Realta Investment Advisors lowered its position in CrowdStrike Holdings, Inc. (NASDAQ:CRWD - Free Report) by 36.6% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 6,885 shares of the company's stock after selling 3,978 shares during the quarter. CrowdStrike accounts for 1.0% of Realta Investment Advisors' investment portfolio, making the stock its 20th biggest position. Realta Investment Advisors' holdings in CrowdStrike were worth $2,138,000 at the end of the most recent reporting period.

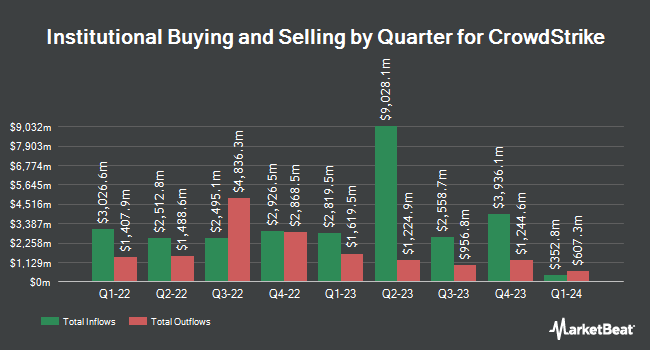

Other institutional investors have also recently added to or reduced their stakes in the company. Abich Financial Wealth Management LLC purchased a new position in shares of CrowdStrike in the 2nd quarter valued at $25,000. Oakworth Capital Inc. acquired a new stake in CrowdStrike in the 3rd quarter valued at $28,000. Tsfg LLC raised its position in CrowdStrike by 593.3% in the third quarter. Tsfg LLC now owns 104 shares of the company's stock valued at $29,000 after purchasing an additional 89 shares during the period. Family Firm Inc. acquired a new position in shares of CrowdStrike during the second quarter worth about $30,000. Finally, Castleview Partners LLC purchased a new stake in shares of CrowdStrike in the third quarter worth about $32,000. Hedge funds and other institutional investors own 71.16% of the company's stock.

Insider Activity at CrowdStrike

In other CrowdStrike news, insider Shawn Henry sold 4,000 shares of the business's stock in a transaction dated Thursday, August 15th. The shares were sold at an average price of $260.00, for a total transaction of $1,040,000.00. Following the sale, the insider now directly owns 179,091 shares in the company, valued at approximately $46,563,660. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. In related news, Director Sameer K. Gandhi sold 6,250 shares of CrowdStrike stock in a transaction dated Friday, October 11th. The stock was sold at an average price of $320.38, for a total transaction of $2,002,375.00. Following the transaction, the director now directly owns 821,766 shares of the company's stock, valued at $263,277,391.08. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Shawn Henry sold 4,000 shares of CrowdStrike stock in a transaction that occurred on Thursday, August 15th. The stock was sold at an average price of $260.00, for a total transaction of $1,040,000.00. Following the completion of the transaction, the insider now directly owns 179,091 shares in the company, valued at $46,563,660. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 103,212 shares of company stock worth $30,529,413 in the last 90 days. Corporate insiders own 4.34% of the company's stock.

Analysts Set New Price Targets

Several brokerages recently commented on CRWD. Canaccord Genuity Group reiterated a "buy" rating and set a $330.00 target price on shares of CrowdStrike in a report on Monday, September 30th. JMP Securities reiterated a "market outperform" rating and set a $400.00 price objective on shares of CrowdStrike in a research note on Tuesday, September 24th. Cantor Fitzgerald restated an "overweight" rating and issued a $350.00 target price on shares of CrowdStrike in a research note on Thursday, September 19th. BNP Paribas began coverage on shares of CrowdStrike in a research note on Tuesday, October 8th. They set a "neutral" rating and a $285.00 price target on the stock. Finally, Susquehanna reissued a "positive" rating and issued a $310.00 price objective on shares of CrowdStrike in a research report on Thursday, September 19th. One research analyst has rated the stock with a sell rating, six have given a hold rating, thirty-one have assigned a buy rating and three have assigned a strong buy rating to the stock. According to data from MarketBeat.com, CrowdStrike presently has an average rating of "Moderate Buy" and a consensus target price of $328.74.

View Our Latest Stock Analysis on CRWD

CrowdStrike Stock Performance

Shares of CRWD traded up $6.26 during mid-day trading on Friday, reaching $303.13. 2,975,940 shares of the company's stock traded hands, compared to its average volume of 5,107,555. The company has a debt-to-equity ratio of 0.26, a quick ratio of 1.90 and a current ratio of 1.90. The business's 50-day moving average price is $284.85 and its 200-day moving average price is $307.83. The stock has a market capitalization of $74.31 billion, a P/E ratio of 439.32, a price-to-earnings-growth ratio of 20.79 and a beta of 1.10. CrowdStrike Holdings, Inc. has a 12 month low of $178.35 and a 12 month high of $398.33.

CrowdStrike (NASDAQ:CRWD - Get Free Report) last announced its earnings results on Wednesday, August 28th. The company reported $1.04 earnings per share for the quarter, beating the consensus estimate of $0.97 by $0.07. CrowdStrike had a return on equity of 8.44% and a net margin of 4.84%. The firm had revenue of $963.87 million for the quarter, compared to the consensus estimate of $958.27 million. During the same quarter in the previous year, the business earned $0.06 EPS. The firm's revenue for the quarter was up 31.7% on a year-over-year basis. Equities analysts predict that CrowdStrike Holdings, Inc. will post 0.52 earnings per share for the current year.

CrowdStrike Company Profile

(

Free Report)

CrowdStrike Holdings, Inc provides cybersecurity solutions in the United States and internationally. Its unified platform offers cloud-delivered protection of endpoints, cloud workloads, identity, and data. The company offers corporate endpoint and cloud workload security, managed security, security and vulnerability management, IT operations management, identity protection, SIEM and log management, threat intelligence, data protection, security orchestration, automation and response and AI powered workflow automation, and securing generative AI workload services.

Recommended Stories

Before you consider CrowdStrike, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CrowdStrike wasn't on the list.

While CrowdStrike currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.