State of Alaska Department of Revenue reduced its holdings in shares of Amdocs Limited (NASDAQ:DOX - Free Report) by 8.9% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 123,128 shares of the technology company's stock after selling 12,035 shares during the period. State of Alaska Department of Revenue owned about 0.10% of Amdocs worth $10,770,000 at the end of the most recent quarter.

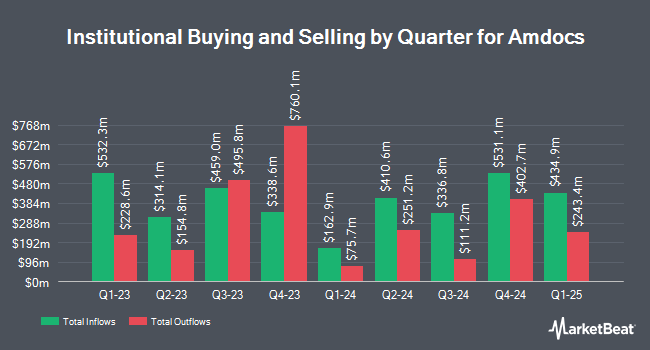

Other institutional investors and hedge funds have also modified their holdings of the company. Vanguard Group Inc. grew its stake in shares of Amdocs by 1.4% during the 4th quarter. Vanguard Group Inc. now owns 1,457,368 shares of the technology company's stock valued at $128,088,000 after acquiring an additional 20,283 shares during the period. Wealth Enhancement Advisory Services LLC increased its stake in shares of Amdocs by 1.7% in the first quarter. Wealth Enhancement Advisory Services LLC now owns 62,367 shares of the technology company's stock worth $5,636,000 after purchasing an additional 1,036 shares in the last quarter. Wasatch Advisors LP bought a new stake in shares of Amdocs during the 1st quarter valued at $1,943,000. Dudley & Shanley Inc. lifted its stake in shares of Amdocs by 1.0% during the 1st quarter. Dudley & Shanley Inc. now owns 263,050 shares of the technology company's stock valued at $23,772,000 after buying an additional 2,600 shares in the last quarter. Finally, Norden Group LLC bought a new position in Amdocs in the 1st quarter worth $219,000. Hedge funds and other institutional investors own 92.02% of the company's stock.

Amdocs Price Performance

DOX stock traded down $0.58 during mid-day trading on Monday, hitting $88.29. The company had a trading volume of 487,326 shares, compared to its average volume of 674,035. The company has a 50-day moving average price of $87.08 and a 200 day moving average price of $83.56. Amdocs Limited has a 12-month low of $74.41 and a 12-month high of $94.04. The company has a market capitalization of $10.38 billion, a price-to-earnings ratio of 20.13, a P/E/G ratio of 1.42 and a beta of 0.74. The company has a quick ratio of 1.24, a current ratio of 1.24 and a debt-to-equity ratio of 0.21.

Amdocs (NASDAQ:DOX - Get Free Report) last posted its earnings results on Wednesday, August 7th. The technology company reported $1.62 EPS for the quarter, topping analysts' consensus estimates of $1.60 by $0.02. Amdocs had a return on equity of 17.89% and a net margin of 10.21%. The company had revenue of $1.25 billion for the quarter, compared to the consensus estimate of $1.25 billion. During the same period in the previous year, the business earned $1.41 earnings per share. The firm's revenue for the quarter was up 1.1% on a year-over-year basis. On average, research analysts anticipate that Amdocs Limited will post 5.67 earnings per share for the current year.

Amdocs Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, October 25th. Investors of record on Monday, September 30th were paid a dividend of $0.479 per share. This represents a $1.92 dividend on an annualized basis and a yield of 2.17%. The ex-dividend date was Monday, September 30th. Amdocs's payout ratio is 42.92%.

Analyst Upgrades and Downgrades

A number of research firms have commented on DOX. StockNews.com raised Amdocs from a "buy" rating to a "strong-buy" rating in a report on Friday. Stifel Nicolaus began coverage on Amdocs in a research note on Wednesday, October 2nd. They set a "buy" rating and a $100.00 target price on the stock. One investment analyst has rated the stock with a hold rating, four have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and an average target price of $102.00.

Read Our Latest Stock Analysis on Amdocs

Amdocs Profile

(

Free Report)

Amdocs Limited, through its subsidiaries, provides software and services worldwide. It designs, develops, operates, implements, supports, and markets open and modular cloud portfolio. The company provides CES23, a 5G and cloud-native microservices-based market-leading customer experience suite, that enables service providers to build, deliver, and monetize advanced services; Amdocs Subscription Marketplace, a software-as-a-service-based platform that includes an expansive network of pre-integrated digital services, such as media, gaming, eLearning, sports, and retail to security and business services; the monetization suite for charging, billing, policy, and revenue management; Intelligent networking suite with a set of modular, flexible, and open service lifecycle management capabilities for network automation journeys; amAIz, a telco GenAI framework; Amdocs Digital Brands Suite, a pre-integrated digital business suite; and Amdocs eSIM Cloud for service providers.

See Also

Before you consider Amdocs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amdocs wasn't on the list.

While Amdocs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.