Benchmark restated their buy rating on shares of Electronic Arts (NASDAQ:EA - Free Report) in a report issued on Wednesday morning, Benzinga reports. They currently have a $163.00 price target on the game software company's stock.

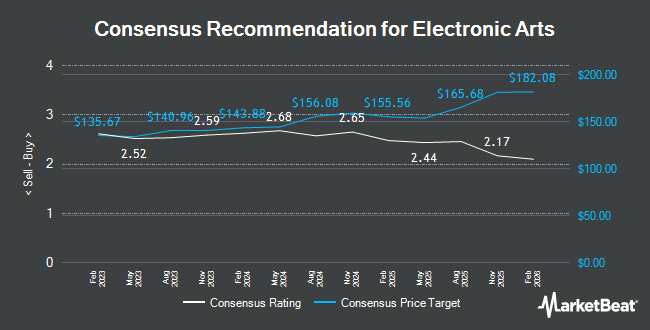

EA has been the topic of several other research reports. Jefferies Financial Group initiated coverage on shares of Electronic Arts in a report on Thursday, July 11th. They set a "buy" rating and a $165.00 price objective on the stock. Bank of America upped their target price on Electronic Arts from $150.00 to $170.00 and gave the stock a "buy" rating in a research report on Wednesday, July 31st. TD Cowen upped their price objective on shares of Electronic Arts from $163.00 to $183.00 and gave the stock a "buy" rating in a report on Wednesday, July 31st. Oppenheimer raised their price target on shares of Electronic Arts from $150.00 to $170.00 and gave the company an "outperform" rating in a research report on Tuesday, July 16th. Finally, BNP Paribas raised Electronic Arts to a "strong-buy" rating in a report on Wednesday, October 9th. Eight research analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, Electronic Arts presently has a consensus rating of "Moderate Buy" and a consensus price target of $163.65.

Check Out Our Latest Analysis on EA

Electronic Arts Trading Up 2.4 %

Shares of EA stock traded up $3.56 during trading hours on Wednesday, hitting $149.18. 2,878,614 shares of the company's stock traded hands, compared to its average volume of 2,053,692. The stock has a market cap of $39.64 billion, a PE ratio of 31.85, a price-to-earnings-growth ratio of 1.97 and a beta of 0.79. The stock's 50 day simple moving average is $144.83 and its 200 day simple moving average is $139.88. The company has a quick ratio of 1.45, a current ratio of 1.45 and a debt-to-equity ratio of 0.25. Electronic Arts has a 12 month low of $121.63 and a 12 month high of $153.51.

Electronic Arts (NASDAQ:EA - Get Free Report) last posted its quarterly earnings data on Tuesday, July 30th. The game software company reported $0.09 earnings per share for the quarter, topping the consensus estimate of $0.03 by $0.06. Electronic Arts had a net margin of 15.77% and a return on equity of 16.34%. The company had revenue of $1.26 billion during the quarter, compared to analysts' expectations of $1.21 billion. On average, sell-side analysts anticipate that Electronic Arts will post 5.93 EPS for the current year.

Insider Buying and Selling

In related news, insider Vijayanthimala Singh sold 7,384 shares of the stock in a transaction dated Wednesday, August 28th. The stock was sold at an average price of $149.91, for a total transaction of $1,106,935.44. Following the sale, the insider now owns 31,190 shares of the company's stock, valued at approximately $4,675,692.90. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In other Electronic Arts news, insider Vijayanthimala Singh sold 7,384 shares of the company's stock in a transaction dated Wednesday, August 28th. The stock was sold at an average price of $149.91, for a total value of $1,106,935.44. Following the transaction, the insider now directly owns 31,190 shares in the company, valued at $4,675,692.90. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Andrew Wilson sold 2,500 shares of Electronic Arts stock in a transaction that occurred on Wednesday, September 25th. The shares were sold at an average price of $141.50, for a total transaction of $353,750.00. Following the sale, the chief executive officer now owns 54,247 shares of the company's stock, valued at approximately $7,675,950.50. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 24,770 shares of company stock valued at $3,652,410. Company insiders own 0.22% of the company's stock.

Institutional Investors Weigh In On Electronic Arts

Institutional investors have recently made changes to their positions in the business. Norden Group LLC bought a new stake in Electronic Arts in the first quarter valued at approximately $1,236,000. First Trust Direct Indexing L.P. increased its position in Electronic Arts by 7.3% during the 1st quarter. First Trust Direct Indexing L.P. now owns 5,430 shares of the game software company's stock valued at $720,000 after purchasing an additional 369 shares during the period. SpiderRock Advisors LLC bought a new position in Electronic Arts in the 1st quarter worth $359,000. BNP Paribas purchased a new stake in shares of Electronic Arts in the 1st quarter worth about $121,000. Finally, Daiwa Securities Group Inc. lifted its position in shares of Electronic Arts by 3.0% in the 1st quarter. Daiwa Securities Group Inc. now owns 46,935 shares of the game software company's stock worth $6,227,000 after purchasing an additional 1,378 shares during the period. Hedge funds and other institutional investors own 90.23% of the company's stock.

Electronic Arts Company Profile

(

Get Free Report)

Electronic Arts Inc develops, markets, publishes, and distributes games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide. It develops and publishes games and services across various genres, such as sports, racing, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Need for Speed, and license games from others, including FIFA, Madden NFL, UFC, and Star Wars brands.

Featured Stories

Before you consider Electronic Arts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Electronic Arts wasn't on the list.

While Electronic Arts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.