Assenagon Asset Management S.A. increased its stake in First Citizens BancShares, Inc. (NASDAQ:FCNCA - Free Report) by 40.8% in the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 3,544 shares of the bank's stock after acquiring an additional 1,027 shares during the period. Assenagon Asset Management S.A.'s holdings in First Citizens BancShares were worth $6,524,000 as of its most recent SEC filing.

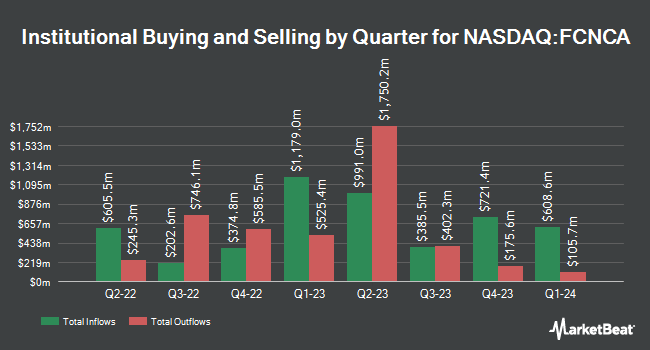

A number of other institutional investors have also added to or reduced their stakes in FCNCA. Allspring Global Investments Holdings LLC boosted its stake in shares of First Citizens BancShares by 76.7% during the first quarter. Allspring Global Investments Holdings LLC now owns 25,618 shares of the bank's stock valued at $41,886,000 after purchasing an additional 11,117 shares during the period. Check Capital Management Inc. CA boosted its position in First Citizens BancShares by 2.0% during the 1st quarter. Check Capital Management Inc. CA now owns 27,801 shares of the bank's stock valued at $45,455,000 after buying an additional 542 shares during the period. First Trust Direct Indexing L.P. bought a new stake in First Citizens BancShares in the 1st quarter worth $221,000. Principal Financial Group Inc. increased its position in shares of First Citizens BancShares by 28.7% in the first quarter. Principal Financial Group Inc. now owns 947 shares of the bank's stock valued at $1,548,000 after acquiring an additional 211 shares during the period. Finally, Commonwealth Equity Services LLC raised its stake in shares of First Citizens BancShares by 16.4% during the first quarter. Commonwealth Equity Services LLC now owns 355 shares of the bank's stock valued at $581,000 after acquiring an additional 50 shares during the last quarter. Institutional investors own 61.18% of the company's stock.

First Citizens BancShares Trading Up 0.8 %

Shares of NASDAQ:FCNCA traded up $15.83 during mid-day trading on Tuesday, reaching $1,941.86. 115,068 shares of the company were exchanged, compared to its average volume of 86,767. First Citizens BancShares, Inc. has a 1 year low of $1,339.10 and a 1 year high of $2,174.80. The company has a debt-to-equity ratio of 1.72, a current ratio of 1.08 and a quick ratio of 1.08. The firm's 50-day simple moving average is $1,946.31 and its 200 day simple moving average is $1,829.72. The firm has a market cap of $28.22 billion, a price-to-earnings ratio of 10.69 and a beta of 0.81.

First Citizens BancShares (NASDAQ:FCNCA - Get Free Report) last released its earnings results on Thursday, October 24th. The bank reported $45.87 earnings per share for the quarter, missing the consensus estimate of $47.40 by ($1.53). The firm had revenue of $2.45 billion during the quarter, compared to analyst estimates of $2.36 billion. First Citizens BancShares had a net margin of 18.19% and a return on equity of 14.84%. During the same period in the prior year, the firm earned $55.92 earnings per share. Equities research analysts forecast that First Citizens BancShares, Inc. will post 198.72 EPS for the current year.

First Citizens BancShares announced that its Board of Directors has authorized a stock repurchase program on Thursday, July 25th that allows the company to buyback $3.50 billion in outstanding shares. This buyback authorization allows the bank to reacquire up to 12.3% of its shares through open market purchases. Shares buyback programs are generally a sign that the company's board believes its shares are undervalued.

First Citizens BancShares Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Friday, November 29th will be paid a dividend of $1.95 per share. This represents a $7.80 dividend on an annualized basis and a dividend yield of 0.40%. This is a positive change from First Citizens BancShares's previous quarterly dividend of $1.64. The ex-dividend date is Friday, November 29th. First Citizens BancShares's dividend payout ratio is presently 4.33%.

Wall Street Analysts Forecast Growth

FCNCA has been the topic of several recent analyst reports. Wedbush cut their price target on shares of First Citizens BancShares from $2,150.00 to $2,000.00 and set a "neutral" rating on the stock in a report on Friday. Keefe, Bruyette & Woods increased their price objective on First Citizens BancShares from $2,100.00 to $2,300.00 and gave the company an "outperform" rating in a research report on Friday, July 26th. Jefferies Financial Group started coverage on shares of First Citizens BancShares in a research report on Tuesday, July 9th. They set a "buy" rating and a $2,005.00 target price for the company. Raymond James upgraded First Citizens BancShares from a "market perform" rating to an "outperform" rating and set a $1,900.00 price objective on the stock in a research report on Tuesday, July 2nd. Finally, Piper Sandler increased their price target on First Citizens BancShares from $1,950.00 to $2,150.00 and gave the company a "neutral" rating in a research note on Friday, July 26th. Five analysts have rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, First Citizens BancShares presently has an average rating of "Moderate Buy" and an average target price of $2,025.90.

Check Out Our Latest Stock Analysis on FCNCA

First Citizens BancShares Company Profile

(

Free Report)

First Citizens BancShares, Inc operates as the holding company for First-Citizens Bank & Trust Company that provides retail and commercial banking services to individuals, businesses, and professionals. The company's deposit products include checking, savings, money market, and time deposit accounts.

Featured Articles

Before you consider First Citizens BancShares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Citizens BancShares wasn't on the list.

While First Citizens BancShares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.