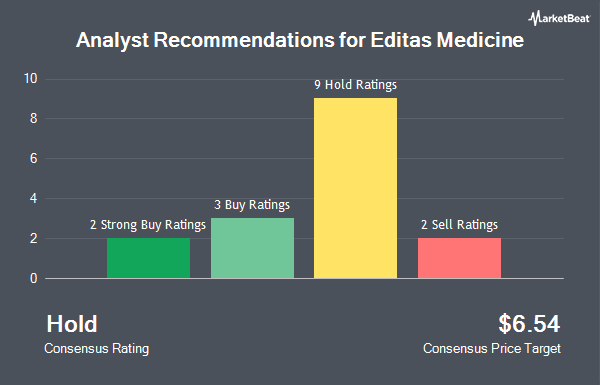

Editas Medicine, Inc. (NASDAQ:EDIT - Get Free Report) has earned a consensus rating of "Hold" from the ten brokerages that are currently covering the stock, MarketBeat.com reports. Seven research analysts have rated the stock with a hold recommendation and three have assigned a buy recommendation to the company. The average 12 month price target among analysts that have covered the stock in the last year is $10.22.

A number of equities analysts have issued reports on the stock. Barclays cut their target price on shares of Editas Medicine from $9.00 to $7.00 and set an "equal weight" rating on the stock in a report on Thursday, August 8th. Bank of America raised Editas Medicine from a "neutral" rating to a "buy" rating and increased their target price for the stock from $13.00 to $15.00 in a research report on Thursday, August 8th. Royal Bank of Canada reaffirmed a "sector perform" rating and issued a $8.00 price objective on shares of Editas Medicine in a report on Thursday, September 19th. Truist Financial reduced their target price on shares of Editas Medicine from $20.00 to $12.00 and set a "buy" rating for the company in a research note on Thursday, August 8th. Finally, Oppenheimer restated a "market perform" rating and issued a $12.00 price target on shares of Editas Medicine in a research note on Tuesday, June 18th.

Read Our Latest Research Report on EDIT

Insider Activity at Editas Medicine

In other news, EVP Linda Burkly sold 11,886 shares of the stock in a transaction on Thursday, July 25th. The stock was sold at an average price of $5.42, for a total transaction of $64,422.12. Following the completion of the sale, the executive vice president now owns 73,136 shares in the company, valued at approximately $396,397.12. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In related news, EVP Baisong Mei sold 6,619 shares of the company's stock in a transaction that occurred on Friday, July 19th. The shares were sold at an average price of $5.21, for a total value of $34,484.99. Following the completion of the sale, the executive vice president now owns 134,413 shares in the company, valued at approximately $700,291.73. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, EVP Linda Burkly sold 11,886 shares of the firm's stock in a transaction that occurred on Thursday, July 25th. The stock was sold at an average price of $5.42, for a total transaction of $64,422.12. Following the completion of the transaction, the executive vice president now directly owns 73,136 shares of the company's stock, valued at $396,397.12. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 20,578 shares of company stock valued at $105,997 over the last ninety days. Insiders own 1.90% of the company's stock.

Institutional Trading of Editas Medicine

Hedge funds have recently modified their holdings of the business. Millennium Management LLC grew its holdings in shares of Editas Medicine by 10.0% during the second quarter. Millennium Management LLC now owns 2,459,629 shares of the company's stock valued at $11,486,000 after buying an additional 223,012 shares in the last quarter. Los Angeles Capital Management LLC purchased a new stake in shares of Editas Medicine in the first quarter worth approximately $1,097,000. Integral Health Asset Management LLC boosted its holdings in shares of Editas Medicine by 50.0% during the second quarter. Integral Health Asset Management LLC now owns 675,000 shares of the company's stock worth $3,152,000 after purchasing an additional 225,000 shares during the period. Vanguard Group Inc. grew its position in Editas Medicine by 1.1% during the first quarter. Vanguard Group Inc. now owns 8,555,597 shares of the company's stock valued at $63,483,000 after purchasing an additional 93,740 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD increased its stake in Editas Medicine by 16.9% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 49,704 shares of the company's stock valued at $369,000 after buying an additional 7,174 shares during the period. Hedge funds and other institutional investors own 71.90% of the company's stock.

Editas Medicine Price Performance

NASDAQ:EDIT traded up $0.23 during mid-day trading on Friday, reaching $3.19. The stock had a trading volume of 2,265,755 shares, compared to its average volume of 1,914,850. The company has a market capitalization of $262.34 million, a price-to-earnings ratio of -1.52 and a beta of 1.99. Editas Medicine has a 1-year low of $2.91 and a 1-year high of $11.69. The stock's 50 day simple moving average is $3.71 and its two-hundred day simple moving average is $4.92.

Editas Medicine (NASDAQ:EDIT - Get Free Report) last issued its quarterly earnings results on Wednesday, August 7th. The company reported ($0.82) earnings per share for the quarter, missing analysts' consensus estimates of ($0.70) by ($0.12). Editas Medicine had a negative net margin of 288.59% and a negative return on equity of 62.61%. The firm had revenue of $0.51 million during the quarter, compared to the consensus estimate of $4.78 million. During the same quarter last year, the firm posted ($0.56) earnings per share. Editas Medicine's revenue was down 82.2% compared to the same quarter last year. Sell-side analysts anticipate that Editas Medicine will post -2.98 EPS for the current fiscal year.

About Editas Medicine

(

Get Free ReportEditas Medicine, Inc, a clinical stage genome editing company, focuses on developing transformative genomic medicines to treat a range of serious diseases. It develops a proprietary gene editing platform based on CRISPR technology. The company develops EDIT-101, which is in Phase 1/2 BRILLIANCE trial for Leber Congenital Amaurosis; and reni-cel, a clinical development gene-edited medicine to treat sickle cell disease and transfusion-dependent beta-thalassemia.

Featured Articles

Before you consider Editas Medicine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Editas Medicine wasn't on the list.

While Editas Medicine currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.