ExlService (NASDAQ:EXLS - Get Free Report) will post its quarterly earnings results after the market closes on Tuesday, October 29th. Analysts expect ExlService to post earnings of $0.41 per share for the quarter. ExlService has set its FY24 guidance at $1.59-1.62 EPS and its FY 2024 guidance at 1.590-1.620 EPS.Parties that are interested in participating in the company's conference call can do so using this link.

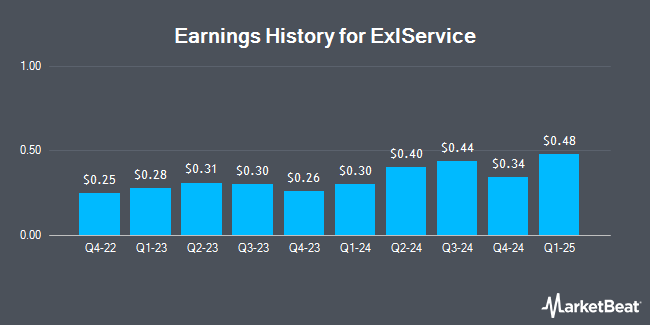

ExlService (NASDAQ:EXLS - Get Free Report) last released its earnings results on Thursday, August 1st. The business services provider reported $0.40 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.39 by $0.01. ExlService had a return on equity of 22.92% and a net margin of 10.45%. The business had revenue of $448.40 million during the quarter, compared to the consensus estimate of $444.61 million. During the same period last year, the business posted $0.31 earnings per share. The business's revenue for the quarter was up 10.7% on a year-over-year basis. On average, analysts expect ExlService to post $1 EPS for the current fiscal year and $2 EPS for the next fiscal year.

ExlService Stock Performance

EXLS traded down $0.38 during trading hours on Tuesday, hitting $39.45. The stock had a trading volume of 484,533 shares, compared to its average volume of 946,915. ExlService has a 1 year low of $25.17 and a 1 year high of $40.77. The company's fifty day simple moving average is $37.23 and its 200 day simple moving average is $33.31. The stock has a market cap of $6.61 billion, a PE ratio of 36.53, a price-to-earnings-growth ratio of 2.05 and a beta of 1.00. The company has a quick ratio of 2.45, a current ratio of 2.45 and a debt-to-equity ratio of 0.30.

Wall Street Analyst Weigh In

Several analysts have recently issued reports on the stock. Robert W. Baird boosted their price target on shares of ExlService from $35.00 to $40.00 and gave the company a "neutral" rating in a research report on Thursday, October 10th. JPMorgan Chase & Co. boosted their price objective on shares of ExlService from $38.00 to $41.00 and gave the company an "overweight" rating in a research note on Friday, September 6th. Jefferies Financial Group upgraded shares of ExlService from a "hold" rating to a "buy" rating and increased their target price for the stock from $35.00 to $42.00 in a research note on Monday, September 9th. Needham & Company LLC reaffirmed a "buy" rating and issued a $40.00 price target on shares of ExlService in a report on Friday, August 2nd. Finally, Citigroup lifted their price objective on ExlService from $38.00 to $46.00 and gave the company a "buy" rating in a research note on Monday, October 14th. Two investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $40.86.

Check Out Our Latest Report on EXLS

Insider Buying and Selling at ExlService

In other news, CEO Rohit Kapoor sold 40,000 shares of the stock in a transaction on Thursday, August 8th. The stock was sold at an average price of $34.05, for a total value of $1,362,000.00. Following the sale, the chief executive officer now directly owns 1,509,588 shares of the company's stock, valued at approximately $51,401,471.40. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. In other news, CEO Rohit Kapoor sold 40,000 shares of the stock in a transaction that occurred on Thursday, August 8th. The shares were sold at an average price of $34.05, for a total transaction of $1,362,000.00. Following the sale, the chief executive officer now owns 1,509,588 shares in the company, valued at $51,401,471.40. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, EVP Anita Mahon sold 25,670 shares of the company's stock in a transaction that occurred on Wednesday, August 21st. The shares were sold at an average price of $35.50, for a total value of $911,285.00. Following the completion of the transaction, the executive vice president now directly owns 68,857 shares in the company, valued at $2,444,423.50. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 134,875 shares of company stock valued at $4,716,859. Corporate insiders own 3.75% of the company's stock.

About ExlService

(

Get Free Report)

ExlService Holdings, Inc operates as a data analytics, and digital operations and solutions company in the United States and internationally. The company operates through Insurance, Healthcare, Analytics, and Emerging Business segments. It also provides digital operations and solutions and analytics-driven services, such as claims processing, premium and benefit administration, agency management, account reconciliation, policy research, underwriting support, new business acquisition, policy servicing, premium audit, surveys, billing and collection, commercial and residential survey, and customer service using digital technology, artificial intelligence, machine learning, and advanced automation; digital customer acquisition services using a software-as-a-service delivery model through LifePRO and LISS platforms; subrogation services; and Subrosource software platform, an end-to-end subrogation platform.

Featured Stories

Before you consider ExlService, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ExlService wasn't on the list.

While ExlService currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.