Assenagon Asset Management S.A. boosted its stake in shares of Grab Holdings Limited (NASDAQ:GRAB - Free Report) by 129.4% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 8,078,843 shares of the company's stock after purchasing an additional 4,557,800 shares during the period. Assenagon Asset Management S.A. owned approximately 0.21% of Grab worth $30,700,000 at the end of the most recent reporting period.

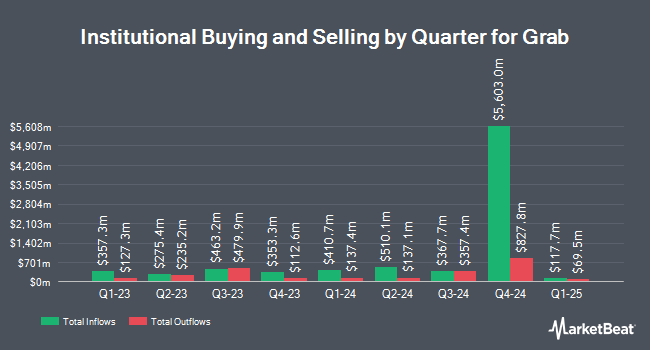

Several other hedge funds and other institutional investors have also modified their holdings of GRAB. Miracle Mile Advisors LLC bought a new position in shares of Grab in the first quarter worth $32,000. Dorsey & Whitney Trust CO LLC bought a new stake in shares of Grab during the 1st quarter worth about $32,000. Callan Capital LLC acquired a new stake in shares of Grab in the first quarter worth $34,000. Blue Trust Inc. lifted its position in shares of Grab by 53.6% during the 3rd quarter. Blue Trust Inc. now owns 9,767 shares of the company's stock worth $35,000 after purchasing an additional 3,408 shares during the last quarter. Finally, Sage Rhino Capital LLC bought a new position in Grab during the second quarter worth $38,000. 55.52% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of research analysts have issued reports on the company. Benchmark reissued a "buy" rating and set a $6.00 price objective on shares of Grab in a report on Wednesday, September 11th. Daiwa Capital Markets initiated coverage on shares of Grab in a research note on Wednesday. They issued an "outperform" rating and a $4.60 target price for the company. Finally, Jefferies Financial Group lowered their target price on Grab from $5.00 to $4.70 and set a "buy" rating on the stock in a research report on Wednesday, July 17th. Eight analysts have rated the stock with a buy rating, According to data from MarketBeat.com, Grab currently has a consensus rating of "Buy" and a consensus target price of $4.70.

Read Our Latest Stock Report on Grab

Grab Price Performance

GRAB traded down $0.06 during trading on Friday, reaching $4.07. 21,567,341 shares of the company were exchanged, compared to its average volume of 23,667,188. The company's 50-day moving average is $3.57 and its two-hundred day moving average is $3.52. The company has a quick ratio of 2.97, a current ratio of 3.00 and a debt-to-equity ratio of 0.03. Grab Holdings Limited has a 12-month low of $2.90 and a 12-month high of $4.32. The company has a market cap of $15.97 billion, a price-to-earnings ratio of -58.14 and a beta of 0.83.

Grab (NASDAQ:GRAB - Get Free Report) last issued its earnings results on Thursday, August 15th. The company reported ($0.01) earnings per share (EPS) for the quarter, hitting the consensus estimate of ($0.01). The business had revenue of $664.00 million during the quarter, compared to analyst estimates of $674.17 million. Grab had a negative return on equity of 3.35% and a negative net margin of 8.24%. Grab's revenue for the quarter was up 17.1% on a year-over-year basis. During the same quarter in the prior year, the firm earned ($0.03) earnings per share. Research analysts forecast that Grab Holdings Limited will post -0.04 earnings per share for the current fiscal year.

Grab Profile

(

Free Report)

Grab Holdings Limited engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. The company offers its Grab ecosystem, a single platform with superapps for driver- and merchant-partners and consumers, that allows access to mobility, delivery, digital financial services, and enterprise sector offerings.

Further Reading

Before you consider Grab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grab wasn't on the list.

While Grab currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.