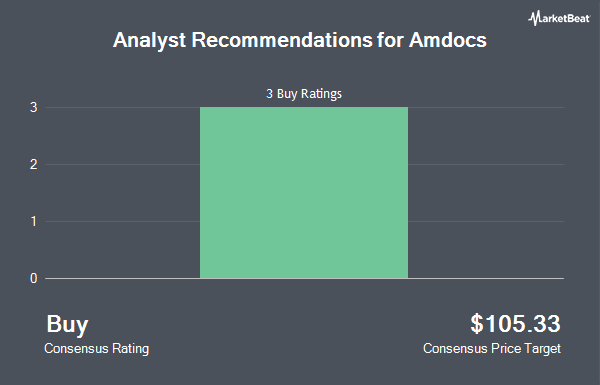

Shares of Amdocs Limited (NASDAQ:DOX - Get Free Report) have earned a consensus recommendation of "Moderate Buy" from the five ratings firms that are covering the company, Marketbeat reports. One equities research analyst has rated the stock with a hold recommendation and four have assigned a buy recommendation to the company. The average 12 month price objective among brokers that have updated their coverage on the stock in the last year is $102.00.

DOX has been the subject of a number of recent analyst reports. StockNews.com raised shares of Amdocs from a "buy" rating to a "strong-buy" rating in a report on Friday. Stifel Nicolaus started coverage on Amdocs in a report on Wednesday, October 2nd. They issued a "buy" rating and a $100.00 target price on the stock.

Check Out Our Latest Report on Amdocs

Amdocs Price Performance

Shares of DOX stock traded down $0.87 during trading on Friday, hitting $88.87. The company had a trading volume of 242,979 shares, compared to its average volume of 674,938. The firm has a market capitalization of $10.45 billion, a P/E ratio of 19.97, a price-to-earnings-growth ratio of 1.42 and a beta of 0.74. Amdocs has a one year low of $74.41 and a one year high of $94.04. The company has a debt-to-equity ratio of 0.21, a quick ratio of 1.24 and a current ratio of 1.24. The stock's 50-day moving average price is $87.08 and its 200 day moving average price is $83.59.

Amdocs (NASDAQ:DOX - Get Free Report) last released its earnings results on Wednesday, August 7th. The technology company reported $1.62 earnings per share for the quarter, beating analysts' consensus estimates of $1.60 by $0.02. The firm had revenue of $1.25 billion during the quarter, compared to the consensus estimate of $1.25 billion. Amdocs had a return on equity of 17.89% and a net margin of 10.21%. The company's revenue was up 1.1% compared to the same quarter last year. During the same period in the prior year, the company posted $1.41 EPS. Equities analysts expect that Amdocs will post 5.67 EPS for the current fiscal year.

Amdocs Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, October 25th. Shareholders of record on Monday, September 30th were paid a dividend of $0.479 per share. The ex-dividend date was Monday, September 30th. This represents a $1.92 dividend on an annualized basis and a dividend yield of 2.16%. Amdocs's payout ratio is presently 42.92%.

Institutional Investors Weigh In On Amdocs

Several hedge funds have recently added to or reduced their stakes in DOX. Wasatch Advisors LP acquired a new stake in shares of Amdocs in the first quarter valued at about $1,943,000. State Board of Administration of Florida Retirement System increased its position in Amdocs by 7.9% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 166,927 shares of the technology company's stock valued at $16,030,000 after purchasing an additional 12,178 shares during the period. Boston Trust Walden Corp raised its holdings in Amdocs by 17.0% during the 2nd quarter. Boston Trust Walden Corp now owns 618,387 shares of the technology company's stock worth $48,803,000 after purchasing an additional 89,726 shares during the last quarter. SG Americas Securities LLC increased its position in shares of Amdocs by 402.4% during the second quarter. SG Americas Securities LLC now owns 154,968 shares of the technology company's stock worth $12,230,000 after buying an additional 124,122 shares during the period. Finally, Sargent Investment Group LLC bought a new position in Amdocs during the second quarter worth $289,000. 92.02% of the stock is currently owned by institutional investors and hedge funds.

Amdocs Company Profile

(

Get Free ReportAmdocs Limited, through its subsidiaries, provides software and services worldwide. It designs, develops, operates, implements, supports, and markets open and modular cloud portfolio. The company provides CES23, a 5G and cloud-native microservices-based market-leading customer experience suite, that enables service providers to build, deliver, and monetize advanced services; Amdocs Subscription Marketplace, a software-as-a-service-based platform that includes an expansive network of pre-integrated digital services, such as media, gaming, eLearning, sports, and retail to security and business services; the monetization suite for charging, billing, policy, and revenue management; Intelligent networking suite with a set of modular, flexible, and open service lifecycle management capabilities for network automation journeys; amAIz, a telco GenAI framework; Amdocs Digital Brands Suite, a pre-integrated digital business suite; and Amdocs eSIM Cloud for service providers.

Featured Stories

Before you consider Amdocs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amdocs wasn't on the list.

While Amdocs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.