CoStar Group (NASDAQ:CSGP - Get Free Report) had its target price dropped by investment analysts at Citigroup from $97.00 to $90.00 in a research note issued to investors on Thursday, Benzinga reports. The firm currently has a "buy" rating on the technology company's stock. Citigroup's price objective indicates a potential upside of 21.77% from the company's current price.

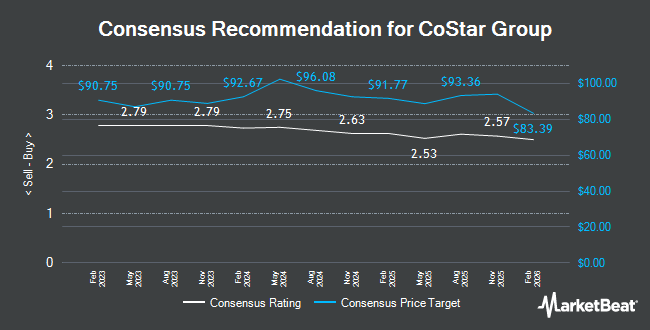

Other analysts also recently issued research reports about the stock. Robert W. Baird reduced their price objective on shares of CoStar Group from $105.00 to $100.00 and set an "outperform" rating for the company in a research report on Wednesday, July 24th. Royal Bank of Canada lowered shares of CoStar Group from an "outperform" rating to a "sector perform" rating and dropped their price objective for the company from $96.00 to $83.00 in a report on Wednesday. JMP Securities restated a "market outperform" rating and issued a $90.00 target price on shares of CoStar Group in a research note on Friday, September 6th. The Goldman Sachs Group dropped their price target on CoStar Group from $108.00 to $93.00 and set a "buy" rating on the stock in a research note on Wednesday, July 24th. Finally, Keefe, Bruyette & Woods reduced their price objective on CoStar Group from $109.00 to $100.00 and set an "outperform" rating for the company in a research note on Wednesday, July 17th. Five equities research analysts have rated the stock with a hold rating and eleven have issued a buy rating to the stock. According to MarketBeat.com, CoStar Group has a consensus rating of "Moderate Buy" and an average price target of $92.62.

View Our Latest Stock Report on CoStar Group

CoStar Group Trading Up 1.5 %

Shares of NASDAQ:CSGP traded up $1.09 during midday trading on Thursday, hitting $73.91. 7,867,046 shares of the stock were exchanged, compared to its average volume of 2,339,765. The business's 50-day moving average price is $76.46 and its 200 day moving average price is $79.20. The stock has a market capitalization of $30.29 billion, a price-to-earnings ratio of 167.98 and a beta of 0.81. CoStar Group has a 12 month low of $67.35 and a 12 month high of $100.38. The company has a debt-to-equity ratio of 0.13, a quick ratio of 9.27 and a current ratio of 9.27.

CoStar Group (NASDAQ:CSGP - Get Free Report) last released its quarterly earnings results on Tuesday, October 22nd. The technology company reported $0.22 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.16 by $0.06. The firm had revenue of $692.60 million during the quarter, compared to analyst estimates of $695.91 million. CoStar Group had a net margin of 6.57% and a return on equity of 3.54%. The company's revenue was up 10.9% compared to the same quarter last year. During the same quarter last year, the business earned $0.25 EPS. Analysts predict that CoStar Group will post 0.49 earnings per share for the current year.

Institutional Trading of CoStar Group

Institutional investors and hedge funds have recently modified their holdings of the business. Vanguard Group Inc. increased its position in shares of CoStar Group by 0.8% during the 1st quarter. Vanguard Group Inc. now owns 65,451,499 shares of the technology company's stock valued at $6,322,615,000 after purchasing an additional 541,700 shares during the last quarter. Janus Henderson Group PLC increased its holdings in CoStar Group by 17.7% during the first quarter. Janus Henderson Group PLC now owns 11,808,027 shares of the technology company's stock worth $1,140,650,000 after buying an additional 1,773,564 shares during the last quarter. Bank of New York Mellon Corp raised its position in CoStar Group by 2.1% in the second quarter. Bank of New York Mellon Corp now owns 6,117,260 shares of the technology company's stock worth $453,534,000 after acquiring an additional 124,761 shares during the period. Blair William & Co. IL boosted its stake in CoStar Group by 0.6% in the first quarter. Blair William & Co. IL now owns 4,419,778 shares of the technology company's stock valued at $426,951,000 after acquiring an additional 26,800 shares during the last quarter. Finally, Vulcan Value Partners LLC grew its position in shares of CoStar Group by 90.1% during the 2nd quarter. Vulcan Value Partners LLC now owns 4,138,987 shares of the technology company's stock valued at $306,831,000 after acquiring an additional 1,961,917 shares during the period. 96.60% of the stock is owned by hedge funds and other institutional investors.

CoStar Group Company Profile

(

Get Free Report)

CoStar Group, Inc provides information, analytics, and online marketplace services to the commercial real estate, hospitality, residential, and related professionals industries in the United States, Canada, Europe, the Asia Pacific, and Latin America. The company offers CoStar Property that provides inventory of office, industrial, retail, multifamily, hospitality, and student housing properties and land; CoStar Sales, a robust database of comparable commercial real estate sales transactions; CoStar Market Analytics to view and report on aggregated market and submarket trends; and CoStar Tenant, an online business-to-business prospecting and analytical tool that provides tenant information.

Further Reading

Before you consider CoStar Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CoStar Group wasn't on the list.

While CoStar Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.