Lecap Asset Management Ltd. purchased a new position in shares of Exact Sciences Co. (NASDAQ:EXAS - Free Report) during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 8,705 shares of the medical research company's stock, valued at approximately $593,000.

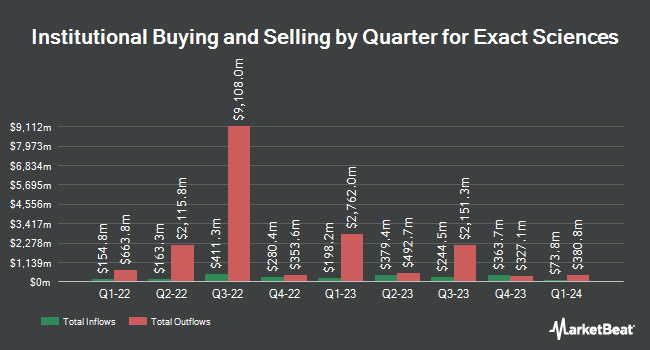

A number of other hedge funds have also recently added to or reduced their stakes in EXAS. Mitsubishi UFJ Asset Management Co. Ltd. lifted its holdings in Exact Sciences by 16.1% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 89,196 shares of the medical research company's stock valued at $6,160,000 after purchasing an additional 12,349 shares in the last quarter. CANADA LIFE ASSURANCE Co increased its position in shares of Exact Sciences by 5.3% during the first quarter. CANADA LIFE ASSURANCE Co now owns 207,364 shares of the medical research company's stock valued at $14,361,000 after acquiring an additional 10,356 shares during the last quarter. Profund Advisors LLC boosted its stake in shares of Exact Sciences by 239.8% in the second quarter. Profund Advisors LLC now owns 78,589 shares of the medical research company's stock valued at $3,320,000 after purchasing an additional 55,459 shares during the period. William Blair Investment Management LLC purchased a new position in shares of Exact Sciences in the second quarter valued at approximately $163,896,000. Finally, Grandfield & Dodd LLC boosted its stake in shares of Exact Sciences by 142.5% in the first quarter. Grandfield & Dodd LLC now owns 55,224 shares of the medical research company's stock valued at $3,814,000 after purchasing an additional 32,453 shares during the period. 88.82% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of brokerages recently issued reports on EXAS. Stifel Nicolaus decreased their price target on shares of Exact Sciences from $100.00 to $82.00 and set a "buy" rating for the company in a research note on Thursday, August 1st. Benchmark cut their target price on shares of Exact Sciences from $91.00 to $67.00 and set a "buy" rating on the stock in a report on Thursday, August 1st. Canaccord Genuity Group reaffirmed a "buy" rating and issued a $75.00 target price on shares of Exact Sciences in a report on Friday, September 13th. Scotiabank began coverage on shares of Exact Sciences in a research note on Thursday, June 27th. They issued a "sector outperform" rating and a $70.00 price objective on the stock. Finally, Raymond James reissued a "market perform" rating on shares of Exact Sciences in a research note on Thursday, September 26th. One analyst has rated the stock with a hold rating and fourteen have given a buy rating to the company. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $78.38.

Get Our Latest Report on Exact Sciences

Insider Activity

In related news, EVP Brian Baranick sold 929 shares of the stock in a transaction that occurred on Tuesday, October 8th. The shares were sold at an average price of $70.00, for a total transaction of $65,030.00. Following the completion of the sale, the executive vice president now owns 12,758 shares of the company's stock, valued at approximately $893,060. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 1.36% of the company's stock.

Exact Sciences Trading Down 1.6 %

NASDAQ:EXAS traded down $1.15 on Friday, reaching $69.11. The stock had a trading volume of 864,850 shares, compared to its average volume of 2,547,537. The company has a market cap of $12.75 billion, a price-to-earnings ratio of -53.23 and a beta of 1.27. The company has a debt-to-equity ratio of 0.73, a current ratio of 2.17 and a quick ratio of 1.98. The firm's fifty day moving average is $65.56 and its two-hundred day moving average is $56.72. Exact Sciences Co. has a 12-month low of $40.62 and a 12-month high of $79.62.

Exact Sciences (NASDAQ:EXAS - Get Free Report) last posted its quarterly earnings data on Wednesday, July 31st. The medical research company reported ($0.09) EPS for the quarter, beating analysts' consensus estimates of ($0.37) by $0.28. Exact Sciences had a negative net margin of 6.70% and a negative return on equity of 4.97%. The company had revenue of $699.26 million during the quarter, compared to the consensus estimate of $690.02 million. During the same quarter in the prior year, the company posted ($0.45) EPS. The company's quarterly revenue was up 12.4% compared to the same quarter last year. Equities analysts expect that Exact Sciences Co. will post -0.87 EPS for the current fiscal year.

About Exact Sciences

(

Free Report)

Exact Sciences Corporation provides cancer screening and diagnostic test products in the United States and internationally. The company offers Cologuard, a non-invasive stool-based DNA screening test to detect DNA and hemoglobin biomarkers associated with colorectal cancer and pre-cancer. It also provides Oncotype DX Breast Recurrence Score Test; Oncotype DX Breast DCIS Score Test; Oncotype DX Colon Recurrence Score Test; OncoExTra Test for tumor profiling for patients with advanced, metastatic, refractory, relapsed, or recurrent cancer; and Covid-19 testing services.

Recommended Stories

Before you consider Exact Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Exact Sciences wasn't on the list.

While Exact Sciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.