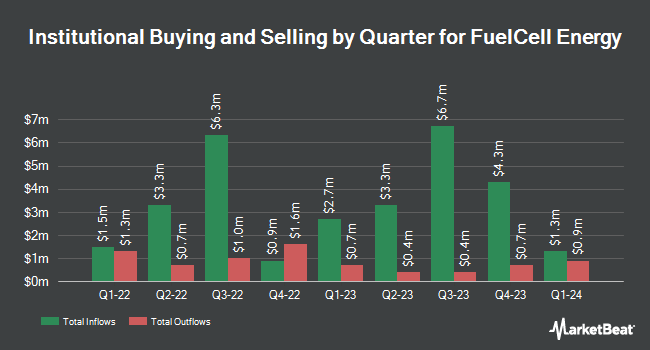

SG Americas Securities LLC lifted its position in FuelCell Energy, Inc. (NASDAQ:FCEL - Free Report) by 156.6% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 4,708,109 shares of the energy company's stock after acquiring an additional 2,873,171 shares during the quarter. SG Americas Securities LLC owned 0.95% of FuelCell Energy worth $1,789,000 at the end of the most recent reporting period.

Other institutional investors have also recently made changes to their positions in the company. SageView Advisory Group LLC purchased a new position in FuelCell Energy during the 1st quarter valued at about $41,000. Algert Global LLC acquired a new position in shares of FuelCell Energy in the 2nd quarter valued at $29,000. Quadrature Capital Ltd purchased a new stake in FuelCell Energy in the 4th quarter worth $79,000. Ballentine Partners LLC purchased a new stake in FuelCell Energy in the 1st quarter worth $59,000. Finally, AQR Capital Management LLC increased its holdings in FuelCell Energy by 106.0% in the 2nd quarter. AQR Capital Management LLC now owns 50,952 shares of the energy company's stock worth $33,000 after acquiring an additional 26,223 shares in the last quarter. Institutional investors own 42.78% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts have recently issued reports on FCEL shares. Canaccord Genuity Group dropped their target price on shares of FuelCell Energy from $1.50 to $1.25 and set a "hold" rating for the company in a report on Friday, September 6th. UBS Group decreased their price target on shares of FuelCell Energy from $1.35 to $0.50 and set a "neutral" rating for the company in a research note on Tuesday, August 6th. Finally, B. Riley raised shares of FuelCell Energy to a "hold" rating in a report on Tuesday, June 25th.

Get Our Latest Report on FCEL

FuelCell Energy Trading Down 3.2 %

Shares of NASDAQ FCEL traded down $0.01 on Wednesday, reaching $0.34. 29,700,455 shares of the company traded hands, compared to its average volume of 31,429,010. The company has a 50 day moving average of $0.43 and a 200 day moving average of $0.69. The stock has a market capitalization of $168.35 million, a PE ratio of -1.35 and a beta of 3.87. FuelCell Energy, Inc. has a fifty-two week low of $0.33 and a fifty-two week high of $1.84. The company has a current ratio of 6.91, a quick ratio of 4.97 and a debt-to-equity ratio of 0.18.

FuelCell Energy (NASDAQ:FCEL - Get Free Report) last issued its earnings results on Thursday, September 5th. The energy company reported ($0.07) earnings per share for the quarter, hitting the consensus estimate of ($0.07). FuelCell Energy had a negative return on equity of 17.02% and a negative net margin of 135.76%. The firm had revenue of $23.70 million for the quarter, compared to analyst estimates of $23.22 million. During the same period last year, the company earned ($0.06) earnings per share. On average, equities research analysts forecast that FuelCell Energy, Inc. will post -0.25 earnings per share for the current fiscal year.

FuelCell Energy Profile

(

Free Report)

FuelCell Energy, Inc, together with its subsidiaries, manufactures and sells stationary fuel cell and electrolysis platforms that decarbonize power and produce hydrogen. The company provides various configurations and applications of its platform, including on-site power, utility grid support, and microgrid, as well as distributed hydrogen; solid oxide-based electrolysis; solutions for long duration hydrogen-based energy storage and electrolysis technology; and carbon capture, separation, and utilization systems.

Further Reading

Before you consider FuelCell Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FuelCell Energy wasn't on the list.

While FuelCell Energy currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.