Loring Wolcott & Coolidge Fiduciary Advisors LLP MA increased its stake in Cintas Co. (NASDAQ:CTAS - Free Report) by 278.7% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 30,991 shares of the business services provider's stock after purchasing an additional 22,807 shares during the period. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA's holdings in Cintas were worth $6,481,000 as of its most recent SEC filing.

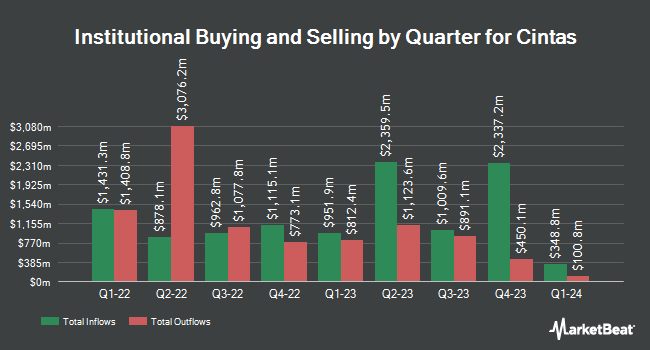

A number of other institutional investors and hedge funds have also bought and sold shares of the stock. Brookstone Capital Management bought a new stake in shares of Cintas during the 1st quarter worth $233,000. Allspring Global Investments Holdings LLC boosted its holdings in shares of Cintas by 0.9% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 25,152 shares of the business services provider's stock worth $17,280,000 after purchasing an additional 225 shares in the last quarter. Monument Capital Management bought a new position in shares of Cintas during the 1st quarter valued at about $223,000. Norden Group LLC raised its holdings in shares of Cintas by 3,915.0% during the 1st quarter. Norden Group LLC now owns 14,976 shares of the business services provider's stock valued at $10,291,000 after buying an additional 14,603 shares in the last quarter. Finally, First Trust Direct Indexing L.P. boosted its stake in Cintas by 18.2% in the first quarter. First Trust Direct Indexing L.P. now owns 1,983 shares of the business services provider's stock worth $1,363,000 after buying an additional 305 shares in the last quarter. 63.46% of the stock is owned by hedge funds and other institutional investors.

Cintas Stock Down 0.6 %

Cintas stock traded down $1.29 on Wednesday, hitting $207.85. 472,628 shares of the stock traded hands, compared to its average volume of 1,455,568. Cintas Co. has a 1 year low of $125.62 and a 1 year high of $215.37. The company has a current ratio of 1.53, a quick ratio of 1.33 and a debt-to-equity ratio of 0.50. The business's fifty day simple moving average is $217.14 and its 200 day simple moving average is $191.17. The firm has a market cap of $21.09 billion, a P/E ratio of 14.44, a price-to-earnings-growth ratio of 4.12 and a beta of 1.32.

Cintas (NASDAQ:CTAS - Get Free Report) last released its earnings results on Wednesday, September 25th. The business services provider reported $1.10 EPS for the quarter, topping analysts' consensus estimates of $1.00 by $0.10. The firm had revenue of $2.50 billion for the quarter, compared to analysts' expectations of $2.49 billion. Cintas had a return on equity of 39.56% and a net margin of 16.80%. The company's quarterly revenue was up 6.8% on a year-over-year basis. During the same period in the prior year, the firm posted $3.70 earnings per share. As a group, sell-side analysts forecast that Cintas Co. will post 4.23 earnings per share for the current year.

Cintas Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Friday, November 15th will be issued a $0.39 dividend. This represents a $1.56 dividend on an annualized basis and a yield of 0.75%. Cintas's payout ratio is currently 10.77%.

Cintas announced that its board has approved a share buyback program on Tuesday, July 23rd that allows the company to repurchase $1.00 billion in shares. This repurchase authorization allows the business services provider to buy up to 1.3% of its shares through open market purchases. Shares repurchase programs are generally an indication that the company's management believes its shares are undervalued.

Analysts Set New Price Targets

Several equities analysts recently commented on the stock. Robert W. Baird increased their target price on shares of Cintas from $194.00 to $209.00 and gave the company a "neutral" rating in a report on Thursday, September 26th. Wells Fargo & Company raised their price target on Cintas from $184.00 to $191.00 and gave the stock an "underweight" rating in a research report on Thursday, September 26th. Jefferies Financial Group lowered their price objective on Cintas from $730.00 to $200.00 and set a "hold" rating for the company in a research report on Thursday, September 26th. UBS Group increased their price objective on Cintas from $219.00 to $240.00 and gave the company a "buy" rating in a research note on Thursday, September 26th. Finally, Stifel Nicolaus upped their price target on shares of Cintas from $166.75 to $199.50 and gave the company a "hold" rating in a report on Friday, July 19th. Two equities research analysts have rated the stock with a sell rating, nine have assigned a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat.com, the company currently has an average rating of "Hold" and a consensus price target of $199.63.

Check Out Our Latest Report on Cintas

About Cintas

(

Free Report)

Cintas Corporation engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America. It operates through Uniform Rental and Facility Services, First Aid and Safety Services, and All Other segments. The company rents and services uniforms and other garments, including flame resistant clothing, mats, mops and shop towels, and other ancillary items; and provides restroom cleaning services and supplies, as well as sells uniforms.

Further Reading

Before you consider Cintas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cintas wasn't on the list.

While Cintas currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.