Mediolanum International Funds Ltd acquired a new position in shares of Genmab A/S (NASDAQ:GMAB - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 28,661 shares of the company's stock, valued at approximately $699,000.

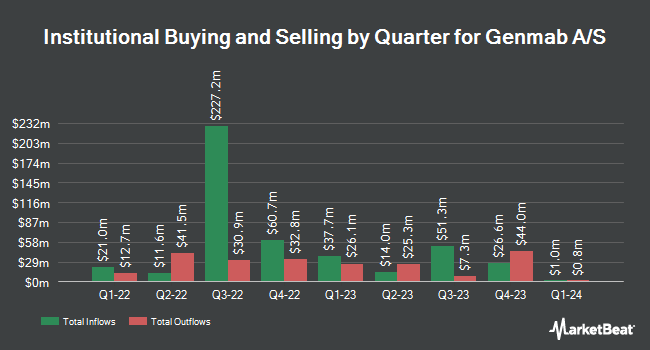

Several other hedge funds have also recently added to or reduced their stakes in GMAB. Russell Investments Group Ltd. increased its stake in Genmab A/S by 137.7% during the first quarter. Russell Investments Group Ltd. now owns 939 shares of the company's stock valued at $28,000 after acquiring an additional 544 shares during the period. Allspring Global Investments Holdings LLC bought a new stake in Genmab A/S in the 1st quarter valued at $43,000. Blue Trust Inc. raised its position in Genmab A/S by 892.0% in the third quarter. Blue Trust Inc. now owns 4,315 shares of the company's stock worth $108,000 after purchasing an additional 3,880 shares in the last quarter. Headlands Technologies LLC lifted its stake in Genmab A/S by 1,702.8% during the second quarter. Headlands Technologies LLC now owns 5,138 shares of the company's stock worth $129,000 after purchasing an additional 4,853 shares during the period. Finally, Benjamin F. Edwards & Company Inc. boosted its holdings in Genmab A/S by 7.1% during the second quarter. Benjamin F. Edwards & Company Inc. now owns 7,227 shares of the company's stock valued at $182,000 after purchasing an additional 478 shares in the last quarter. Institutional investors own 7.07% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts have issued reports on the company. Redburn Atlantic started coverage on Genmab A/S in a research note on Tuesday, October 8th. They set a "buy" rating for the company. HC Wainwright restated a "buy" rating and set a $50.00 price target on shares of Genmab A/S in a research report on Wednesday, October 16th. Truist Financial decreased their target price on Genmab A/S from $53.00 to $50.00 and set a "buy" rating on the stock in a report on Monday, September 9th. Royal Bank of Canada upgraded shares of Genmab A/S from a "sector perform" rating to an "outperform" rating in a research report on Monday, July 15th. Finally, Morgan Stanley reaffirmed an "equal weight" rating and issued a $31.00 target price on shares of Genmab A/S in a research note on Wednesday, September 11th. One analyst has rated the stock with a sell rating, two have issued a hold rating and nine have assigned a buy rating to the company. According to data from MarketBeat, Genmab A/S has an average rating of "Moderate Buy" and an average price target of $45.20.

View Our Latest Stock Report on GMAB

Genmab A/S Trading Up 0.1 %

Shares of NASDAQ:GMAB traded up $0.02 during trading on Monday, hitting $23.14. 866,055 shares of the company's stock were exchanged, compared to its average volume of 643,547. Genmab A/S has a 1-year low of $22.39 and a 1-year high of $32.89. The firm has a market cap of $15.31 billion, a P/E ratio of 19.12, a PEG ratio of 0.68 and a beta of 0.98. The firm has a 50-day moving average price of $25.25 and a two-hundred day moving average price of $26.77.

Genmab A/S (NASDAQ:GMAB - Get Free Report) last announced its quarterly earnings data on Thursday, August 8th. The company reported $0.22 EPS for the quarter, missing analysts' consensus estimates of $0.29 by ($0.07). Genmab A/S had a return on equity of 17.48% and a net margin of 29.06%. The company had revenue of $779.50 million for the quarter, compared to analyst estimates of $734.60 million. As a group, research analysts predict that Genmab A/S will post 1.29 EPS for the current year.

Genmab A/S Company Profile

(

Free Report)

Genmab A/S develops antibody therapeutics for the treatment of cancer and other diseases primarily in Denmark. The company markets DARZALEX, a human monoclonal antibody for the treatment of patients with multiple myeloma (MM); teprotumumab for the treatment of thyroid eye disease; and Amivantamab for advanced or metastatic gastric or esophageal cancer and NSCLC.

See Also

Before you consider Genmab A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genmab A/S wasn't on the list.

While Genmab A/S currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.