Amicus Therapeutics (NASDAQ:FOLD - Get Free Report) is set to release its earnings data before the market opens on Wednesday, November 6th. Analysts expect Amicus Therapeutics to post earnings of $0.08 per share for the quarter. Amicus Therapeutics has set its FY 2024 guidance at EPS.Persons that wish to register for the company's earnings conference call can do so using this link.

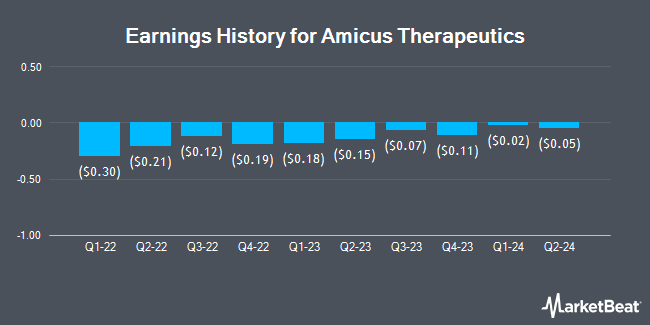

Amicus Therapeutics (NASDAQ:FOLD - Get Free Report) last posted its earnings results on Thursday, August 8th. The biopharmaceutical company reported ($0.05) earnings per share for the quarter, hitting analysts' consensus estimates of ($0.05). The firm had revenue of $126.67 million for the quarter, compared to the consensus estimate of $121.21 million. Amicus Therapeutics had a negative net margin of 26.23% and a negative return on equity of 41.47%. The business's quarterly revenue was up 34.0% on a year-over-year basis. During the same period in the previous year, the firm posted ($0.15) EPS. On average, analysts expect Amicus Therapeutics to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Amicus Therapeutics Trading Up 0.8 %

FOLD traded up $0.09 on Wednesday, hitting $11.58. The company had a trading volume of 1,709,034 shares, compared to its average volume of 2,720,361. Amicus Therapeutics has a 12-month low of $9.02 and a 12-month high of $14.57. The company has a quick ratio of 2.26, a current ratio of 2.75 and a debt-to-equity ratio of 2.93. The business's fifty day simple moving average is $11.16 and its 200 day simple moving average is $10.57. The company has a market cap of $3.43 billion, a PE ratio of -23.63 and a beta of 0.69.

Insider Activity at Amicus Therapeutics

In other Amicus Therapeutics news, CEO Bradley L. Campbell sold 7,500 shares of Amicus Therapeutics stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $11.71, for a total transaction of $87,825.00. Following the completion of the sale, the chief executive officer now directly owns 886,654 shares of the company's stock, valued at $10,382,718.34. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Over the last quarter, insiders sold 22,500 shares of company stock worth $244,875. Company insiders own 2.20% of the company's stock.

Analyst Upgrades and Downgrades

FOLD has been the subject of a number of analyst reports. Cantor Fitzgerald restated an "overweight" rating and issued a $20.00 price target on shares of Amicus Therapeutics in a research report on Friday, September 20th. JPMorgan Chase & Co. cut their price target on shares of Amicus Therapeutics from $17.00 to $16.00 and set an "overweight" rating on the stock in a report on Friday, August 16th. Morgan Stanley decreased their price objective on shares of Amicus Therapeutics from $19.00 to $18.00 and set an "overweight" rating for the company in a research note on Friday, October 11th. Needham & Company LLC reaffirmed a "hold" rating on shares of Amicus Therapeutics in a research note on Friday, August 9th. Finally, Jefferies Financial Group started coverage on Amicus Therapeutics in a research note on Friday, September 6th. They set a "buy" rating and a $18.00 price target for the company. One research analyst has rated the stock with a hold rating and nine have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $17.13.

Read Our Latest Analysis on FOLD

About Amicus Therapeutics

(

Get Free Report)

Amicus Therapeutics, Inc, a biotechnology company, focuses on discovering, developing, and delivering medicines for rare diseases. Its commercial product and product candidates include Galafold, an oral precision medicine for the treatment of adults with a confirmed diagnosis of Fabry disease and an amenable galactosidase alpha gene variant; and Pombiliti + Opfolda, for the treatment of late onset.

Recommended Stories

Before you consider Amicus Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amicus Therapeutics wasn't on the list.

While Amicus Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.