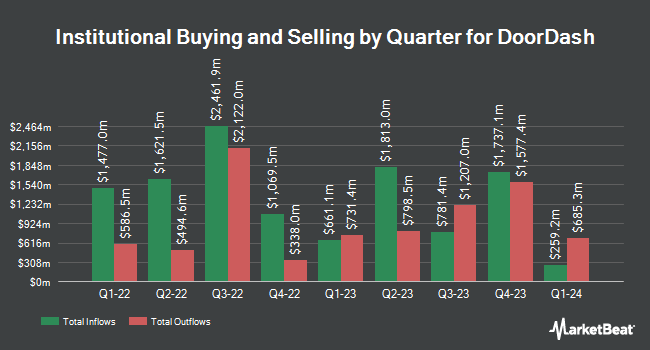

Yong Rong HK Asset Management Ltd purchased a new position in DoorDash, Inc. (NASDAQ:DASH - Free Report) in the third quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor purchased 199,150 shares of the company's stock, valued at approximately $28,425,000. DoorDash accounts for 8.2% of Yong Rong HK Asset Management Ltd's portfolio, making the stock its 6th biggest holding.

A number of other institutional investors and hedge funds have also recently bought and sold shares of the stock. Baillie Gifford & Co. raised its position in shares of DoorDash by 0.8% in the 2nd quarter. Baillie Gifford & Co. now owns 12,497,488 shares of the company's stock valued at $1,359,477,000 after purchasing an additional 94,241 shares in the last quarter. Capital World Investors raised its position in shares of DoorDash by 0.8% in the 1st quarter. Capital World Investors now owns 9,470,247 shares of the company's stock valued at $1,304,242,000 after purchasing an additional 74,504 shares in the last quarter. Price T Rowe Associates Inc. MD raised its position in shares of DoorDash by 4.6% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 5,469,647 shares of the company's stock valued at $753,281,000 after purchasing an additional 242,956 shares in the last quarter. Janus Henderson Group PLC raised its position in shares of DoorDash by 11,416.7% in the 1st quarter. Janus Henderson Group PLC now owns 3,455,116 shares of the company's stock valued at $475,837,000 after purchasing an additional 3,425,115 shares in the last quarter. Finally, Dragoneer Investment Group LLC raised its position in shares of DoorDash by 77.9% in the 2nd quarter. Dragoneer Investment Group LLC now owns 2,847,537 shares of the company's stock valued at $309,755,000 after purchasing an additional 1,246,567 shares in the last quarter. Hedge funds and other institutional investors own 90.64% of the company's stock.

DoorDash Stock Performance

DASH traded down $1.04 during trading on Friday, reaching $155.66. The company had a trading volume of 4,092,814 shares, compared to its average volume of 3,844,751. The firm's 50-day simple moving average is $140.40 and its 200 day simple moving average is $124.21. The company has a market cap of $64.06 billion, a price-to-earnings ratio of -345.91, a PEG ratio of 331.02 and a beta of 1.70. DoorDash, Inc. has a 12-month low of $83.58 and a 12-month high of $165.07.

DoorDash (NASDAQ:DASH - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The company reported $0.38 EPS for the quarter, topping analysts' consensus estimates of $0.21 by $0.17. DoorDash had a negative return on equity of 2.46% and a negative net margin of 1.69%. The firm had revenue of $2.71 billion during the quarter, compared to analyst estimates of $2.66 billion. During the same period last year, the company posted ($0.19) EPS. The business's quarterly revenue was up 25.0% compared to the same quarter last year. On average, sell-side analysts expect that DoorDash, Inc. will post 0.01 EPS for the current year.

Insiders Place Their Bets

In other news, Director Shona L. Brown sold 5,005 shares of DoorDash stock in a transaction dated Monday, August 5th. The stock was sold at an average price of $120.00, for a total transaction of $600,600.00. Following the completion of the sale, the director now directly owns 65,186 shares in the company, valued at $7,822,320. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. In other news, Director Shona L. Brown sold 5,005 shares of DoorDash stock in a transaction dated Monday, August 5th. The stock was sold at an average price of $120.00, for a total transaction of $600,600.00. Following the completion of the sale, the director now directly owns 65,186 shares in the company, valued at $7,822,320. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Andy Fang sold 50,000 shares of DoorDash stock in a transaction dated Monday, October 14th. The shares were sold at an average price of $149.83, for a total value of $7,491,500.00. Following the sale, the director now owns 18,089 shares of the company's stock, valued at approximately $2,710,274.87. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 383,710 shares of company stock worth $53,725,640. 7.92% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

A number of brokerages have issued reports on DASH. Roth Mkm upped their target price on DoorDash from $118.00 to $124.00 and gave the company a "neutral" rating in a research report on Monday, August 5th. Susquehanna upped their price target on DoorDash from $140.00 to $180.00 and gave the company a "positive" rating in a research report on Friday. Oppenheimer upped their price target on DoorDash from $145.00 to $160.00 and gave the company an "outperform" rating in a research report on Friday, September 27th. Needham & Company LLC upped their price target on DoorDash from $145.00 to $180.00 and gave the company a "buy" rating in a research report on Thursday. Finally, Barclays upped their price target on DoorDash from $120.00 to $163.00 and gave the company an "equal weight" rating in a research report on Friday. Ten analysts have rated the stock with a hold rating and twenty-four have assigned a buy rating to the stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $163.12.

Check Out Our Latest Stock Report on DoorDash

About DoorDash

(

Free Report)

DoorDash, Inc, together with its subsidiaries, operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally. The company operates DoorDash Marketplace and Wolt Marketplace, which provide various services, such as customer acquisition, demand generation, order fulfillment, merchandising, payment processing, and customer support.

Further Reading

Before you consider DoorDash, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoorDash wasn't on the list.

While DoorDash currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report