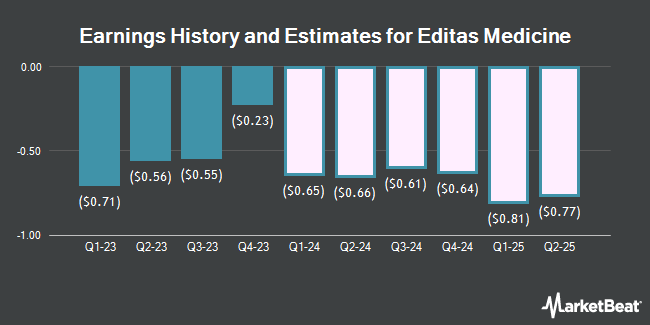

Editas Medicine, Inc. (NASDAQ:EDIT - Free Report) - Investment analysts at Chardan Capital boosted their FY2024 earnings per share estimates for shares of Editas Medicine in a research note issued on Wednesday, October 23rd. Chardan Capital analyst Y. Livshits now expects that the company will post earnings of ($2.58) per share for the year, up from their previous forecast of ($2.89). Chardan Capital currently has a "Buy" rating and a $12.00 target price on the stock. The consensus estimate for Editas Medicine's current full-year earnings is ($2.98) per share.

A number of other research analysts also recently weighed in on the company. Barclays cut their price objective on Editas Medicine from $9.00 to $7.00 and set an "equal weight" rating on the stock in a research note on Thursday, August 8th. Bank of America raised Editas Medicine from a "neutral" rating to a "buy" rating and raised their price objective for the company from $13.00 to $15.00 in a research note on Thursday, August 8th. Royal Bank of Canada reissued a "sector perform" rating and issued a $8.00 price objective on shares of Editas Medicine in a research note on Thursday, September 19th. Wells Fargo & Company cut their price objective on Editas Medicine from $27.00 to $9.00 and set an "overweight" rating on the stock in a research note on Wednesday, October 23rd. Finally, Truist Financial cut their price objective on Editas Medicine from $20.00 to $12.00 and set a "buy" rating on the stock in a research note on Thursday, August 8th. One analyst has rated the stock with a sell rating, six have issued a hold rating and five have issued a buy rating to the stock. According to MarketBeat, Editas Medicine has a consensus rating of "Hold" and a consensus target price of $9.91.

Get Our Latest Stock Report on Editas Medicine

Editas Medicine Stock Performance

Shares of Editas Medicine stock traded up $0.08 during trading on Monday, hitting $3.26. 1,340,543 shares of the stock traded hands, compared to its average volume of 1,913,230. The stock has a market cap of $268.10 million, a P/E ratio of -1.55 and a beta of 1.99. Editas Medicine has a twelve month low of $2.91 and a twelve month high of $11.69. The company has a fifty day moving average price of $3.55 and a two-hundred day moving average price of $4.65.

Editas Medicine (NASDAQ:EDIT - Get Free Report) last announced its quarterly earnings results on Wednesday, August 7th. The company reported ($0.82) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.70) by ($0.12). The firm had revenue of $0.51 million for the quarter, compared to analyst estimates of $4.78 million. Editas Medicine had a negative net margin of 288.59% and a negative return on equity of 62.61%. The firm's quarterly revenue was down 82.2% compared to the same quarter last year. During the same quarter in the prior year, the firm earned ($0.56) earnings per share.

Institutional Trading of Editas Medicine

Several institutional investors have recently made changes to their positions in the business. China Universal Asset Management Co. Ltd. boosted its holdings in Editas Medicine by 64.2% during the third quarter. China Universal Asset Management Co. Ltd. now owns 15,863 shares of the company's stock valued at $54,000 after purchasing an additional 6,202 shares in the last quarter. Ballentine Partners LLC bought a new position in shares of Editas Medicine during the 3rd quarter worth approximately $36,000. Hennion & Walsh Asset Management Inc. boosted its stake in Editas Medicine by 34.7% in the 3rd quarter. Hennion & Walsh Asset Management Inc. now owns 226,756 shares of the company's stock valued at $773,000 after buying an additional 58,385 shares in the last quarter. International Assets Investment Management LLC grew its position in Editas Medicine by 262.0% in the third quarter. International Assets Investment Management LLC now owns 113,863 shares of the company's stock valued at $388,000 after acquiring an additional 82,406 shares during the period. Finally, Signaturefd LLC grew its position in Editas Medicine by 494.8% in the third quarter. Signaturefd LLC now owns 9,326 shares of the company's stock valued at $32,000 after acquiring an additional 7,758 shares during the period. 71.90% of the stock is currently owned by institutional investors and hedge funds.

About Editas Medicine

(

Get Free Report)

Editas Medicine, Inc, a clinical stage genome editing company, focuses on developing transformative genomic medicines to treat a range of serious diseases. It develops a proprietary gene editing platform based on CRISPR technology. The company develops EDIT-101, which is in Phase 1/2 BRILLIANCE trial for Leber Congenital Amaurosis; and reni-cel, a clinical development gene-edited medicine to treat sickle cell disease and transfusion-dependent beta-thalassemia.

Featured Stories

Before you consider Editas Medicine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Editas Medicine wasn't on the list.

While Editas Medicine currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.