Editas Medicine (NASDAQ:EDIT - Get Free Report) had its price objective cut by equities researchers at Chardan Capital from $20.00 to $12.00 in a research note issued on Tuesday, Benzinga reports. The brokerage presently has a "buy" rating on the stock. Chardan Capital's price target points to a potential upside of 264.74% from the company's current price.

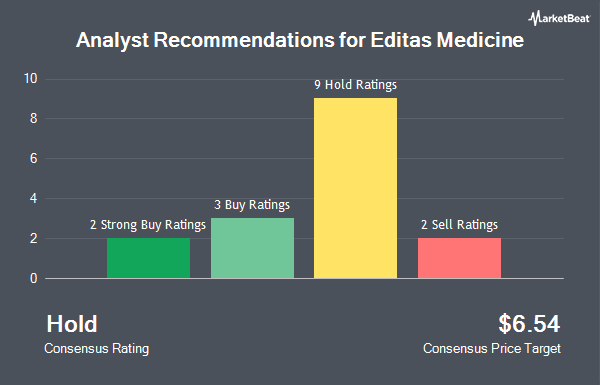

Several other equities research analysts also recently weighed in on EDIT. Barclays reduced their price target on Editas Medicine from $9.00 to $7.00 and set an "equal weight" rating on the stock in a report on Thursday, August 8th. Bank of America upgraded shares of Editas Medicine from a "neutral" rating to a "buy" rating and upped their price target for the stock from $13.00 to $15.00 in a report on Thursday, August 8th. Truist Financial reduced their price target on shares of Editas Medicine from $20.00 to $12.00 and set a "buy" rating on the stock in a research note on Thursday, August 8th. Finally, Royal Bank of Canada restated a "sector perform" rating and issued a $8.00 target price on shares of Editas Medicine in a research note on Thursday, September 19th. One analyst has rated the stock with a sell rating, six have assigned a hold rating and four have issued a buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $10.40.

View Our Latest Analysis on EDIT

Editas Medicine Stock Down 12.5 %

NASDAQ EDIT traded down $0.47 during trading on Tuesday, hitting $3.29. 3,317,804 shares of the stock traded hands, compared to its average volume of 1,918,343. The company has a market capitalization of $270.56 million, a P/E ratio of -1.57 and a beta of 1.99. Editas Medicine has a 12-month low of $2.91 and a 12-month high of $11.69. The firm has a 50-day simple moving average of $3.61 and a 200-day simple moving average of $4.75.

Editas Medicine (NASDAQ:EDIT - Get Free Report) last released its quarterly earnings results on Wednesday, August 7th. The company reported ($0.82) EPS for the quarter, missing the consensus estimate of ($0.70) by ($0.12). The company had revenue of $0.51 million during the quarter, compared to analysts' expectations of $4.78 million. Editas Medicine had a negative return on equity of 62.61% and a negative net margin of 288.59%. The company's revenue was down 82.2% on a year-over-year basis. During the same quarter in the prior year, the business posted ($0.56) EPS. As a group, research analysts predict that Editas Medicine will post -2.98 EPS for the current fiscal year.

Insider Activity

In related news, EVP Linda Burkly sold 11,886 shares of the stock in a transaction that occurred on Thursday, July 25th. The shares were sold at an average price of $5.42, for a total value of $64,422.12. Following the transaction, the executive vice president now owns 73,136 shares in the company, valued at approximately $396,397.12. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Over the last three months, insiders have sold 13,959 shares of company stock valued at $71,512. Company insiders own 1.90% of the company's stock.

Hedge Funds Weigh In On Editas Medicine

Several large investors have recently made changes to their positions in EDIT. International Assets Investment Management LLC grew its holdings in Editas Medicine by 10.5% in the second quarter. International Assets Investment Management LLC now owns 31,457 shares of the company's stock valued at $147,000 after purchasing an additional 3,000 shares during the period. The Manufacturers Life Insurance Company lifted its position in shares of Editas Medicine by 10.1% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 33,599 shares of the company's stock valued at $157,000 after buying an additional 3,089 shares in the last quarter. Rhumbline Advisers grew its stake in Editas Medicine by 2.9% in the 2nd quarter. Rhumbline Advisers now owns 137,986 shares of the company's stock valued at $644,000 after acquiring an additional 3,862 shares during the period. Allspring Global Investments Holdings LLC increased its holdings in Editas Medicine by 20.0% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 24,485 shares of the company's stock worth $83,000 after acquiring an additional 4,089 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD raised its position in Editas Medicine by 16.9% during the first quarter. Price T Rowe Associates Inc. MD now owns 49,704 shares of the company's stock worth $369,000 after acquiring an additional 7,174 shares during the period. 71.90% of the stock is currently owned by institutional investors and hedge funds.

About Editas Medicine

(

Get Free Report)

Editas Medicine, Inc, a clinical stage genome editing company, focuses on developing transformative genomic medicines to treat a range of serious diseases. It develops a proprietary gene editing platform based on CRISPR technology. The company develops EDIT-101, which is in Phase 1/2 BRILLIANCE trial for Leber Congenital Amaurosis; and reni-cel, a clinical development gene-edited medicine to treat sickle cell disease and transfusion-dependent beta-thalassemia.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Editas Medicine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Editas Medicine wasn't on the list.

While Editas Medicine currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.