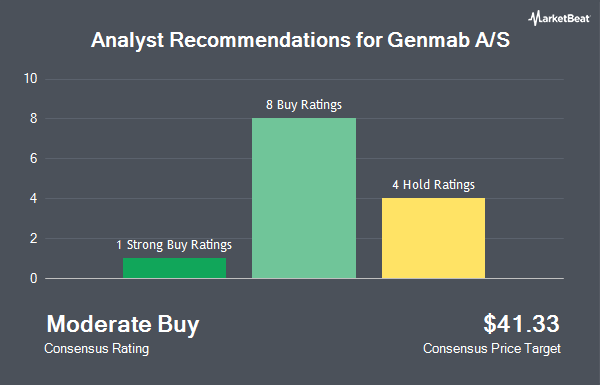

Shares of Genmab A/S (NASDAQ:GMAB - Get Free Report) have been assigned an average recommendation of "Moderate Buy" from the twelve research firms that are presently covering the company, Marketbeat reports. One research analyst has rated the stock with a sell recommendation, two have given a hold recommendation and nine have assigned a buy recommendation to the company. The average 12-month target price among brokers that have updated their coverage on the stock in the last year is $45.20.

GMAB has been the topic of several research analyst reports. Redburn Atlantic started coverage on shares of Genmab A/S in a research note on Tuesday, October 8th. They issued a "buy" rating on the stock. JPMorgan Chase & Co. restated a "neutral" rating on shares of Genmab A/S in a research report on Tuesday, August 20th. Morgan Stanley restated an "equal weight" rating and set a $31.00 target price on shares of Genmab A/S in a research report on Wednesday, September 11th. Royal Bank of Canada upgraded shares of Genmab A/S from a "sector perform" rating to an "outperform" rating in a research report on Monday, July 15th. Finally, Truist Financial decreased their target price on shares of Genmab A/S from $53.00 to $50.00 and set a "buy" rating on the stock in a research report on Monday, September 9th.

Check Out Our Latest Stock Analysis on Genmab A/S

Genmab A/S Trading Down 1.1 %

Genmab A/S stock traded down $0.25 during mid-day trading on Thursday, hitting $22.32. The stock had a trading volume of 964,928 shares, compared to its average volume of 652,249. The firm has a market capitalization of $14.77 billion, a P/E ratio of 18.65, a P/E/G ratio of 0.68 and a beta of 0.98. The firm's 50 day moving average is $25.07 and its 200 day moving average is $26.69. Genmab A/S has a one year low of $22.22 and a one year high of $32.89.

Genmab A/S (NASDAQ:GMAB - Get Free Report) last announced its quarterly earnings results on Thursday, August 8th. The company reported $0.22 EPS for the quarter, missing the consensus estimate of $0.29 by ($0.07). The company had revenue of $779.50 million during the quarter, compared to analysts' expectations of $734.60 million. Genmab A/S had a return on equity of 17.48% and a net margin of 29.06%. As a group, equities research analysts forecast that Genmab A/S will post 1.29 earnings per share for the current year.

Hedge Funds Weigh In On Genmab A/S

Hedge funds have recently added to or reduced their stakes in the company. DDD Partners LLC bought a new position in Genmab A/S in the 2nd quarter worth about $8,860,000. Capital International Investors grew its stake in Genmab A/S by 7.8% in the 1st quarter. Capital International Investors now owns 4,373,277 shares of the company's stock worth $130,805,000 after acquiring an additional 315,355 shares in the last quarter. Cubist Systematic Strategies LLC grew its stake in Genmab A/S by 109.7% in the 2nd quarter. Cubist Systematic Strategies LLC now owns 278,541 shares of the company's stock worth $7,000,000 after acquiring an additional 145,689 shares in the last quarter. Renaissance Technologies LLC grew its stake in Genmab A/S by 7.6% in the 2nd quarter. Renaissance Technologies LLC now owns 1,462,459 shares of the company's stock worth $36,752,000 after acquiring an additional 103,859 shares in the last quarter. Finally, Sanctuary Advisors LLC bought a new position in Genmab A/S in the 2nd quarter worth about $1,354,000. 7.07% of the stock is currently owned by institutional investors.

Genmab A/S Company Profile

(

Get Free ReportGenmab A/S develops antibody therapeutics for the treatment of cancer and other diseases primarily in Denmark. The company markets DARZALEX, a human monoclonal antibody for the treatment of patients with multiple myeloma (MM); teprotumumab for the treatment of thyroid eye disease; and Amivantamab for advanced or metastatic gastric or esophageal cancer and NSCLC.

Further Reading

Before you consider Genmab A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genmab A/S wasn't on the list.

While Genmab A/S currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.