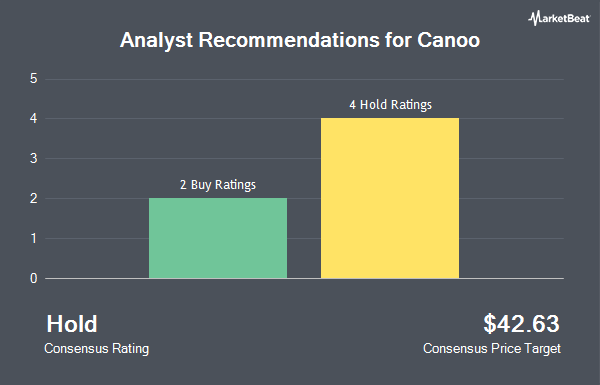

Canoo Inc. (NASDAQ:GOEV - Get Free Report) has received an average recommendation of "Moderate Buy" from the seven ratings firms that are covering the firm, Marketbeat.com reports. Two research analysts have rated the stock with a hold rating and five have given a buy rating to the company. The average 12-month price objective among analysts that have updated their coverage on the stock in the last year is $23.04.

A number of analysts have recently issued reports on GOEV shares. R. F. Lafferty lowered Canoo from a "buy" rating to a "hold" rating in a report on Wednesday, May 15th. Benchmark reiterated a "buy" rating and set a $5.00 price objective on shares of Canoo in a report on Wednesday, May 22nd. Roth Mkm cut their price objective on Canoo from $3.00 to $1.50 and set a "neutral" rating for the company in a report on Thursday, August 15th. Finally, HC Wainwright cut their price objective on Canoo from $7.00 to $4.00 and set a "buy" rating for the company in a report on Friday, August 16th.

Read Our Latest Report on GOEV

Insider Transactions at Canoo

In related news, CAO Ramesh Murthy sold 10,948 shares of the firm's stock in a transaction that occurred on Wednesday, July 3rd. The stock was sold at an average price of $2.33, for a total value of $25,508.84. Following the transaction, the chief accounting officer now directly owns 181,447 shares of the company's stock, valued at approximately $422,771.51. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other Canoo news, CAO Ramesh Murthy sold 10,948 shares of the company's stock in a transaction dated Wednesday, July 3rd. The shares were sold at an average price of $2.33, for a total transaction of $25,508.84. Following the completion of the sale, the chief accounting officer now directly owns 181,447 shares in the company, valued at $422,771.51. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, General Counsel Hector M. Ruiz sold 10,937 shares of Canoo stock in a transaction dated Wednesday, July 3rd. The stock was sold at an average price of $2.33, for a total value of $25,483.21. Following the completion of the transaction, the general counsel now owns 181,513 shares in the company, valued at $422,925.29. The disclosure for this sale can be found here. 9.70% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Canoo

Several hedge funds have recently modified their holdings of the business. EP Wealth Advisors LLC raised its stake in Canoo by 269.3% during the 4th quarter. EP Wealth Advisors LLC now owns 1,000,000 shares of the company's stock valued at $257,000 after purchasing an additional 729,236 shares during the last quarter. Susquehanna Fundamental Investments LLC bought a new stake in shares of Canoo in the first quarter valued at about $900,000. Bank of New York Mellon Corp acquired a new stake in Canoo during the second quarter worth about $392,000. Rhumbline Advisers bought a new position in Canoo during the second quarter valued at about $153,000. Finally, Daiwa Securities Group Inc. acquired a new position in Canoo in the 2nd quarter valued at approximately $70,000. 36.23% of the stock is owned by institutional investors.

Canoo Stock Up 4.3 %

Shares of GOEV traded up $0.06 during mid-day trading on Friday, reaching $1.47. The company's stock had a trading volume of 1,852,239 shares, compared to its average volume of 5,512,286. The business has a fifty day moving average of $1.96 and a 200 day moving average of $2.44. The company has a market cap of $100.79 million, a price-to-earnings ratio of -0.14 and a beta of 1.28. Canoo has a 1 year low of $1.22 and a 1 year high of $15.96.

Canoo Company Profile

(

Get Free ReportCanoo Inc, a mobility technology company, designs, develops, markets, and manufactures electric vehicles for consumer, commercial fleet, government, and military customers in the United States. the company utilizes its multi-purpose platform architecture, a self-contained, fully functional rolling chassis that directly houses the critical components for operation of an electric vehicle, including its in-house designed proprietary electric drivetrain, battery systems, advanced vehicle control electronics and software, and other critical components.

See Also

Before you consider Canoo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canoo wasn't on the list.

While Canoo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.