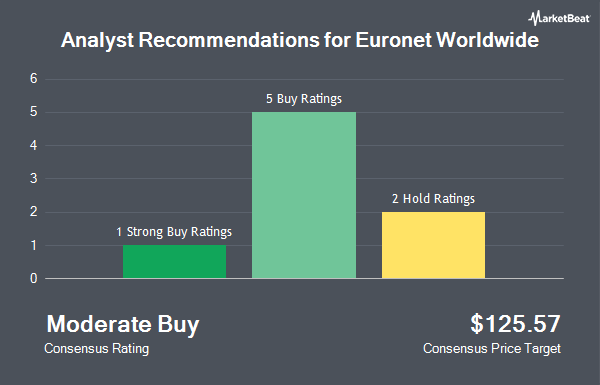

Shares of Euronet Worldwide, Inc. (NASDAQ:EEFT - Get Free Report) have earned an average recommendation of "Moderate Buy" from the eleven brokerages that are covering the stock, MarketBeat.com reports. Four investment analysts have rated the stock with a hold rating and seven have given a buy rating to the company. The average twelve-month price target among analysts that have covered the stock in the last year is $122.56.

Several brokerages have recently issued reports on EEFT. Oppenheimer initiated coverage on shares of Euronet Worldwide in a research report on Tuesday, October 1st. They set an "outperform" rating and a $121.00 price objective for the company. Needham & Company LLC reissued a "buy" rating and issued a $125.00 price target on shares of Euronet Worldwide in a research note on Wednesday, September 4th. DA Davidson reaffirmed a "buy" rating and set a $136.00 price objective on shares of Euronet Worldwide in a research report on Tuesday, October 8th. Monness Crespi & Hardt lifted their target price on Euronet Worldwide from $140.00 to $145.00 and gave the company a "neutral" rating in a research report on Monday, July 22nd. Finally, StockNews.com downgraded Euronet Worldwide from a "buy" rating to a "hold" rating in a research report on Friday, August 9th.

Get Our Latest Stock Report on EEFT

Insider Transactions at Euronet Worldwide

In other news, Director Thomas A. Mcdonnell bought 3,206 shares of the firm's stock in a transaction that occurred on Monday, August 5th. The stock was acquired at an average cost of $93.86 per share, with a total value of $300,915.16. Following the completion of the purchase, the director now owns 90,000 shares of the company's stock, valued at $8,447,400. This represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which can be accessed through this link. In other news, Director Thomas A. Mcdonnell bought 3,206 shares of the company's stock in a transaction dated Monday, August 5th. The shares were bought at an average cost of $93.86 per share, with a total value of $300,915.16. Following the acquisition, the director now owns 90,000 shares in the company, valued at $8,447,400. This trade represents a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CEO Juan Bianchi sold 4,000 shares of Euronet Worldwide stock in a transaction dated Thursday, September 5th. The stock was sold at an average price of $102.58, for a total value of $410,320.00. Following the transaction, the chief executive officer now owns 12,440 shares of the company's stock, valued at $1,276,095.20. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 10.50% of the company's stock.

Institutional Investors Weigh In On Euronet Worldwide

A number of large investors have recently added to or reduced their stakes in the business. CWM LLC increased its holdings in shares of Euronet Worldwide by 38.8% in the first quarter. CWM LLC now owns 991 shares of the business services provider's stock valued at $109,000 after purchasing an additional 277 shares during the last quarter. Cooper Financial Group acquired a new position in Euronet Worldwide in the 1st quarter valued at about $621,000. FCF Advisors LLC raised its holdings in Euronet Worldwide by 7.8% in the 1st quarter. FCF Advisors LLC now owns 8,436 shares of the business services provider's stock valued at $927,000 after acquiring an additional 613 shares during the period. Oak Thistle LLC acquired a new stake in Euronet Worldwide during the first quarter worth approximately $588,000. Finally, State of Michigan Retirement System boosted its holdings in shares of Euronet Worldwide by 1.9% during the first quarter. State of Michigan Retirement System now owns 10,717 shares of the business services provider's stock worth $1,178,000 after acquiring an additional 200 shares during the period. Institutional investors own 91.60% of the company's stock.

Euronet Worldwide Trading Down 0.4 %

EEFT traded down $0.41 during midday trading on Friday, reaching $98.66. 189,495 shares of the company were exchanged, compared to its average volume of 304,204. The company has a debt-to-equity ratio of 0.85, a quick ratio of 1.19 and a current ratio of 1.19. The stock has a market capitalization of $4.52 billion, a P/E ratio of 17.37 and a beta of 1.46. The stock's 50-day simple moving average is $100.52 and its 200 day simple moving average is $104.53. Euronet Worldwide has a one year low of $75.41 and a one year high of $117.66.

Euronet Worldwide (NASDAQ:EEFT - Get Free Report) last released its quarterly earnings data on Thursday, July 18th. The business services provider reported $2.25 earnings per share for the quarter, topping the consensus estimate of $2.04 by $0.21. The business had revenue of $986.20 million for the quarter, compared to analyst estimates of $1.09 billion. Euronet Worldwide had a net margin of 7.46% and a return on equity of 27.81%. Euronet Worldwide's quarterly revenue was up 5.0% compared to the same quarter last year. During the same quarter last year, the firm earned $1.84 EPS. As a group, analysts forecast that Euronet Worldwide will post 7.88 earnings per share for the current fiscal year.

Euronet Worldwide Company Profile

(

Get Free ReportEuronet Worldwide, Inc provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide. It operates through three segments: Electronic Fund Transfer Processing, epay, and Money Transfer. The Electronic Fund Transfer Processing segment provides electronic payment solutions, including automated teller machine (ATM) cash withdrawal and deposit services, ATM network participation, outsourced ATM and point-of-sale (POS) management solutions, credit and debit and prepaid card outsourcing, card issuing, and merchant acquiring services.

Further Reading

Before you consider Euronet Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Euronet Worldwide wasn't on the list.

While Euronet Worldwide currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.