International Assets Investment Management LLC boosted its stake in shares of Golub Capital BDC, Inc. (NASDAQ:GBDC - Free Report) by 2,083.7% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 167,993 shares of the investment management company's stock after acquiring an additional 160,300 shares during the quarter. International Assets Investment Management LLC owned 0.10% of Golub Capital BDC worth $25,380,000 at the end of the most recent reporting period.

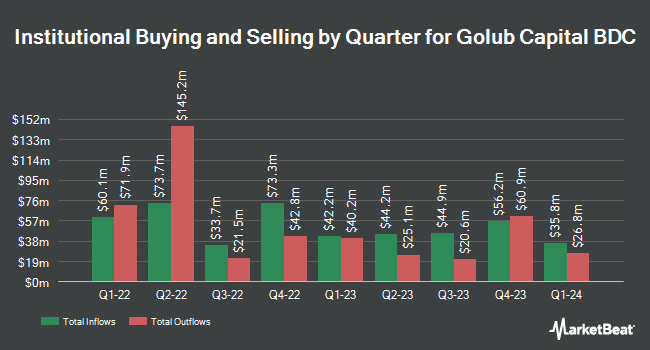

A number of other large investors also recently bought and sold shares of GBDC. Eagle Bay Advisors LLC increased its holdings in shares of Golub Capital BDC by 5.1% during the 3rd quarter. Eagle Bay Advisors LLC now owns 100,815 shares of the investment management company's stock valued at $1,523,000 after purchasing an additional 4,891 shares in the last quarter. Foundations Investment Advisors LLC grew its position in Golub Capital BDC by 22.2% during the third quarter. Foundations Investment Advisors LLC now owns 15,646 shares of the investment management company's stock valued at $236,000 after buying an additional 2,841 shares during the period. Embree Financial Group acquired a new position in shares of Golub Capital BDC in the third quarter worth about $171,000. Onyx Bridge Wealth Group LLC raised its position in shares of Golub Capital BDC by 36.1% in the third quarter. Onyx Bridge Wealth Group LLC now owns 61,157 shares of the investment management company's stock worth $924,000 after acquiring an additional 16,213 shares during the period. Finally, Naviter Wealth LLC grew its position in shares of Golub Capital BDC by 26.5% during the 3rd quarter. Naviter Wealth LLC now owns 220,359 shares of the investment management company's stock valued at $3,330,000 after acquiring an additional 46,145 shares during the period. 42.38% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of equities analysts recently weighed in on GBDC shares. Oppenheimer reaffirmed an "outperform" rating and issued a $17.00 price target on shares of Golub Capital BDC in a report on Wednesday, August 7th. Wells Fargo & Company increased their target price on Golub Capital BDC from $15.00 to $15.50 and gave the company an "equal weight" rating in a research report on Tuesday. StockNews.com raised shares of Golub Capital BDC from a "sell" rating to a "hold" rating in a research note on Thursday, October 10th. Finally, Keefe, Bruyette & Woods reduced their price objective on shares of Golub Capital BDC from $17.50 to $16.50 and set an "outperform" rating for the company in a research report on Wednesday, August 7th. Three investment analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat.com, Golub Capital BDC has an average rating of "Moderate Buy" and an average target price of $16.50.

Read Our Latest Analysis on GBDC

Golub Capital BDC Price Performance

Shares of GBDC traded down $0.16 during trading hours on Tuesday, hitting $15.35. 1,088,992 shares of the stock were exchanged, compared to its average volume of 1,165,605. The stock's 50-day moving average price is $15.06 and its two-hundred day moving average price is $15.62. The company has a debt-to-equity ratio of 1.06, a quick ratio of 5.01 and a current ratio of 5.01. The company has a market cap of $2.63 billion, a price-to-earnings ratio of 7.56 and a beta of 0.53. Golub Capital BDC, Inc. has a 12-month low of $14.05 and a 12-month high of $17.72.

Golub Capital BDC (NASDAQ:GBDC - Get Free Report) last released its earnings results on Monday, August 5th. The investment management company reported $0.48 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.49 by ($0.01). The business had revenue of $171.27 million for the quarter, compared to analysts' expectations of $205.24 million. Golub Capital BDC had a return on equity of 11.99% and a net margin of 42.14%. During the same period in the previous year, the company earned $0.44 EPS. Research analysts expect that Golub Capital BDC, Inc. will post 1.92 earnings per share for the current year.

Golub Capital BDC Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, September 27th. Shareholders of record on Friday, August 30th were paid a $0.39 dividend. This represents a $1.56 dividend on an annualized basis and a yield of 10.16%. The ex-dividend date of this dividend was Friday, August 30th. Golub Capital BDC's dividend payout ratio (DPR) is 76.85%.

Insider Transactions at Golub Capital BDC

In related news, Director Anita J. Rival purchased 26,000 shares of the business's stock in a transaction that occurred on Thursday, August 8th. The stock was purchased at an average price of $14.40 per share, with a total value of $374,400.00. Following the completion of the acquisition, the director now owns 95,000 shares in the company, valued at $1,368,000. This trade represents a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is available through this link. In other news, CEO David Golub bought 20,000 shares of Golub Capital BDC stock in a transaction on Monday, August 19th. The shares were bought at an average cost of $14.70 per share, with a total value of $294,000.00. Following the completion of the purchase, the chief executive officer now directly owns 1,758,880 shares of the company's stock, valued at approximately $25,855,536. This trade represents a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Anita J. Rival bought 26,000 shares of the firm's stock in a transaction on Thursday, August 8th. The stock was purchased at an average price of $14.40 per share, for a total transaction of $374,400.00. Following the completion of the acquisition, the director now directly owns 95,000 shares in the company, valued at $1,368,000. The trade was a 0.00 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders have purchased a total of 146,000 shares of company stock worth $2,159,400 in the last ninety days. Insiders own 2.70% of the company's stock.

About Golub Capital BDC

(

Free Report)

Golub Capital BDC, Inc (GBDC) is a business development company and operates as an externally managed closed-end non-diversified management investment company. It invests in debt and minority equity investments in middle-market companies that are, in most cases, sponsored by private equity investors.

Featured Articles

Before you consider Golub Capital BDC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Golub Capital BDC wasn't on the list.

While Golub Capital BDC currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report