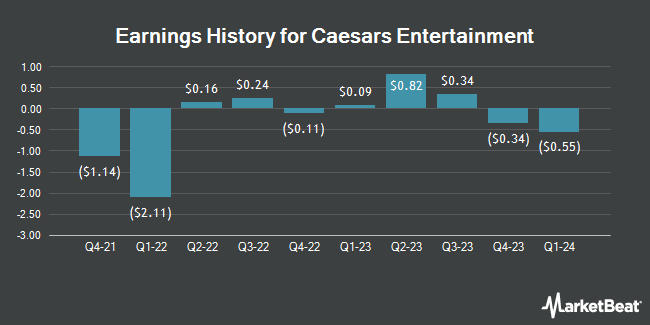

Caesars Entertainment (NASDAQ:CZR - Get Free Report) released its earnings results on Tuesday. The company reported ($0.04) earnings per share for the quarter, missing analysts' consensus estimates of $0.21 by ($0.25), Briefing.com reports. Caesars Entertainment had a negative return on equity of 2.57% and a negative net margin of 2.44%. The firm had revenue of $2.87 billion for the quarter, compared to analyst estimates of $2.93 billion. During the same period in the prior year, the firm earned $0.34 EPS. The firm's revenue was down 4.0% on a year-over-year basis.

Caesars Entertainment Trading Down 8.2 %

NASDAQ CZR traded down $3.72 during trading hours on Wednesday, hitting $41.57. The company's stock had a trading volume of 10,647,666 shares, compared to its average volume of 4,166,162. The stock has a fifty day moving average of $40.90 and a 200 day moving average of $38.14. Caesars Entertainment has a twelve month low of $31.74 and a twelve month high of $50.51. The firm has a market capitalization of $9.00 billion, a P/E ratio of 11.77 and a beta of 2.97. The company has a quick ratio of 0.68, a current ratio of 0.70 and a debt-to-equity ratio of 5.56.

Analyst Upgrades and Downgrades

Several research firms have recently issued reports on CZR. JPMorgan Chase & Co. boosted their price objective on shares of Caesars Entertainment from $54.00 to $58.00 and gave the stock an "overweight" rating in a report on Wednesday. Stifel Nicolaus upped their target price on shares of Caesars Entertainment from $56.00 to $58.00 and gave the company a "buy" rating in a research note on Wednesday, October 9th. Jefferies Financial Group lowered their target price on shares of Caesars Entertainment from $62.00 to $60.00 and set a "buy" rating on the stock in a research note on Wednesday, July 31st. StockNews.com cut shares of Caesars Entertainment from a "hold" rating to a "sell" rating in a research note on Thursday, August 1st. Finally, Macquarie reissued an "outperform" rating and issued a $50.00 target price on shares of Caesars Entertainment in a research note on Wednesday. Two equities research analysts have rated the stock with a sell rating, one has issued a hold rating, eleven have given a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $54.00.

Check Out Our Latest Analysis on Caesars Entertainment

Caesars Entertainment Company Profile

(

Get Free Report)

Caesars Entertainment, Inc operates as a gaming and hospitality company. The company owns, leases, or manages domestic properties in 18 states with slot machines, video lottery terminals and e-tables, and hotel rooms, as well as table games, including poker. It also operates and conducts retail and online sports wagering across 31 jurisdictions in North America and operates iGaming in five jurisdictions in North America; sports betting from our retail and online sportsbooks; and other games, such as keno.

Featured Stories

Before you consider Caesars Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Caesars Entertainment wasn't on the list.

While Caesars Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.