jvl associates llc raised its stake in Cintas Co. (NASDAQ:CTAS - Free Report) by 300.4% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 4,048 shares of the business services provider's stock after buying an additional 3,037 shares during the period. Cintas comprises about 0.3% of jvl associates llc's investment portfolio, making the stock its 29th biggest position. jvl associates llc's holdings in Cintas were worth $833,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

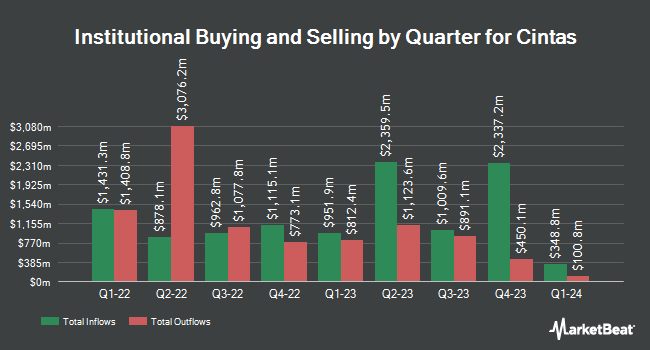

Several other institutional investors and hedge funds have also recently made changes to their positions in the stock. LGT Financial Advisors LLC increased its stake in Cintas by 311.1% in the second quarter. LGT Financial Advisors LLC now owns 37 shares of the business services provider's stock valued at $26,000 after acquiring an additional 28 shares during the last quarter. Atwood & Palmer Inc. bought a new position in shares of Cintas during the 2nd quarter valued at about $27,000. Pathway Financial Advisers LLC purchased a new position in shares of Cintas during the 1st quarter valued at about $29,000. Rise Advisors LLC bought a new stake in Cintas in the 1st quarter worth approximately $30,000. Finally, Meeder Asset Management Inc. boosted its stake in Cintas by 226.7% in the second quarter. Meeder Asset Management Inc. now owns 49 shares of the business services provider's stock worth $34,000 after buying an additional 34 shares in the last quarter. Hedge funds and other institutional investors own 63.46% of the company's stock.

Cintas Stock Up 0.2 %

Shares of NASDAQ:CTAS traded up $0.36 during trading on Friday, hitting $204.91. The stock had a trading volume of 1,747,351 shares, compared to its average volume of 1,492,867. The company has a quick ratio of 1.52, a current ratio of 1.74 and a debt-to-equity ratio of 0.47. Cintas Co. has a 12 month low of $119.86 and a 12 month high of $211.57. The company has a market capitalization of $20.79 billion, a PE ratio of 14.05, a PEG ratio of 4.09 and a beta of 1.32. The firm's fifty day moving average is $210.09 and its 200 day moving average is $185.32.

Cintas (NASDAQ:CTAS - Get Free Report) last announced its quarterly earnings data on Wednesday, September 25th. The business services provider reported $1.10 EPS for the quarter, beating the consensus estimate of $1.00 by $0.10. The business had revenue of $2.50 billion during the quarter, compared to analyst estimates of $2.49 billion. Cintas had a return on equity of 37.82% and a net margin of 16.38%. The company's revenue for the quarter was up 6.8% on a year-over-year basis. During the same quarter last year, the firm posted $3.70 earnings per share. Analysts anticipate that Cintas Co. will post 4.16 EPS for the current fiscal year.

Cintas announced that its Board of Directors has authorized a stock buyback plan on Tuesday, July 23rd that permits the company to buyback $1.00 billion in shares. This buyback authorization permits the business services provider to reacquire up to 1.3% of its shares through open market purchases. Shares buyback plans are usually a sign that the company's leadership believes its shares are undervalued.

Cintas Cuts Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, September 3rd. Shareholders of record on Thursday, August 15th were paid a dividend of $0.39 per share. This represents a $1.56 dividend on an annualized basis and a dividend yield of 0.76%. The ex-dividend date was Thursday, August 15th. Cintas's dividend payout ratio is 10.77%.

Insider Activity

In other news, Director Gerald S. Adolph sold 4,400 shares of the stock in a transaction on Wednesday, July 24th. The stock was sold at an average price of $191.43, for a total value of $842,292.00. Following the sale, the director now directly owns 125,808 shares of the company's stock, valued at approximately $24,083,425.44. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Company insiders own 15.10% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently weighed in on CTAS shares. Baird R W lowered shares of Cintas from a "strong-buy" rating to a "hold" rating in a report on Friday, July 19th. Morgan Stanley boosted their price target on shares of Cintas from $170.00 to $185.00 and gave the stock an "equal weight" rating in a research note on Thursday, September 26th. Stifel Nicolaus raised their price objective on Cintas from $166.75 to $199.50 and gave the company a "hold" rating in a research note on Friday, July 19th. The Goldman Sachs Group lifted their price objective on Cintas from $212.00 to $236.00 and gave the stock a "buy" rating in a report on Thursday, September 26th. Finally, Jefferies Financial Group dropped their target price on Cintas from $730.00 to $200.00 and set a "hold" rating for the company in a report on Thursday, September 26th. Two equities research analysts have rated the stock with a sell rating, nine have given a hold rating and seven have issued a buy rating to the company's stock. According to MarketBeat.com, Cintas presently has a consensus rating of "Hold" and a consensus target price of $199.63.

Get Our Latest Stock Report on CTAS

About Cintas

(

Free Report)

Cintas Corporation engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America. It operates through Uniform Rental and Facility Services, First Aid and Safety Services, and All Other segments. The company rents and services uniforms and other garments, including flame resistant clothing, mats, mops and shop towels, and other ancillary items; and provides restroom cleaning services and supplies, as well as sells uniforms.

See Also

Want to see what other hedge funds are holding CTAS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Cintas Co. (NASDAQ:CTAS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cintas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cintas wasn't on the list.

While Cintas currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.