Raymond James & Associates raised its stake in shares of First Citizens BancShares, Inc. (NASDAQ:FCNCA - Free Report) by 5.1% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 16,826 shares of the bank's stock after acquiring an additional 811 shares during the period. Raymond James & Associates owned approximately 0.12% of First Citizens BancShares worth $30,976,000 as of its most recent SEC filing.

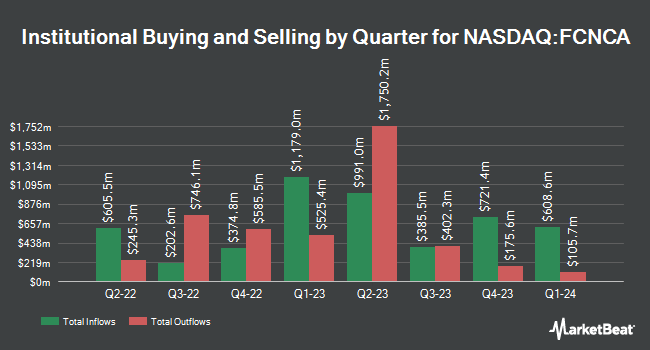

A number of other institutional investors have also made changes to their positions in the stock. Vanguard Group Inc. increased its position in shares of First Citizens BancShares by 4.6% during the first quarter. Vanguard Group Inc. now owns 1,064,822 shares of the bank's stock valued at $1,740,984,000 after acquiring an additional 47,167 shares during the last quarter. Capital Research Global Investors acquired a new position in shares of First Citizens BancShares in the first quarter valued at approximately $298,180,000. Reinhart Partners LLC. grew its holdings in shares of First Citizens BancShares by 0.7% in the third quarter. Reinhart Partners LLC. now owns 56,798 shares of the bank's stock valued at $104,562,000 after purchasing an additional 416 shares in the last quarter. Zurich Insurance Group Ltd FI grew its holdings in shares of First Citizens BancShares by 225.2% in the second quarter. Zurich Insurance Group Ltd FI now owns 42,159 shares of the bank's stock valued at $70,979,000 after purchasing an additional 29,194 shares in the last quarter. Finally, Sculptor Capital LP grew its holdings in shares of First Citizens BancShares by 16.8% in the second quarter. Sculptor Capital LP now owns 37,998 shares of the bank's stock valued at $63,974,000 after purchasing an additional 5,467 shares in the last quarter. 61.18% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of research analysts recently weighed in on the stock. Raymond James upgraded shares of First Citizens BancShares from a "market perform" rating to an "outperform" rating and set a $1,900.00 price objective for the company in a report on Tuesday, July 2nd. Piper Sandler lifted their price target on shares of First Citizens BancShares from $1,950.00 to $2,150.00 and gave the stock a "neutral" rating in a research note on Friday, July 26th. Jefferies Financial Group started coverage on shares of First Citizens BancShares in a research note on Tuesday, July 9th. They issued a "buy" rating and a $2,005.00 price target for the company. Keefe, Bruyette & Woods lifted their price target on shares of First Citizens BancShares from $2,100.00 to $2,300.00 and gave the stock an "outperform" rating in a research note on Friday, July 26th. Finally, Barclays lifted their price target on shares of First Citizens BancShares from $1,950.00 to $2,250.00 and gave the stock an "equal weight" rating in a research note on Monday, July 29th. One investment analyst has rated the stock with a sell rating, four have given a hold rating and five have issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $2,012.11.

Read Our Latest Stock Report on FCNCA

First Citizens BancShares Stock Down 9.7 %

Shares of NASDAQ:FCNCA traded down $202.66 during trading on Thursday, hitting $1,879.94. 305,593 shares of the company were exchanged, compared to its average volume of 86,416. The stock has a market capitalization of $27.32 billion, a P/E ratio of 10.44 and a beta of 0.81. The company has a debt-to-equity ratio of 1.72, a current ratio of 1.08 and a quick ratio of 1.08. First Citizens BancShares, Inc. has a 12-month low of $1,290.60 and a 12-month high of $2,174.80. The firm's 50 day moving average price is $1,951.59 and its 200-day moving average price is $1,822.63.

First Citizens BancShares (NASDAQ:FCNCA - Get Free Report) last issued its quarterly earnings data on Thursday, July 25th. The bank reported $50.87 earnings per share for the quarter, topping the consensus estimate of $44.91 by $5.96. The business had revenue of $3.77 billion during the quarter, compared to the consensus estimate of $2.30 billion. First Citizens BancShares had a net margin of 18.19% and a return on equity of 14.84%. During the same quarter in the previous year, the firm earned $52.60 EPS. On average, research analysts predict that First Citizens BancShares, Inc. will post 200 earnings per share for the current fiscal year.

First Citizens BancShares announced that its board has approved a stock repurchase plan on Thursday, July 25th that allows the company to repurchase $3.50 billion in shares. This repurchase authorization allows the bank to reacquire up to 12.3% of its stock through open market purchases. Stock repurchase plans are generally an indication that the company's board of directors believes its shares are undervalued.

First Citizens BancShares Profile

(

Free Report)

First Citizens BancShares, Inc operates as the holding company for First-Citizens Bank & Trust Company that provides retail and commercial banking services to individuals, businesses, and professionals. The company's deposit products include checking, savings, money market, and time deposit accounts.

See Also

Before you consider First Citizens BancShares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Citizens BancShares wasn't on the list.

While First Citizens BancShares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.