The Ensign Group (NASDAQ:ENSG - Get Free Report) issued an update on its FY 2024 earnings guidance on Thursday morning. The company provided earnings per share (EPS) guidance of 5.460-5.520 for the period, compared to the consensus estimate of 5.460. The company issued revenue guidance of $4.3 billion-$4.3 billion, compared to the consensus revenue estimate of $4.2 billion.

The Ensign Group Stock Down 0.8 %

Shares of ENSG stock traded down $1.13 during midday trading on Thursday, reaching $148.85. 758,813 shares of the stock were exchanged, compared to its average volume of 369,327. The Ensign Group has a 1 year low of $92.69 and a 1 year high of $154.93. The company's 50 day moving average is $148.22 and its two-hundred day moving average is $133.16. The company has a current ratio of 1.53, a quick ratio of 1.53 and a debt-to-equity ratio of 0.09. The firm has a market cap of $8.47 billion, a PE ratio of 39.47, a price-to-earnings-growth ratio of 1.96 and a beta of 0.96.

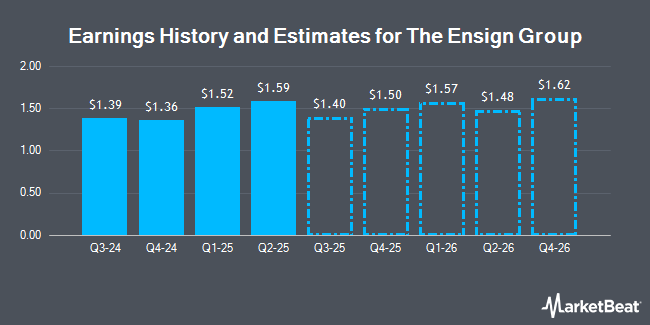

The Ensign Group (NASDAQ:ENSG - Get Free Report) last posted its earnings results on Thursday, July 25th. The company reported $1.32 earnings per share for the quarter, topping analysts' consensus estimates of $1.30 by $0.02. The Ensign Group had a return on equity of 17.32% and a net margin of 5.68%. The firm had revenue of $1.04 billion for the quarter, compared to the consensus estimate of $1.02 billion. During the same quarter in the prior year, the business earned $1.08 EPS. The business's revenue for the quarter was up 12.5% on a year-over-year basis. On average, equities research analysts predict that The Ensign Group will post 4.99 EPS for the current year.

The Ensign Group Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Thursday, October 31st. Shareholders of record on Monday, September 30th will be issued a dividend of $0.06 per share. The ex-dividend date is Monday, September 30th. This represents a $0.24 dividend on an annualized basis and a dividend yield of 0.16%. The Ensign Group's dividend payout ratio (DPR) is 6.32%.

Analyst Upgrades and Downgrades

ENSG has been the topic of several recent research reports. Royal Bank of Canada upped their price target on The Ensign Group from $133.00 to $167.00 and gave the stock an "outperform" rating in a research note on Monday. Truist Financial upped their price objective on The Ensign Group from $150.00 to $160.00 and gave the company a "hold" rating in a research report on Wednesday, July 31st. Macquarie initiated coverage on The Ensign Group in a research report on Friday, June 28th. They issued an "outperform" rating and a $134.00 price objective on the stock. Finally, Oppenheimer increased their price target on The Ensign Group from $155.00 to $165.00 and gave the company an "outperform" rating in a report on Monday, September 16th. One analyst has rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $152.20.

Check Out Our Latest Stock Report on The Ensign Group

Insider Buying and Selling

In related news, CEO Barry Port sold 3,000 shares of the firm's stock in a transaction on Tuesday, August 6th. The stock was sold at an average price of $140.00, for a total value of $420,000.00. Following the transaction, the chief executive officer now directly owns 53,716 shares of the company's stock, valued at approximately $7,520,240. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. In other The Ensign Group news, Director Daren Shaw sold 2,000 shares of the stock in a transaction on Thursday, August 15th. The stock was sold at an average price of $141.71, for a total value of $283,420.00. Following the completion of the sale, the director now owns 29,125 shares in the company, valued at approximately $4,127,303.75. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, CEO Barry Port sold 3,000 shares of the firm's stock in a transaction dated Tuesday, August 6th. The shares were sold at an average price of $140.00, for a total value of $420,000.00. Following the transaction, the chief executive officer now owns 53,716 shares of the company's stock, valued at approximately $7,520,240. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 14,118 shares of company stock valued at $2,053,620. 3.90% of the stock is owned by company insiders.

The Ensign Group Company Profile

(

Get Free Report)

The Ensign Group, Inc provides skilled nursing, senior living, and rehabilitative services. It operates through two segments: Skilled Services and Standard Bearer. The company's Skilled Services segment engages in the operation of skilled nursing facilities and rehabilitation therapy services for patients with chronic conditions, prolonged illness, and the elderly; and offers nursing facilities including specialty care, such as on-site dialysis, ventilator care, cardiac, and pulmonary management, as well as standard services comprising room and board, special nutritional programs, social services, recreational activities, entertainment, and other services.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider The Ensign Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Ensign Group wasn't on the list.

While The Ensign Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.