Deltec Asset Management LLC lifted its stake in Caesars Entertainment, Inc. (NASDAQ:CZR - Free Report) by 7.9% during the 3rd quarter, according to the company in its most recent filing with the SEC. The fund owned 415,903 shares of the company's stock after acquiring an additional 30,500 shares during the quarter. Caesars Entertainment accounts for 3.4% of Deltec Asset Management LLC's investment portfolio, making the stock its 8th largest position. Deltec Asset Management LLC owned 0.19% of Caesars Entertainment worth $17,360,000 as of its most recent filing with the SEC.

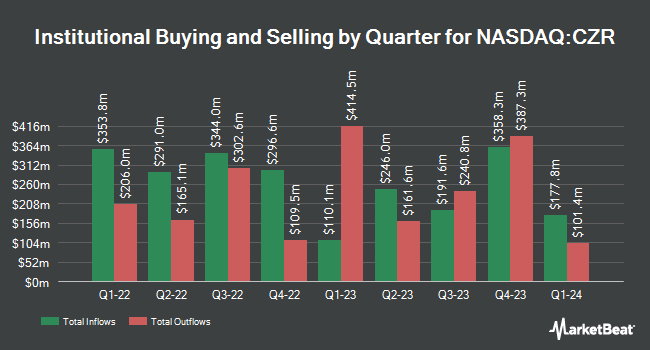

A number of other hedge funds have also recently made changes to their positions in the stock. Blue Trust Inc. grew its stake in shares of Caesars Entertainment by 525.3% in the second quarter. Blue Trust Inc. now owns 594 shares of the company's stock worth $26,000 after acquiring an additional 499 shares in the last quarter. UMB Bank n.a. purchased a new position in Caesars Entertainment in the third quarter valued at $51,000. GAMMA Investing LLC grew its stake in Caesars Entertainment by 63.1% during the 2nd quarter. GAMMA Investing LLC now owns 1,607 shares of the company's stock worth $64,000 after purchasing an additional 622 shares in the last quarter. Signaturefd LLC increased its holdings in Caesars Entertainment by 77.0% during the 2nd quarter. Signaturefd LLC now owns 2,540 shares of the company's stock worth $101,000 after purchasing an additional 1,105 shares during the period. Finally, Acadian Asset Management LLC purchased a new position in shares of Caesars Entertainment in the 2nd quarter valued at about $147,000. Hedge funds and other institutional investors own 91.79% of the company's stock.

Caesars Entertainment Price Performance

Shares of NASDAQ CZR traded down $3.72 during midday trading on Wednesday, hitting $41.57. The company had a trading volume of 10,647,666 shares, compared to its average volume of 4,166,162. The company has a quick ratio of 0.68, a current ratio of 0.70 and a debt-to-equity ratio of 5.56. The business has a 50-day simple moving average of $40.90 and a two-hundred day simple moving average of $38.14. Caesars Entertainment, Inc. has a twelve month low of $31.74 and a twelve month high of $50.51. The firm has a market capitalization of $9.00 billion, a price-to-earnings ratio of 11.77 and a beta of 2.97.

Caesars Entertainment (NASDAQ:CZR - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The company reported ($0.04) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.21 by ($0.25). The firm had revenue of $2.87 billion for the quarter, compared to analyst estimates of $2.93 billion. Caesars Entertainment had a negative return on equity of 2.57% and a negative net margin of 2.44%. The company's quarterly revenue was down 4.0% compared to the same quarter last year. During the same period last year, the firm earned $0.34 EPS. Equities research analysts anticipate that Caesars Entertainment, Inc. will post -0.18 earnings per share for the current year.

Analysts Set New Price Targets

A number of analysts recently weighed in on the stock. Susquehanna restated a "negative" rating and set a $33.00 target price on shares of Caesars Entertainment in a research note on Wednesday, July 31st. Morgan Stanley upped their price objective on Caesars Entertainment from $40.00 to $42.00 and gave the stock an "equal weight" rating in a research report on Tuesday, October 22nd. Macquarie restated an "outperform" rating and set a $50.00 target price on shares of Caesars Entertainment in a research note on Wednesday. Barclays dropped their price target on shares of Caesars Entertainment from $59.00 to $57.00 and set an "overweight" rating on the stock in a research note on Wednesday. Finally, JPMorgan Chase & Co. boosted their price objective on shares of Caesars Entertainment from $54.00 to $58.00 and gave the stock an "overweight" rating in a research report on Wednesday. Two research analysts have rated the stock with a sell rating, one has assigned a hold rating, eleven have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, Caesars Entertainment has a consensus rating of "Moderate Buy" and a consensus price target of $54.00.

Read Our Latest Research Report on CZR

Caesars Entertainment Company Profile

(

Free Report)

Caesars Entertainment, Inc operates as a gaming and hospitality company. The company owns, leases, or manages domestic properties in 18 states with slot machines, video lottery terminals and e-tables, and hotel rooms, as well as table games, including poker. It also operates and conducts retail and online sports wagering across 31 jurisdictions in North America and operates iGaming in five jurisdictions in North America; sports betting from our retail and online sportsbooks; and other games, such as keno.

Featured Articles

Before you consider Caesars Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Caesars Entertainment wasn't on the list.

While Caesars Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.