SG Americas Securities LLC lessened its stake in Castle Biosciences, Inc. (NASDAQ:CSTL - Free Report) by 71.6% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 7,659 shares of the company's stock after selling 19,330 shares during the quarter. SG Americas Securities LLC's holdings in Castle Biosciences were worth $218,000 at the end of the most recent reporting period.

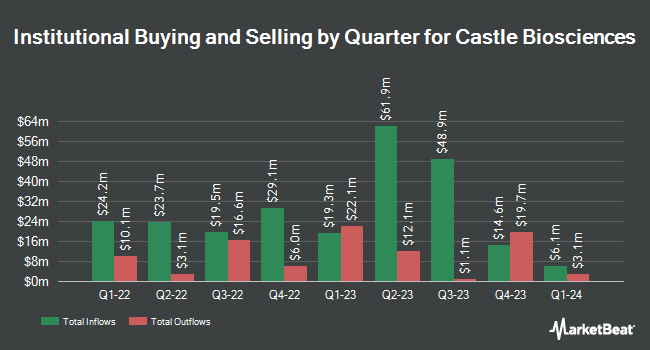

Other large investors also recently bought and sold shares of the company. RiverPark Advisors LLC grew its stake in Castle Biosciences by 362.2% during the 1st quarter. RiverPark Advisors LLC now owns 2,861 shares of the company's stock valued at $63,000 after purchasing an additional 2,242 shares in the last quarter. Denali Advisors LLC acquired a new stake in shares of Castle Biosciences during the first quarter worth approximately $186,000. Zurcher Kantonalbank Zurich Cantonalbank increased its stake in shares of Castle Biosciences by 10.7% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 9,882 shares of the company's stock worth $215,000 after buying an additional 952 shares during the last quarter. XTX Topco Ltd acquired a new stake in Castle Biosciences in the second quarter valued at $218,000. Finally, The Manufacturers Life Insurance Company boosted its stake in Castle Biosciences by 7.1% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 10,122 shares of the company's stock valued at $220,000 after acquiring an additional 675 shares during the last quarter. Institutional investors and hedge funds own 92.60% of the company's stock.

Insider Activity

In related news, insider Derek J. Maetzold sold 986 shares of the stock in a transaction that occurred on Friday, October 4th. The shares were sold at an average price of $28.73, for a total transaction of $28,327.78. Following the completion of the sale, the insider now directly owns 94,622 shares of the company's stock, valued at $2,718,490.06. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. In other Castle Biosciences news, insider Derek J. Maetzold sold 1,972 shares of the firm's stock in a transaction dated Monday, October 14th. The shares were sold at an average price of $32.27, for a total value of $63,636.44. Following the completion of the transaction, the insider now directly owns 91,664 shares in the company, valued at $2,957,997.28. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. Also, insider Derek J. Maetzold sold 986 shares of Castle Biosciences stock in a transaction that occurred on Friday, October 4th. The stock was sold at an average price of $28.73, for a total transaction of $28,327.78. Following the completion of the transaction, the insider now directly owns 94,622 shares in the company, valued at approximately $2,718,490.06. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 45,476 shares of company stock worth $1,181,637. Corporate insiders own 7.20% of the company's stock.

Castle Biosciences Price Performance

Shares of CSTL stock traded down $0.34 during midday trading on Wednesday, reaching $31.92. 283,589 shares of the company were exchanged, compared to its average volume of 314,383. The company's 50 day moving average price is $29.82 and its two-hundred day moving average price is $24.81. The company has a market cap of $881.22 million, a P/E ratio of -27.76 and a beta of 1.03. Castle Biosciences, Inc. has a 12 month low of $12.23 and a 12 month high of $34.50. The company has a debt-to-equity ratio of 0.02, a quick ratio of 7.92 and a current ratio of 8.12.

Castle Biosciences (NASDAQ:CSTL - Get Free Report) last released its earnings results on Monday, August 5th. The company reported $0.31 earnings per share for the quarter, topping analysts' consensus estimates of ($0.16) by $0.47. Castle Biosciences had a negative return on equity of 0.77% and a negative net margin of 1.08%. The firm had revenue of $87.00 million during the quarter, compared to the consensus estimate of $69.95 million. During the same period in the prior year, the firm posted ($0.70) earnings per share. On average, sell-side analysts expect that Castle Biosciences, Inc. will post -0.58 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of brokerages have recently issued reports on CSTL. Stephens restated an "overweight" rating and issued a $37.00 target price on shares of Castle Biosciences in a research note on Tuesday, August 6th. Robert W. Baird upped their price objective on Castle Biosciences from $34.00 to $37.00 and gave the company an "outperform" rating in a research note on Tuesday, August 6th. Finally, BTIG Research lifted their target price on Castle Biosciences from $35.00 to $40.00 and gave the stock a "buy" rating in a research report on Monday, October 14th. Six equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, Castle Biosciences has an average rating of "Buy" and an average target price of $34.00.

Read Our Latest Research Report on CSTL

About Castle Biosciences

(

Free Report)

Castle Biosciences, Inc, a molecular diagnostics company, provides testing solutions for the diagnosis and treatment of dermatologic cancers, Barrett's esophagus, uveal melanoma, and mental health conditions. It offers DecisionDx-Melanoma, a risk stratification gene expression profile (GEP) test to identify the risk of metastasis for patients diagnosed with invasive cutaneous melanoma; DecisionDx-SCC, a proprietary risk stratification GEP test for patients with cutaneous squamous cell carcinoma; MyPath Melanoma, a test used for patients with difficult-to-diagnose melanocytic lesions; and TissueCypher, a spatial omics test to predict future development of high-grade dysplasia and/or esophageal cancer in patients with non-dysplastic, indefinite dysplasia, or low-grade dysplasia Barrett's esophagus.

Featured Stories

Before you consider Castle Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Castle Biosciences wasn't on the list.

While Castle Biosciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.