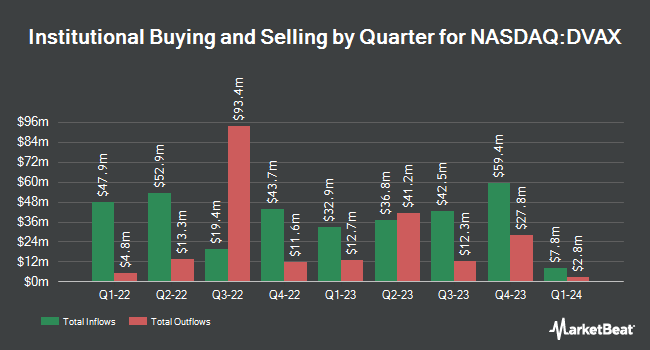

Assenagon Asset Management S.A. acquired a new stake in shares of Dynavax Technologies Co. (NASDAQ:DVAX - Free Report) during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm acquired 744,282 shares of the biopharmaceutical company's stock, valued at approximately $8,291,000. Assenagon Asset Management S.A. owned about 0.57% of Dynavax Technologies at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. Diversified Trust Co raised its position in shares of Dynavax Technologies by 3.2% during the first quarter. Diversified Trust Co now owns 29,548 shares of the biopharmaceutical company's stock valued at $367,000 after buying an additional 925 shares during the last quarter. Zurcher Kantonalbank Zurich Cantonalbank increased its position in Dynavax Technologies by 1.0% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 118,037 shares of the biopharmaceutical company's stock worth $1,326,000 after purchasing an additional 1,172 shares during the last quarter. SummerHaven Investment Management LLC increased its position in Dynavax Technologies by 2.4% in the second quarter. SummerHaven Investment Management LLC now owns 54,926 shares of the biopharmaceutical company's stock worth $617,000 after purchasing an additional 1,303 shares during the last quarter. Texas Permanent School Fund Corp increased its position in Dynavax Technologies by 1.3% in the first quarter. Texas Permanent School Fund Corp now owns 113,128 shares of the biopharmaceutical company's stock worth $1,404,000 after purchasing an additional 1,467 shares during the last quarter. Finally, GAMMA Investing LLC increased its position in Dynavax Technologies by 175.5% in the third quarter. GAMMA Investing LLC now owns 2,645 shares of the biopharmaceutical company's stock worth $29,000 after purchasing an additional 1,685 shares during the last quarter. Institutional investors own 96.96% of the company's stock.

Wall Street Analysts Forecast Growth

DVAX has been the topic of several research reports. The Goldman Sachs Group reduced their price target on shares of Dynavax Technologies from $20.00 to $15.00 and set a "neutral" rating on the stock in a research report on Thursday, August 8th. HC Wainwright restated a "buy" rating and issued a $29.00 price target on shares of Dynavax Technologies in a research report on Tuesday, October 15th. Two research analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $23.67.

Get Our Latest Report on Dynavax Technologies

Dynavax Technologies Trading Up 3.7 %

NASDAQ DVAX traded up $0.42 on Tuesday, hitting $11.81. 2,815,738 shares of the stock were exchanged, compared to its average volume of 2,093,206. The company has a debt-to-equity ratio of 0.35, a quick ratio of 13.18 and a current ratio of 14.18. The stock has a fifty day moving average price of $11.02 and a two-hundred day moving average price of $11.21. The firm has a market capitalization of $1.55 billion, a P/E ratio of 189.83 and a beta of 1.37. Dynavax Technologies Co. has a 52-week low of $9.74 and a 52-week high of $15.15.

Dynavax Technologies (NASDAQ:DVAX - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The biopharmaceutical company reported $0.08 EPS for the quarter, topping the consensus estimate of $0.06 by $0.02. The company had revenue of $73.80 million during the quarter, compared to analyst estimates of $76.92 million. Dynavax Technologies had a net margin of 6.88% and a return on equity of 2.76%. During the same period in the previous year, the firm earned $0.03 earnings per share. Research analysts forecast that Dynavax Technologies Co. will post 0.16 EPS for the current fiscal year.

Dynavax Technologies Company Profile

(

Free Report)

Dynavax Technologies Corporation, a commercial stage biopharmaceutical company, focuses on developing and commercializing vaccines in the United States. It markets HEPLISAV-B, a hepatitis B vaccine for prevention of infection caused by all known subtypes of hepatitis B virus in age 18 years and older in the United States and Europe.

Featured Articles

Before you consider Dynavax Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dynavax Technologies wasn't on the list.

While Dynavax Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.