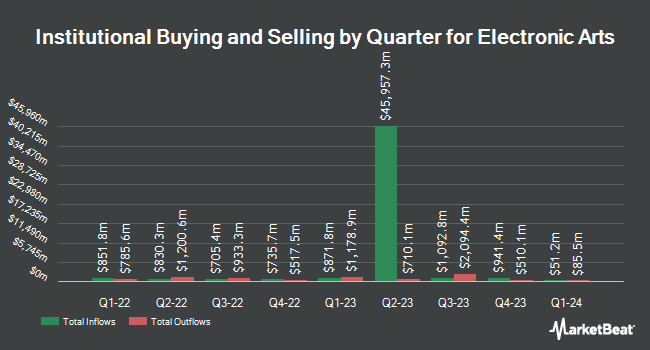

Greenwood Capital Associates LLC purchased a new stake in shares of Electronic Arts Inc. (NASDAQ:EA - Free Report) in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The firm purchased 39,022 shares of the game software company's stock, valued at approximately $5,597,000.

Other institutional investors also recently bought and sold shares of the company. Opal Wealth Advisors LLC acquired a new stake in Electronic Arts in the second quarter valued at approximately $28,000. Family Firm Inc. acquired a new stake in shares of Electronic Arts in the second quarter worth approximately $33,000. New Covenant Trust Company N.A. acquired a new stake in shares of Electronic Arts in the first quarter worth approximately $35,000. Reston Wealth Management LLC acquired a new stake in shares of Electronic Arts in the third quarter worth approximately $36,000. Finally, Gradient Investments LLC boosted its stake in shares of Electronic Arts by 592.1% in the second quarter. Gradient Investments LLC now owns 263 shares of the game software company's stock worth $37,000 after acquiring an additional 225 shares during the last quarter. 90.23% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at Electronic Arts

In other news, insider Vijayanthimala Singh sold 7,384 shares of the company's stock in a transaction dated Wednesday, August 28th. The stock was sold at an average price of $149.91, for a total transaction of $1,106,935.44. Following the completion of the transaction, the insider now directly owns 31,190 shares of the company's stock, valued at approximately $4,675,692.90. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. In related news, CEO Andrew Wilson sold 2,500 shares of the company's stock in a transaction dated Monday, August 26th. The stock was sold at an average price of $148.88, for a total value of $372,200.00. Following the completion of the sale, the chief executive officer now directly owns 56,747 shares of the company's stock, valued at $8,448,493.36. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Vijayanthimala Singh sold 7,384 shares of the stock in a transaction that occurred on Wednesday, August 28th. The stock was sold at an average price of $149.91, for a total value of $1,106,935.44. Following the sale, the insider now directly owns 31,190 shares of the company's stock, valued at $4,675,692.90. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 23,644 shares of company stock valued at $3,491,207. 0.22% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

A number of brokerages have recently issued reports on EA. StockNews.com raised Electronic Arts from a "buy" rating to a "strong-buy" rating in a research note on Thursday, October 31st. Robert W. Baird lifted their price target on Electronic Arts from $170.00 to $175.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 30th. Stifel Nicolaus boosted their price objective on Electronic Arts from $165.00 to $167.00 and gave the stock a "buy" rating in a research note on Wednesday, July 31st. Jefferies Financial Group assumed coverage on Electronic Arts in a research note on Thursday, July 11th. They set a "buy" rating and a $165.00 price objective on the stock. Finally, UBS Group boosted their price objective on Electronic Arts from $155.00 to $160.00 and gave the stock a "neutral" rating in a research note on Wednesday, October 30th. Eight analysts have rated the stock with a hold rating, eleven have issued a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $164.39.

Get Our Latest Report on EA

Electronic Arts Stock Up 1.7 %

Shares of NASDAQ:EA traded up $2.61 on Tuesday, hitting $155.50. 2,337,593 shares of the company's stock were exchanged, compared to its average volume of 2,060,325. The firm's 50-day moving average is $145.05 and its 200 day moving average is $140.58. The company has a market capitalization of $41.08 billion, a PE ratio of 39.97, a P/E/G ratio of 1.95 and a beta of 0.78. Electronic Arts Inc. has a 1-year low of $124.92 and a 1-year high of $155.55. The company has a debt-to-equity ratio of 0.25, a quick ratio of 1.45 and a current ratio of 1.43.

Electronic Arts Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Wednesday, November 27th will be given a dividend of $0.19 per share. The ex-dividend date of this dividend is Wednesday, November 27th. This represents a $0.76 annualized dividend and a dividend yield of 0.49%. Electronic Arts's dividend payout ratio is currently 19.54%.

Electronic Arts Profile

(

Free Report)

Electronic Arts Inc develops, markets, publishes, and distributes games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide. It develops and publishes games and services across various genres, such as sports, racing, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Need for Speed, and license games from others, including FIFA, Madden NFL, UFC, and Star Wars brands.

Featured Stories

Before you consider Electronic Arts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Electronic Arts wasn't on the list.

While Electronic Arts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.