First Interstate BancSystem (NASDAQ:FIBK - Get Free Report) had its target price cut by investment analysts at Piper Sandler from $38.00 to $36.00 in a report issued on Monday, Benzinga reports. The firm currently has an "overweight" rating on the financial services provider's stock. Piper Sandler's target price indicates a potential upside of 13.39% from the stock's current price.

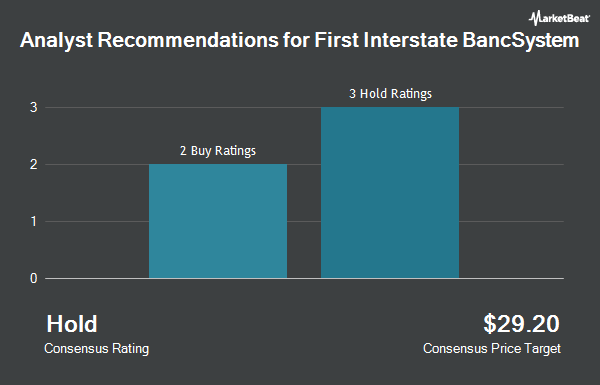

Other equities research analysts have also recently issued reports about the company. Wells Fargo & Company cut First Interstate BancSystem from an "equal weight" rating to an "underweight" rating and lowered their target price for the stock from $30.00 to $28.00 in a report on Tuesday, October 1st. Keefe, Bruyette & Woods raised their target price on shares of First Interstate BancSystem from $29.00 to $31.00 and gave the company a "market perform" rating in a research report on Monday, July 29th. Barclays upped their price target on shares of First Interstate BancSystem from $31.00 to $32.00 and gave the stock an "equal weight" rating in a research report on Friday, September 27th. Stephens reissued an "overweight" rating and set a $36.00 price objective on shares of First Interstate BancSystem in a report on Thursday, October 10th. Finally, StockNews.com lowered First Interstate BancSystem from a "hold" rating to a "sell" rating in a report on Thursday, October 3rd. Two equities research analysts have rated the stock with a sell rating, three have given a hold rating and two have given a buy rating to the company. According to data from MarketBeat.com, First Interstate BancSystem has a consensus rating of "Hold" and a consensus target price of $32.83.

Check Out Our Latest Research Report on FIBK

First Interstate BancSystem Trading Up 2.6 %

NASDAQ FIBK traded up $0.80 during trading on Monday, hitting $31.75. The stock had a trading volume of 568,530 shares, compared to its average volume of 678,625. The stock has a market capitalization of $3.32 billion, a price-to-earnings ratio of 12.40 and a beta of 0.81. The stock has a 50 day simple moving average of $30.46 and a 200 day simple moving average of $28.65. First Interstate BancSystem has a one year low of $22.74 and a one year high of $33.00. The company has a debt-to-equity ratio of 0.92, a quick ratio of 0.79 and a current ratio of 0.79.

First Interstate BancSystem (NASDAQ:FIBK - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The financial services provider reported $0.54 EPS for the quarter, missing the consensus estimate of $0.58 by ($0.04). First Interstate BancSystem had a net margin of 17.22% and a return on equity of 8.19%. During the same period in the prior year, the company posted $0.70 earnings per share. Sell-side analysts predict that First Interstate BancSystem will post 2.34 earnings per share for the current year.

Institutional Trading of First Interstate BancSystem

Several large investors have recently added to or reduced their stakes in the company. CWM LLC boosted its holdings in First Interstate BancSystem by 16.0% in the second quarter. CWM LLC now owns 3,123 shares of the financial services provider's stock valued at $87,000 after purchasing an additional 430 shares during the last quarter. PNC Financial Services Group Inc. raised its position in shares of First Interstate BancSystem by 28.2% in the fourth quarter. PNC Financial Services Group Inc. now owns 3,378 shares of the financial services provider's stock worth $104,000 after acquiring an additional 744 shares during the period. Innealta Capital LLC purchased a new stake in shares of First Interstate BancSystem during the 2nd quarter worth about $106,000. nVerses Capital LLC grew its position in shares of First Interstate BancSystem by 412.5% during the 2nd quarter. nVerses Capital LLC now owns 4,100 shares of the financial services provider's stock valued at $114,000 after acquiring an additional 3,300 shares during the period. Finally, Telos Capital Management Inc. acquired a new stake in shares of First Interstate BancSystem during the 3rd quarter valued at about $201,000. Hedge funds and other institutional investors own 88.71% of the company's stock.

First Interstate BancSystem Company Profile

(

Get Free Report)

First Interstate BancSystem, Inc operates as the bank holding company for First Interstate Bank that provides range of banking products and services in the United States. It offers various traditional depository products, including checking, savings, and time deposits; and repurchase agreements primarily for commercial and municipal depositors.

Further Reading

Before you consider First Interstate BancSystem, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Interstate BancSystem wasn't on the list.

While First Interstate BancSystem currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.