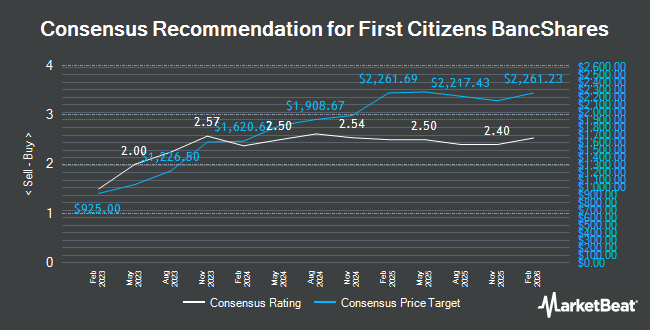

First Citizens BancShares (NASDAQ:FCNCA - Get Free Report) was upgraded by stock analysts at StockNews.com from a "sell" rating to a "hold" rating in a report issued on Monday.

Several other research analysts have also recently issued reports on the stock. Barclays increased their price target on shares of First Citizens BancShares from $1,950.00 to $2,250.00 and gave the stock an "equal weight" rating in a report on Monday, July 29th. Jefferies Financial Group initiated coverage on First Citizens BancShares in a research note on Tuesday, July 9th. They issued a "buy" rating and a $2,005.00 price target on the stock. Raymond James upgraded First Citizens BancShares from a "market perform" rating to an "outperform" rating and set a $1,900.00 price objective for the company in a research report on Tuesday, July 2nd. Keefe, Bruyette & Woods boosted their target price on shares of First Citizens BancShares from $2,100.00 to $2,300.00 and gave the stock an "outperform" rating in a research report on Friday, July 26th. Finally, Wedbush lowered their price target on shares of First Citizens BancShares from $2,150.00 to $2,000.00 and set a "neutral" rating on the stock in a research note on Friday. Five equities research analysts have rated the stock with a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $2,025.90.

Read Our Latest Research Report on First Citizens BancShares

First Citizens BancShares Stock Performance

Shares of FCNCA stock traded up $44.20 during trading hours on Monday, hitting $1,926.03. The stock had a trading volume of 83,759 shares, compared to its average volume of 86,631. The company has a debt-to-equity ratio of 1.72, a current ratio of 1.08 and a quick ratio of 1.08. The firm has a market capitalization of $27.99 billion, a PE ratio of 10.69 and a beta of 0.81. The stock's 50 day moving average is $1,948.26 and its 200 day moving average is $1,827.43. First Citizens BancShares has a twelve month low of $1,339.10 and a twelve month high of $2,174.80.

First Citizens BancShares (NASDAQ:FCNCA - Get Free Report) last announced its earnings results on Thursday, October 24th. The bank reported $45.87 EPS for the quarter, missing analysts' consensus estimates of $47.40 by ($1.53). First Citizens BancShares had a net margin of 18.19% and a return on equity of 14.84%. The business had revenue of $2.45 billion during the quarter, compared to analysts' expectations of $2.36 billion. During the same period in the previous year, the company posted $55.92 earnings per share. As a group, research analysts forecast that First Citizens BancShares will post 198.72 earnings per share for the current fiscal year.

First Citizens BancShares declared that its Board of Directors has authorized a share buyback plan on Thursday, July 25th that authorizes the company to repurchase $3.50 billion in outstanding shares. This repurchase authorization authorizes the bank to buy up to 12.3% of its stock through open market purchases. Stock repurchase plans are generally an indication that the company's leadership believes its shares are undervalued.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the business. ORG Partners LLC acquired a new position in shares of First Citizens BancShares during the first quarter worth about $29,000. LRI Investments LLC purchased a new position in First Citizens BancShares in the 1st quarter worth approximately $33,000. V Square Quantitative Management LLC acquired a new stake in First Citizens BancShares in the second quarter valued at approximately $35,000. Gradient Investments LLC purchased a new stake in shares of First Citizens BancShares during the second quarter valued at approximately $52,000. Finally, Blue Trust Inc. lifted its position in shares of First Citizens BancShares by 120.0% during the second quarter. Blue Trust Inc. now owns 66 shares of the bank's stock worth $108,000 after purchasing an additional 36 shares in the last quarter. 61.18% of the stock is owned by institutional investors and hedge funds.

About First Citizens BancShares

(

Get Free Report)

First Citizens BancShares, Inc operates as the holding company for First-Citizens Bank & Trust Company that provides retail and commercial banking services to individuals, businesses, and professionals. The company's deposit products include checking, savings, money market, and time deposit accounts.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider First Citizens BancShares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Citizens BancShares wasn't on the list.

While First Citizens BancShares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.