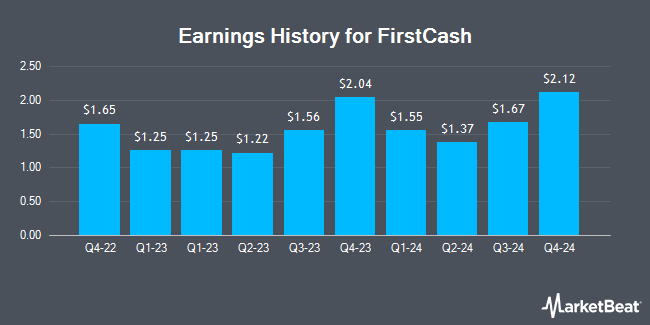

FirstCash (NASDAQ:FCFS - Get Free Report) issued its earnings results on Thursday. The company reported $1.67 earnings per share for the quarter, beating analysts' consensus estimates of $1.62 by $0.05, Briefing.com reports. FirstCash had a return on equity of 14.90% and a net margin of 7.17%. The business had revenue of $837.30 million during the quarter, compared to analyst estimates of $843.94 million. During the same period in the previous year, the company posted $1.56 EPS. FirstCash's revenue was up 6.5% on a year-over-year basis.

FirstCash Stock Up 3.2 %

Shares of NASDAQ:FCFS traded up $3.28 during trading hours on Friday, hitting $105.54. The company's stock had a trading volume of 748,245 shares, compared to its average volume of 204,962. The firm's fifty day moving average price is $115.22 and its 200 day moving average price is $114.69. FirstCash has a 52 week low of $100.39 and a 52 week high of $133.64. The company has a market capitalization of $4.72 billion, a price-to-earnings ratio of 20.22 and a beta of 0.62. The company has a debt-to-equity ratio of 0.85, a current ratio of 4.03 and a quick ratio of 3.04.

FirstCash Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, November 27th. Shareholders of record on Friday, November 15th will be issued a dividend of $0.38 per share. This represents a $1.52 annualized dividend and a yield of 1.44%. The ex-dividend date of this dividend is Friday, November 15th. FirstCash's payout ratio is 29.12%.

Insider Activity

In other FirstCash news, Director Douglas Richard Rippel sold 2,864 shares of the company's stock in a transaction on Monday, August 26th. The stock was sold at an average price of $120.01, for a total transaction of $343,708.64. Following the completion of the sale, the director now owns 4,743,159 shares in the company, valued at $569,226,511.59. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. In other news, Director Douglas Richard Rippel sold 2,864 shares of the stock in a transaction on Monday, August 26th. The stock was sold at an average price of $120.01, for a total transaction of $343,708.64. Following the completion of the sale, the director now owns 4,743,159 shares in the company, valued at approximately $569,226,511.59. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CFO R Douglas Orr sold 2,000 shares of the firm's stock in a transaction dated Monday, August 5th. The stock was sold at an average price of $107.18, for a total value of $214,360.00. Following the completion of the sale, the chief financial officer now directly owns 90,715 shares of the company's stock, valued at approximately $9,722,833.70. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 16,154 shares of company stock worth $1,912,562. Corporate insiders own 14.77% of the company's stock.

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the stock. Allspring Global Investments Holdings LLC purchased a new position in shares of FirstCash in the first quarter worth about $26,000. Point72 Asia Singapore Pte. Ltd. purchased a new position in FirstCash during the 2nd quarter worth approximately $54,000. Whittier Trust Co. raised its position in FirstCash by 62.2% during the 1st quarter. Whittier Trust Co. now owns 459 shares of the company's stock worth $59,000 after buying an additional 176 shares during the last quarter. CWM LLC lifted its stake in FirstCash by 157.5% during the 3rd quarter. CWM LLC now owns 569 shares of the company's stock valued at $65,000 after acquiring an additional 348 shares during the period. Finally, GAMMA Investing LLC boosted its holdings in shares of FirstCash by 28.9% in the 3rd quarter. GAMMA Investing LLC now owns 900 shares of the company's stock valued at $103,000 after acquiring an additional 202 shares during the last quarter. Institutional investors and hedge funds own 80.30% of the company's stock.

About FirstCash

(

Get Free Report)

FirstCash Holdings, Inc, together with its subsidiaries, operates retail pawn stores in the United States, Mexico, and rest of Latin America. The company operates in three segments: U.S. Pawn, Latin America Pawn, and Retail POS Payment Solutions segments. Its pawn stores lend money on the collateral of pledged personal property, including jewelry, electronics, tools, appliances, sporting goods, and musical instruments; and retails merchandise acquired through collateral forfeitures on forfeited pawn loans and over-the-counter purchases of merchandise directly from customers.

Featured Stories

Before you consider FirstCash, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FirstCash wasn't on the list.

While FirstCash currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.