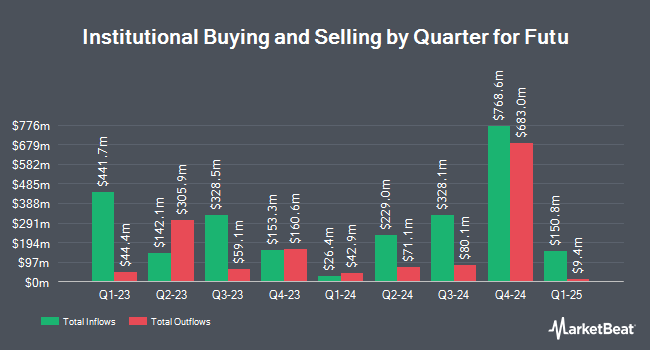

Yong Rong HK Asset Management Ltd grew its holdings in shares of Futu Holdings Limited (NASDAQ:FUTU - Free Report) by 2,525.3% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 393,800 shares of the company's stock after buying an additional 378,800 shares during the quarter. Futu accounts for approximately 10.9% of Yong Rong HK Asset Management Ltd's holdings, making the stock its biggest holding. Yong Rong HK Asset Management Ltd owned approximately 0.29% of Futu worth $37,667,000 as of its most recent SEC filing.

Other hedge funds have also recently made changes to their positions in the company. APG Asset Management N.V. purchased a new stake in Futu in the 2nd quarter worth about $496,000. Sei Investments Co. raised its position in Futu by 261.3% in the 2nd quarter. Sei Investments Co. now owns 25,351 shares of the company's stock worth $1,663,000 after purchasing an additional 18,334 shares during the period. Susquehanna Fundamental Investments LLC purchased a new stake in Futu in the 1st quarter worth about $747,000. Seven Eight Capital LP purchased a new stake in Futu in the 2nd quarter worth about $1,956,000. Finally, Canada Pension Plan Investment Board raised its position in Futu by 221.4% in the 2nd quarter. Canada Pension Plan Investment Board now owns 90,000 shares of the company's stock worth $5,904,000 after purchasing an additional 62,000 shares during the period.

Futu Price Performance

FUTU stock traded up $0.09 during mid-day trading on Friday, reaching $95.08. The company had a trading volume of 2,153,147 shares, compared to its average volume of 2,284,920. The company has a market capitalization of $13.10 billion, a PE ratio of 24.57, a price-to-earnings-growth ratio of 1.00 and a beta of 0.75. The firm has a 50 day moving average of $82.99 and a 200 day moving average of $72.59. Futu Holdings Limited has a 12 month low of $43.61 and a 12 month high of $130.50.

Futu (NASDAQ:FUTU - Get Free Report) last issued its earnings results on Tuesday, August 20th. The company reported $1.11 EPS for the quarter. The business had revenue of $400.73 million for the quarter. Futu had a net margin of 39.27% and a return on equity of 16.77%. Analysts anticipate that Futu Holdings Limited will post 4.75 EPS for the current year.

Analyst Ratings Changes

Separately, Bank of America increased their price objective on shares of Futu from $80.20 to $90.00 and gave the stock a "buy" rating in a research report on Friday, September 27th. One equities research analyst has rated the stock with a hold rating and six have given a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $72.97.

Check Out Our Latest Stock Analysis on Futu

Futu Company Profile

(

Free Report)

Futu Holdings Limited provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally. It offers online financial services, including securities and derivative trades brokerage, margin financing and fund distribution services through its Futubull and Moomoo digital platforms.

Further Reading

Before you consider Futu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Futu wasn't on the list.

While Futu currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.