarter. Acadian Asset Management LLC grew its holdings in CrowdStrike by 619.0% during the 1st quarter. Acadian Asset Management LLC now owns 554,876 shares of the company's stock valued at $177,865,000 after buying an additional 477,706 shares during the last quarter. Assenagon Asset Management S.A. grew its holdings in CrowdStrike by 248.6% during the 3rd quarter. Assenagon Asset Management S.A. now owns 521,198 shares of the company's stock valued at $146,180,000 after buying an additional 371,695 shares during the last quarter. Finally, Vanguard Group Inc. grew its holdings in CrowdStrike by 2.0% during the 1st quarter. Vanguard Group Inc. now owns 16,061,400 shares of the company's stock valued at $5,149,124,000 after buying an additional 315,280 shares during the last quarter. 71.16% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other news, insider Shawn Henry sold 4,000 shares of the business's stock in a transaction on Thursday, August 15th. The shares were sold at an average price of $260.00, for a total transaction of $1,040,000.00. Following the completion of the transaction, the insider now owns 179,091 shares of the company's stock, valued at approximately $46,563,660. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. In other CrowdStrike news, insider Shawn Henry sold 4,000 shares of the company's stock in a transaction dated Thursday, August 15th. The shares were sold at an average price of $260.00, for a total value of $1,040,000.00. Following the completion of the transaction, the insider now owns 179,091 shares in the company, valued at approximately $46,563,660. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CAO Anurag Saha sold 1,683 shares of the company's stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $297.28, for a total transaction of $500,322.24. Following the completion of the transaction, the chief accounting officer now owns 38,962 shares of the company's stock, valued at approximately $11,582,623.36. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 103,212 shares of company stock valued at $30,529,413 over the last three months. Company insiders own 4.34% of the company's stock.

CrowdStrike Stock Up 0.2 %

NASDAQ:CRWD traded up $0.70 during mid-day trading on Monday, reaching $301.32. The stock had a trading volume of 3,462,674 shares, compared to its average volume of 5,148,124. The company has a market capitalization of $73.33 billion, a price-to-earnings ratio of 570.79, a price-to-earnings-growth ratio of 19.94 and a beta of 1.10. CrowdStrike Holdings, Inc. has a 1-year low of $171.68 and a 1-year high of $398.33. The stock's 50 day simple moving average is $281.37 and its two-hundred day simple moving average is $307.92. The company has a debt-to-equity ratio of 0.26, a current ratio of 1.90 and a quick ratio of 1.90.

CrowdStrike (NASDAQ:CRWD - Get Free Report) last posted its quarterly earnings results on Wednesday, August 28th. The company reported $1.04 EPS for the quarter, topping analysts' consensus estimates of $0.97 by $0.07. CrowdStrike had a return on equity of 8.44% and a net margin of 4.84%. The business had revenue of $963.87 million during the quarter, compared to the consensus estimate of $958.27 million. During the same period last year, the firm earned $0.06 earnings per share. The company's revenue for the quarter was up 31.7% compared to the same quarter last year. Equities analysts anticipate that CrowdStrike Holdings, Inc. will post 0.53 EPS for the current year.

Analysts Set New Price Targets

A number of brokerages have commented on CRWD. Scotiabank lowered their target price on CrowdStrike from $300.00 to $265.00 and set a "sector perform" rating on the stock in a report on Wednesday, August 14th. DA Davidson restated a "buy" rating and set a $310.00 price objective on shares of CrowdStrike in a report on Wednesday, September 18th. Jefferies Financial Group raised their price objective on CrowdStrike from $315.00 to $345.00 and gave the stock a "buy" rating in a report on Tuesday, September 24th. Sanford C. Bernstein decreased their price objective on CrowdStrike from $334.00 to $327.00 and set an "outperform" rating on the stock in a report on Thursday, September 5th. Finally, BNP Paribas began coverage on CrowdStrike in a report on Tuesday, October 8th. They set a "neutral" rating and a $285.00 price objective on the stock. One equities research analyst has rated the stock with a sell rating, six have issued a hold rating, thirty-one have given a buy rating and three have issued a strong buy rating to the company's stock. According to data from MarketBeat, CrowdStrike presently has a consensus rating of "Moderate Buy" and a consensus target price of $328.74.

Check Out Our Latest Stock Analysis on CrowdStrike

CrowdStrike Profile

(

Free Report)

CrowdStrike Holdings, Inc provides cybersecurity solutions in the United States and internationally. Its unified platform offers cloud-delivered protection of endpoints, cloud workloads, identity, and data. The company offers corporate endpoint and cloud workload security, managed security, security and vulnerability management, IT operations management, identity protection, SIEM and log management, threat intelligence, data protection, security orchestration, automation and response and AI powered workflow automation, and securing generative AI workload services.

Further Reading

Before you consider CrowdStrike, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CrowdStrike wasn't on the list.

While CrowdStrike currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report