Sanctuary Advisors LLC acquired a new position in shares of First Hawaiian, Inc. (NASDAQ:FHB - Free Report) in the 2nd quarter, according to its most recent disclosure with the SEC. The institutional investor acquired 21,093 shares of the bank's stock, valued at approximately $462,000.

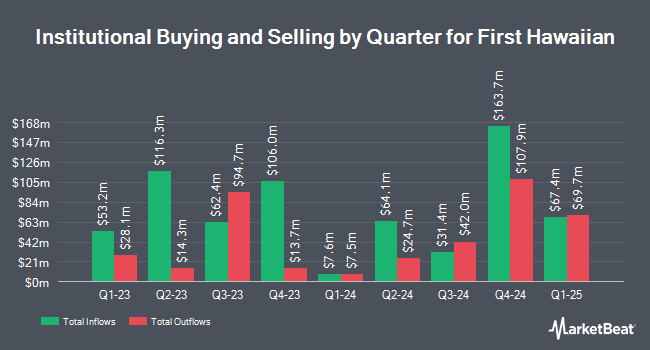

A number of other hedge funds have also made changes to their positions in the business. Vanguard Group Inc. boosted its stake in First Hawaiian by 0.6% in the fourth quarter. Vanguard Group Inc. now owns 14,651,233 shares of the bank's stock valued at $334,927,000 after acquiring an additional 87,304 shares in the last quarter. The Manufacturers Life Insurance Company grew its stake in First Hawaiian by 9.9% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 10,502,160 shares of the bank's stock worth $218,025,000 after buying an additional 942,634 shares during the last quarter. Dimensional Fund Advisors LP grew its stake in First Hawaiian by 7.7% during the 2nd quarter. Dimensional Fund Advisors LP now owns 5,205,140 shares of the bank's stock worth $108,057,000 after buying an additional 370,722 shares during the last quarter. American Century Companies Inc. increased its position in First Hawaiian by 6.5% during the second quarter. American Century Companies Inc. now owns 3,339,180 shares of the bank's stock worth $69,321,000 after buying an additional 203,407 shares during the period. Finally, Reinhart Partners LLC. lifted its stake in First Hawaiian by 0.9% in the second quarter. Reinhart Partners LLC. now owns 2,319,992 shares of the bank's stock valued at $48,163,000 after buying an additional 20,770 shares during the last quarter. Hedge funds and other institutional investors own 97.63% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have recently issued reports on the stock. Wells Fargo & Company lowered their target price on shares of First Hawaiian from $22.00 to $20.00 and set an "underweight" rating on the stock in a research report on Tuesday, October 1st. Piper Sandler raised their price objective on shares of First Hawaiian from $22.00 to $27.00 and gave the stock a "neutral" rating in a research report on Monday, July 29th. The Goldman Sachs Group upped their target price on shares of First Hawaiian from $21.00 to $24.00 and gave the company a "sell" rating in a report on Monday, July 29th. Keefe, Bruyette & Woods raised their price target on First Hawaiian from $25.00 to $26.00 and gave the stock a "market perform" rating in a report on Monday, July 29th. Finally, Barclays upped their price objective on First Hawaiian from $24.00 to $25.00 and gave the company an "equal weight" rating in a research note on Monday, July 29th. Four analysts have rated the stock with a sell rating and three have assigned a hold rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Reduce" and a consensus price target of $24.17.

Get Our Latest Research Report on FHB

First Hawaiian Trading Up 0.9 %

Shares of NASDAQ:FHB traded up $0.23 during midday trading on Thursday, hitting $24.67. 489,448 shares of the stock were exchanged, compared to its average volume of 653,824. First Hawaiian, Inc. has a twelve month low of $17.18 and a twelve month high of $26.18. The company has a 50 day moving average price of $23.39 and a 200-day moving average price of $22.25. The stock has a market cap of $3.15 billion, a P/E ratio of 14.05 and a beta of 0.98.

First Hawaiian (NASDAQ:FHB - Get Free Report) last announced its earnings results on Friday, July 26th. The bank reported $0.48 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.42 by $0.06. The company had revenue of $204.62 million during the quarter, compared to analysts' expectations of $202.94 million. First Hawaiian had a net margin of 18.83% and a return on equity of 8.96%. On average, equities research analysts expect that First Hawaiian, Inc. will post 1.78 earnings per share for the current year.

First Hawaiian Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, August 30th. Shareholders of record on Monday, August 19th were issued a dividend of $0.26 per share. This represents a $1.04 dividend on an annualized basis and a yield of 4.22%. The ex-dividend date of this dividend was Monday, August 19th. First Hawaiian's dividend payout ratio (DPR) is presently 59.77%.

About First Hawaiian

(

Free Report)

First Hawaiian, Inc operates as a bank holding company for First Hawaiian Bank that provides a range of banking products and services to consumer and commercial customers in the United States. It operates in three segments: Retail Banking, Commercial Banking, and Treasury and Other. The company offers various deposit products, including checking, savings, and time deposit accounts, and other deposit accounts.

Featured Articles

Before you consider First Hawaiian, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Hawaiian wasn't on the list.

While First Hawaiian currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.